Dr. Helen K. Simon, CFP FIU STEPP Program January 19, 2010

advertisement

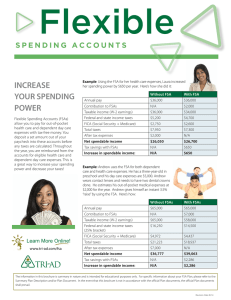

Dr. Helen K. Simon, CFP FIU STEPP Program January 19, 2010 What Is Stress? Stress affects most people in some way Its a combination of emotional and physical pressures It almost always involves a feeling you have little control over the situation (s) Dealing with Stress You can’t deal with it, until you name it! What is causing stress in your life? We have become a culture of what we have instead of who we are Happy to help us….. Leading Cause of Stress?* #1 = Finances Most studies agree that finances are a leading cause of stress. In an online poll conducted in 2005 by LifeCare, Inc., 23 percent of respondents named finances as the leading cause of stress in their lives. Financial stress has led the list in many modern polls. Some who name finances as the leading cause of stress cite major purchases they have to make, such as a home or car. Others are stressed by a loss of income, or mounting credit card debt. For some, financial stress will eventuate in bankruptcy. While college students stress over paying for an education, Baby Boomers and older senior citizens find that retirement income can be a major cause of stress. *downloaded from: http://ezinearticles.com/?7-Leading-Causes-of-Stress&id=473303 CREDIT CARDS Turn from victims into victors! High APRs Excessive spending Cash Back! Budgeting tool Resources Find the right credit card for you: y http://www.bankrate.com/credit-cards.aspx. Check your credit report often! y https://www.freecreditreports360.com/freecreditreport/lp/4 37-dc4c/. Use Quicken: y http://quicken.intuit.com/. Be a Frugalista !! “People who keep up with fashion trends without spending a lot of money. Frugalistas stay fashionable by shopping through alternative outlets, such as online auctions , secondhand stores and classified ads. They also reduce the amount of money spent in other areas of their lives, such as by growing their own food and reducing entertainment expenses. This is a popular term during recessions. “ Downloaded from http://www.investopedia.com/terms/f/frugalista.asp?partner=TOD01. SAVY SPENDING www.Couponheaven.com. Your credit card y www.discovercard.com y www.chaserewardsplus. com Online bill paying www.froogle.com The Sunday newspaper Organized shopping trips Have your cocktail at home Groupon FL restaurants run great specials in the off season Breakfast is a bargain! The Latte Factor y http://www.wisegeek. com/what-is-the-lattefactorreg.htm. The Millionaire Next Door Don’t always think that bigger is better! y The warehouse shopping paradox y Sometimes Publix BOGO is way better! EMPLOYEE BENEFITS FSA (Flexible Spending Account) Deferred savings Tuition reimbursement Disability insurance y Chances of becoming disable pre 65 is 5 Xs greater than dying Life insurance y Do you have enough? Or too much? Discounted Services: y http://www.bcbsfl.com/DocumentLibrary/DiscountPrograms/Bl ueComplementsBrochure_20032.pdf FSA - example 45 Zyrtec tablets cost $25 at drugstore.com That’s .55 per pill or $202.78 per year after tax $ 259.56 before tax dollars = $202.78 in after tax dollars (in the 28% tax bracket) On this one small item, the FSA saves $56.78 per year! Some FSA eligible expenses Some possible FSA eligible expenses IRS publication 969 Health Insurance deductibles and copayments Adult day care Acne treatments Body Scans Sunscreen Hand Sanitizer Medically necessary vitamins How much do you spent per year in FSA eligible expenses? If you are in the 28% margin tax bracket: $500? – save $140 $1000 ? – save $280 $2000? – save $ 560 Retirement Savings 403b 457 Roth IRA Tuition Reimbursement The best investment you can make is in yourself! Education = higher salaries, better jobs, better quality of life You are NEVER too old or too busy to take a class And we can do it for FREE!!!! Available on the FIU library or used on Amazon for <$5 REALISTIC BUDGETING Plan for savings first…? How much cash should you keep in your emergency fund? Where should you keep your emergency fund? y http://home.ingdirect.com/ INVESTMENT MISTAKES Listening to too many financial experts Investing in things you don’t understand Thinking there is a “free-lunch” Thinking you know more than the “experts” Taking too much risk Using insurance as an investment TIAA CREF Investment Results over the last decade (average annual return 12/31/1999 – 12/31/2009*) Equity Index Fund - 0.56% Growth Fund - 4.66% Bond Fund + 5.84% Fixed Account + 6.62% Downloaded on 1/8/2010 from https://www3.tiaa-cref.org/perfview/performance Fixed savings example $10,000 per year in a 403B (in the 28% tax bracket) Immediate tax savings of $2800 $135,706 in 10 years TROPHY KIDS http://www.thetrophykids.com/ Be a good parent – but not too good! Are you stressed out about your child’s college education? Have you sacrificed your own retirement savings planning to pay for your child’s education? Does your child have a job? Is your child employable?