Stock Price Prediction Based on Social Network * A survey

advertisement

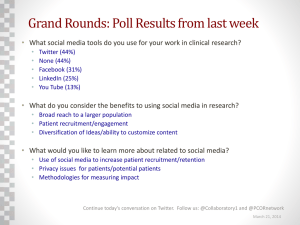

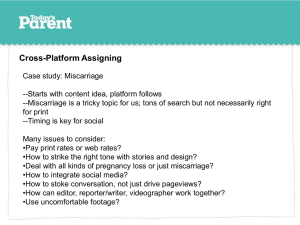

Stock Price Prediction Based on Social Network — A survey Presented by: CHEN En Outline Introduction Related work Methodology Conclusion Outline Introduction Related work Methodology Conclusion Introduction Stock price prediction Act of trying to determine the future value of company stock or other financial instrument trade on financial exchange Successful prediction could yield significant profit! Introduction The efficient-market hypothesis Stock price movement are governed by the random walk hypothesis Inherently unpredictable However, the others disagree and possess myriad prediction methods to gain future price information Fundamental analysis - Performance ratio (i.e. P/E ratio) Technical analysis - Charting analysis (i.e. Head and shoulder) Alternative methods - Internet-based data source for prediction Outline Introduction Related work Methodology Conclusion Related work Traditional investment decision approaches: Capital asset pricing model (CAMP) Arbitrage pricing theory (APT) Unrealistic and time complexity of the required calculation make them not applicable in real world problem Current soft computing techniques: Neural network (NN) (A. N. Refenes, M. Azema-Barac, and A. D. Zapranis1993) Genetic algorithm (GA) (R. Riolo, T. Soule, B. Eorzel2008) Support Vector Machines (SVM) (G. H. John, P. Miller, and R. Kerber1996) Because of widely use of the social network, major prediction are based on these public information. Related work Why social network? Ubiquitous and important for content sharing Facebook, Blog, Twitter feeds, etc. Public information—easily obtained Behavioral economics demonstrate that emotions can profoundly affect individual behavior and decision-making Recent research suggests very early acting prediction indicators can be extracted from online social media Online chat activity predicts book sales (Gruhl, D, Guha, R, Kumar, R, Novak, J2005) Blog sentiment predicts movie sales (Mishne, G & Glance, N.2006) Consumer spending indicate disease infection rates (Choi, H & Varian, H.2009) Outline Introduction Related work Methodology Conclusion Method 1: Twitter message and the stock price Analysis of the relation between twitter messages and stock market index Selection of happiness and unhappiness words Method 1: Twitter message and the stock price Analysis of the relation between twitter messages and stock market index Selection of happiness and unhappiness words Evaluating both happiness and unhappiness words in the same tweet Where f=frequency of i’th word, Avg_happiness(wordi)=happiness value of word and Avg(T)=average happiness of given tweet Method 2: Twitter mood predicts the stock price Analyzing the text content of daily Twitter feeds to find the correlation between stock price and twitter mood Phase 1: Using two mood tracking tools: OpinionFinder & GoogleProfile of Mood states (GPOMs) to extract feature of mood OpinionFinder: Positive vs. nagetive mood GPOMs: Calm, Alert, Sure, Vital, Kind, and Happy Phase 2: Granger causality analysis to test correlation between Dow Jones Industrial average (DJIA) values and GPOMs and OF values Phase 3: Deploying a Self-Organizing Fuzzy Neural Network model (nonlinear model) to test the hypothesis Method 2: Twitter mood predicts the stock price Method 3: Technical analysis with sentiment Combining technical analysis with sentiment analysis for stock prediction Extract feature (using SentiWordNet): Time series data (price and volume) source Social network source (on Engadget) Technical indicators Using a multiple kernel learning framework to learn and prediction the stock price Method 3: Technical analysis with sentiment Technical analysis Emotion analysis Outline Introduction Related work Methodology Conclusion Conclusion Method 1: It is naïve but useful to predict the stock price index by just using happiness and unhappiness Method 2: The result showed that changes in the public mood state could indeed be tracked from the content of large-scale Twitter feed using simple text processing techniques. Method 3: It is considerable to use multiple kernel learning that covers several features.