McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved

Chapter 1

Business Decisions and Financial

Accounting

PowerPoint Authors:

Brandy Mackintosh

Lindsay Heiser

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved

Learning Objective 1-1

Describe various

organizational forms and

business decision

makers.

1-3

Organizational Forms

Sole

Proprietorship

Business organization owned by

one person. The owner is

personally liable for all debts of

the business.

Partnership

Business organization owned by

two or more people. Each partner

is personally liable for all debts of

the business.

Corporation

1-4

A separate legal entity. Owners of

corporations (stockholders) are

not personally liable for debts of

the corporation.

Organizational Forms

Source: IRS.gov.

1-5

The Accounting System

Operating, Investing and

Financing Activities

Accounting

System

Accounting Reports

External users

(creditors, investors, etc.)

Financial

Managerial

Internal users

(managers,

supervisors etc.)

Accounting is a system of analyzing, recording, summarizing and reporting

the results of a business’s activities.

1-6

Learning Objective 1-2

Describe the purpose,

structure, and content of the

four basic financial

statements.

1-7

The Basic Accounting Equation

Resources Owned . . .

by the company

Resources Owed . . .

to creditors

to stockholders

Assets = Liabilities + Stockholders’ Equity

Separate Entity

Assumption

The financial reports of a

business are assumed to

include the results of only

that business’s activities.

1-8

Assets

Economic resources

controlled by the company

that have measurable value

and are expected to provide

future benefits to the

company.

Cash

Equipment

Supplies

1-9

Furniture

Liabilities

Measurable amounts

owed by the

business to

creditors.

Notes

Payable

1-10

Accounts

Payable

Stockholders’ Equity

Owners’ claim to the

business resources.

Contributed

Capital

Retained

Earnings

Stock Certificate

1-11

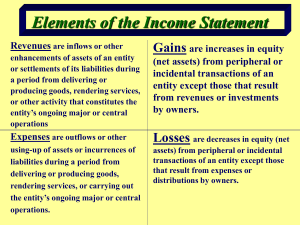

Revenues, Expenses and Net Income

Revenues – Expenses = Net Income

Revenues

Sales of goods or services

to customers. They are

measured at the

amount the business

charges the customer.

1-12

Expenses

The costs of doing

business necessary to

earn revenues,

including wages to

employees, advertising,

insurance, and utilities.

Dividends

Distributions of a

company’s earnings to its

stockholders as a return

on their investment.

Dividends are not an expense.

1-13

Financial Statements

Income

Statement

Statement

of Retained

Earnings

Financial

statements are

typically prepared in

this order.

Balance

Sheet

Statement

of Cash

Flows

1-14

The Income Statement

PIZZA AROMA, INC.

Income Statement

For the Month Ended September 30, 2013

Revenues

$ 12,000

Pizza Revenue

12,000

Total Revenue

Expenses

Supplies Expense

Wages Expense

Rent Expense

Utilities Expense

Insurance Expense

Advertising Expense

Income Tax Expense

Total Expenses

Net Income

1-15

5,000

2,000

1,500

600

300

100

500

10,000

$ 2,000

The unit of

measure

assumption

Reports

the

states that

amount

of

results of

revenues

business

less

activities

expenses

should be

for

a period

reported

in an

appropriate

of time.

monetary

unit.

The Statement of Retained Earnings

PIZZA AROMA, INC.

Statement of Retained Earnings

For the Month Ended September 30, 2013

Retained Earnings, Sept. 1, 2013

Add: Net Income

Subtract: Dividends

Retained Earnings, Sept. 30, 2013

$

2,000

(1,000)

$ 1,000

Reports the way that net income and the

distribution of dividends affected the financial

position of the company during the period.

1-16

The Balance Sheet

Reports at a point in time:

1. What a business owns

(assets).

2. What it owes to

creditors (liabilities).

3. What is left over for the

owners of the

company’s stock

(stockholders’ equity).

PIZZA AROMA, INC.

Balance Sheet

At September 30, 2013

Assets

Cash

Accounts Receivable

Supplies

Equipment

Total Assets

$ 14,000

1,000

3,000

40,000

$ 58,000

Liabilities

Accounts Payable

Notes Payable

Total Liabilities

$ 7,000

20,000

27,000

Stockholders’ Equity

Contributed Capital

30,000

Retained Earnings

1,000

Total Stockholders’ Equity

31,000

Total Liabilities and Stockholders’ Equity $ 58,000

BASIC ACCOUNTING EQUATION

Assets = Liabilities + Stockholders’ Equity

1-17

The Statement of Cash Flows

PIZZA AROMA, INC.

Statement of Cash Flows

For the Month Ended September 30, 2013

Cash Flows from Operating Activities

Cash received from customers

Cash paid to employees and suppliers

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash used to buy equipment

Cash Used in Investing Activities

Cash Flows from Financing Activities

Capital contributed by stockholders

Cash dividends paid to stockholders

Cash borrowed from the bank

Cash Provided by Financing Activities

Change in Cash

Beginning Cash Balance, Sept. 1, 2013

Ending Cash Balance, Sept. 30, 2013

1-18

$ 11,000

(6,000)

5,000

(40,000)

(40,000)

30,000

(1,000)

20,000

49,000

14,000

$ 14,000

Summarizes

how a

business’s

operating,

investing, and

financing

activities

caused its

cash balance

to change over

a particular

period of time.

Notes to the Financial Statements

Notes help financial statement users

understand how the amounts were

derived and what other information

may affect their decisions.

1-19

Relationships Among the Financial Statements

PIZZA AROMA, INC.

Income Statement

For the Month Ended September 30, 2013

Revenues

Pizza Revenue

Total Revenue

$ 12,000

12,000

Expenses

Supplies Expense

Wages Expense

Rent Expense

Utilities Expense

Insurance Expense

Advertising Expense

Income Tax Expense

Total Expenses

Net Income

5,000

2,000

1,500

600

300

100

500

10,000

$ 2,000

PIZZA AROMA, INC.

Statement of Retained Earnings

For the Month Ended September 30, 2013

Retained Earnings, Sept. 1, 2013

Add: Net Income

Subtract: Dividends

Retained Earnings, Sept. 30, 2013

1-20

$

2,000

(1,000)

$ 1,000

Net income

flows from the

Income

Statement to

the Statement

of Retained

Earnings.

1

Relationships Among the Financial Statements

PIZZA AROMA, INC.

Balance Sheet

At September 30, 2013

Ending Retained

Earnings flows from

the Statement of

Retained Earnings to

the Balance Sheet.

2

PIZZA AROMA, INC.

Statement of Retained Earnings

For the Month Ended September 30, 2013

Retained Earnings, Sept. 1, 2013

Add: Net Income

Subtract: Dividends

Retained Earnings, Sept. 30, 2013

1-21

$

2,000

(1,000)

$ 1,000

Assets

Cash

Accounts Receivable

Supplies

Equipment

Total Assets

$ 14,000

1,000

3,000

40,000

$ 58,000

Liabilities

Accounts Payable

Notes Payable

Total Liabilities

$ 7,000

20,000

27,000

Stockholders’ Equity

30,000

Contributed Capital

1,000

Retained Earnings

31,000

Total Stockholders’ Equity

Total Liabilities and Stockholders’ Equity $ 58,000

Relationships Among the Financial Statements

PIZZA AROMA, INC.

Balance Sheet

At September 30, 2013

PIZZA AROMA, INC.

Statement of Cash Flows

For the Month Ended September 30, 2013

Cash Flows from Operating Activities

Cash received from customers

Cash paid to employees and suppliers

Cash Provided by Operating Activities

Cash Flows from Investing Activities

Cash used to buy equipment

Cash Used in Investing Activities

Cash Flows from Financing Activities

Capital contributed by stockholders

Cash dividends paid to stockholders

Cash borrowed from the bank

Cash Provided by Financing Activities

Change in Cash

Beginning Cash Balance, Sept. 1, 2013

Ending Cash Balance, Sept. 30, 2013

$ 11,000

(6,000)

5,000

(40,000)

(40,000)

30,000

(1,000)

20,000

49,000

14,000

$ 14,000

Assets

Cash

Accounts Receivable

Supplies

Equipment

Total Assets

$ 14,000

1,000

3,000

40,000

$ 58,000

Liabilities

Accounts Payable

Notes Payable

Total Liabilities

$ 7,000

20,000

27,000

Stockholders’ Equity

30,000

Contributed Capital

1,000

Retained Earnings

31,000

Total Stockholders’ Equity

Total Liabilities and Stockholders’ Equity $ 58,000

Cash on the Balance Sheet and Cash at End

of Year on the Statement of Cash Flows agree.

3

1-22

Learning Objective 1-3

Explain how financial

statements are used by

decision makers.

1-23

Using Financial Statements

Creditors

1-24

Investors

1. Is the company

generating

enough cash to

make payments

on its loans? … SCF

1. What is the

immediate return

2. Does the company

have enough

assets to cover its

liabilities? … B/S

2. What is the longterm return (through

(through dividends)

on my

contributions? … SRE

stock price increases

resulting from the

company’s profits)?.. I/S

Learning Objective 1-4

Describe factors that

contribute to useful financial

information.

1-25

External Financial Reporting

Main Goal: Provide useful financial information to

external users for decision making.

Useful

Relevant

1-26

Faithful

Faithful

Representation

Accounting Standards

1-27

World

United

States

Where?

FASB

Who?

IASB

GAAP

What?

IFRS

Ethical Conduct

When faced with an ethical dilemma:

Identify who will

benefit from the

situation and how

others will be

harmed.

Identify the

alternative courses

of action.

Choose the

alternative that is the

most ethical.

1-28

Chapter 1

Supplement

Careers That Depend on Accounting

Knowledge

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved

1-30

Chapter 1

Solved Exercises

M1-12, E1-3, E1-6, E1-8, S1-6 (Req. 1)

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved

M1-12 Preparing a Statement of Retained Earnings

Stone Culture Corporation was organized on January 1, 2012.

For its first two years of operations, it reported the following:

Net Income for 2012

Net Income for 2013

Dividends for 2012

Dividends for 2013

Total assets at the end of 2012

Total assets at the end of 2013

$ 40,000

45,000

15,000

20,000

125,000

242,000

On the basis of the data given, prepare a statement of retained

earnings for 2012 (its first year of operations) and 2013. Show

computations.

1-32

M1-12 Preparing a Statement of Retained Earnings

STONE CULTURE CORPORATION

Statement of Retained Earnings

For the Year Ended December 31, 2012

Retained Earnings, January 1, 2012

$

Add: Net Income

40,000

Subtract: Dividends

(15,000)

Retained Earnings, December 31, 2012

$ 25,000

STONE CULTURE CORPORATION

Statement of Retained Earnings

For the Year Ended December 31, 2013

Retained Earnings, January 1, 2013

$ 25,000

Add: Net Income

45,000

Subtract: Dividends

(20,000)

Retained Earnings, December 31, 2013

$ 50,000

1-33

E1-3 Preparing a Balance Sheet

DSW is a designer shoe warehouse, selling some of the most luxurious and

fashionable shoes at prices that people can actually afford. Its balance

sheet, at January 29, 2011, contained the following items (listed

alphabetically, amounts in thousands).

Accounts Payable

$

149,722

Accounts Receivable

12,514

Cash

93,617

Contributed Capital

Notes Payable

314,382

95,589

Other Assets

692,375

Other Liabilities

122,822

Property, Plant, and Equipment

210,391

Retained Earnings

326,382

Total Assets

Total Liabilities and Stockholders’ Equity

1,008,897

?

Required:

1.

2.

1-34

Prepare the balance sheet as of January 29, 2011 solving for the

missing amount.

As of January 29, did most of the financing for assets come from

creditors or stockholders?

E1-3 Preparing a Balance Sheet

DSW, Inc.

Balance Sheet

At January 29, 2011

(In thousands)

Assets

Cash

Accounts Receivable

Property, Plant, and Equipment

Other Assets

Total Assets

Liabilities

Accounts Payable

Notes Payable

Other Liabilities

Total Liabilities

Stockholders’ Equity

Contributed Capital

Retained Earnings

Total Stockholders’ Equity

Total Liabilities and Stockholders’ Equity

1-35

$

93,617

12,514

210,391

692,375

$ 1,008,897

$

149,722

95,589

122,822

368,133

314,382

326,382

640,764

$ 1,008,897

Most of the financing

as of January 29

came from

stockholders. The

stockholders have

financed $640,764 of

the total assets and

creditors have

financed only

$368,133 of the total

assets of the

company.

E1-6 Preparing an Income Statement and Inferring Missing

Values

Cinemark Holdings, Inc. operates movies and food concession

counters throughout the United States. Its income statement for the

quarter ended March 31, 2011, reported the following amounts (listed

alphabetically in thousands):

Admissions Revenues

Concessions Expenses

Concessions Revenues

Film Rental Expenses

Gen. & Admin. Expenses

$ 311,692

23,282

146,681

165,153

179,047

Net Income

Other Expenses

Other Revenues

Rent Expense

Total Expenses

$

?

24,265

24,763

66,426

?

Required:

1. Solve for the missing amounts and prepare an Income Statement

for the quarter ended March 31, 2011.

2. What are Cinemark’s main source of revenue and two biggest

expenses?

1-36

E1-6 Preparing an Income Statement and Inferring Missing Values

Cinemark Holdings, Inc.

Income Statement

For the Quarter Ended March 31, 2011

(in thousands)

Revenues

Admissions Revenues

Concessions Revenues

Other Revenues

Total Revenues

Expenses

Concessions Expenses

Film Rental Expenses

Gen. and Admin. Expenses

Rent Expense

Other Expenses

Total Expenses

Net Income

1-37

$ 311,692

146,681

24,763

$ 483,136

23,282

165,153

179,047

66,426

24,265

458,173

?

$ 24,963?

E1-6 Preparing an Income Statement and Inferring Missing Values

Cinemark Holdings, Inc.

Income Statement

For the Quarter Ended March 31, 2011

(in thousands)

Revenues

Admissions Revenues

Concessions Revenues

Other Revenues

Total Revenues

Expenses

Concessions Expenses

Film Rental Expenses

Gen. and Admin. Expenses

Rent Expense

Other Expenses

Total Expenses

Net Income

1-38

$ 311,692

146,681

24,763

$ 483,136

23,282

165,153

179,047

66,426

24,265

458,173

$ 24,963

E1-8 Inferring Values Using the Income Statement and Balance

Sheet Equations

Review the chapter explanations of the income statement and the

balance sheet equations. Apply these equations in each of the

following independent cases to compute the two missing amounts

for each case. Assume that it is the end of the first full year of

operations for the company.

TIP: First identify the numerical relations among the columns

using the balance sheet and income statement equations. Then

compute the missing amounts.

Independent

Cases

A

Total

Revenues

$110,000

B

80,000

D

50,000

1-39

Net Income

(Loss)

$82,000

80,000

C

E

Total

Expenses

$150,000

12,000

86,000

81,000

Total

Assets

Total

Liabilities

$70,000

112,000

104,000

Stockholders’

Equity

70,000

26,000

20,000

22,000

77,000

(6,000)

73,000

28,000

E1-8 Inferring Values Using the Income Statement and Balance

Sheet Equations

R – E = NI

Independent

Cases

1-40

Total

Revenues

Total

Expenses

Net Income

(Loss)

A = L + SE

Total

Assets

Total

Liabilities

Stockholders’

Equity

A

$110,000

$82,000

$28,000

$150,000

$70,000

$80,000

B

92,000

80,000

12,000

112,000

42,000

70,000

C

80,000

86,000

(6,000)

104,000

26,000

78,000

D

50,000

30,000

20,000

99,000

22,000

77,000

E

75,000

81,000

(6,000)

101,000

73,000

28,000

S1-6 (Req. 1) Critical Thinking: Developing a Balance Sheet

On September 30, Ashley and Jason started arguing about who is

better off. Jason said he was better off because he owned a

PlayStation console that he bought last year for $250. He figures

that, if needed, he could sell it to a friend for $180. Ashley argued

that she was better off because she had $1,000 cash in her bank

account and a piece of art that she bought two years ago for $800

but could now sell for $1,400. Jason countered that Ashley still owed

$250 on her car loan and that Jason’s dad promised to buy him a

Porsche if he does really well in his accounting class. Jason said he

had $6,000 cash in his bank account right now because he just

received a $4,800 student loan. Ashley knows that Jason also owes

a tuition installment of $800 for this term.

Required:

1. Prepare a financial report that compares what Ashley and Jason

each own and owe on September 30. Make a list of any decisions

you had to make when preparing your report.

1-41

S1-6 (Req. 1) Critical Thinking: Developing a Balance Sheet

Balance Sheet

ASSETS

What is owned

Cash

Console

Art

TOTAL

What is owed

LIABILITIES

Car loan

Tuition Payable

Student Loan

TOTAL

“Net worth”

EQUITY

TOTAL

1-42

Ashley

Jason

$1,000

-0800

$1,800

$6,000

250

-0$6,250

$ 250

-0-0250

1,550

$1,800

$ -0800

4,800

5,600

650

$6,250

End of Chapter 1

1-43