Flexible Spending Account - Administrative Services

advertisement

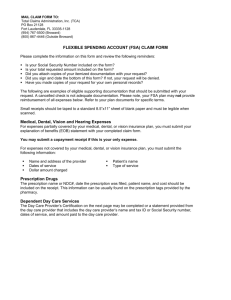

Salt Lake County Flexible Spending Account The Basics • Claims Administrator: – National Benefit Services, LLC – Effective April 1, 2013 • Benefits: – Full FSA, Limited (LP) FSA, & Dependent Care Account – DAILY reimbursements – User friendly website 2 Flexible Spending Account (FSA) Options • Full FSA- only if you don’t participant in the HSA. – Allows you to use pre-tax dollars to pay for out-ofpocket health care expenses • Limited FSA- Dental & Vision expenses only. – This is if you participate in the HSA • Dependent Care Account – Allows you to use pre-tax dollars to pay for daycare expenses while you and your spouse are at work (for your children who are under the age of 13 receiving daycare services). 3 Maximum Annual Limits • Health Care Spending Account – FSA Maximum Annual Limit is $2,500 -Limited FSA Maximum Annual Limit is $2,500 (Due to Health Care Reform Act) • Dependent Care Spending Account – Maximum Annual Limit is $5,000 per year, or $2,500 if married and filing separately. 4 Eligible Expenses FULL FSA LP FSA • • • • • • • • • • • • Medical, Dental, Vision co-pays and deductibles Prescriptions Birth Control Pills Eye Glasses, Contact Lenses Dental Work, including orthodontia Chiropractor Laser Eye Surgery Over the Counter Drugs (Effective 2011, prescription from Doctor needed.) Eye Glasses, Contact Lenses Dental Work, including orthodontia Laser Eye Surgery Eye Exams Dependent Care (For care of your child/children under the age of 13 while you and your spouse are working) • Daycare • Nanny/AuPair There are many additional eligible expenses. Please visit www.IRS.gov for more information. 5 Expenses NOT Covered • Cosmetic Surgery/Procedures • Vitamins (Unless prescribed by a doctor for the treatment of a specific medical condition) • Massage Therapy • Teeth Whitening • Over-the-Counter Drugs and Medicines (Effective 2011, without prescription from Doctor.) 6 How Does it Work? 1. During Open Enrollment, enroll in FSA and elect your annual amount based on your estimated 2013 Health Care and Dependent Care expenses. 2. Once you incur eligible expenses, you may seek reimbursement from your FSA Account. 3. File claim form to NBS. 4. Receive reimbursement as a direct deposit into your bank account or receive a check via mail to your home. 7 Utilizing your FSA • • Use your NBS Visa Debit Card at the time of service or fill out a claim form and submit for reimbursement You may receive a notice from NBS requesting you send in documentation that shows: – – – – • Date of Service Type of Service Amount of Bill AFTER insurance has been paid Copy of the Explanation of Benefits (EOB) from the carrier Why am I getting this notice? 8 Obtaining Account Information • Online Account Information: www.NBSbenefits.com • Customer Service (7 AM – 5 PM , Monday - Friday): (800) 274-0503 (After hours, the Automated Voice Response Unit will be available.) 9 Change of Status • Due to IRS regulations, you cannot change your election amount up or down throughout the course of the plan year, unless you experience a “change of status” (Marriage Change, Employment Change, Dependent Change). • If you experience one of these changes, contact your HR to get your account updated. 10 Plan Year • Plan Year April 1st – March 31st • Grace Period April 1st – June 15th (Able to incur expenses toward prior year’s FSA Account Balance) • Claims Run-out June 30th (Deadline to file claims against your FSA for service incurred before June 15th) 11 Why Participate SAVE ON TAXES! Your contributions to your FSA and/or Dependent Care Spending Accounts are deducted from your pay BEFORE taxes are withheld. 12 Questions? 13