Health Care 101 Understanding the Basics - CPHCC

advertisement

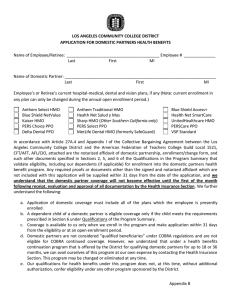

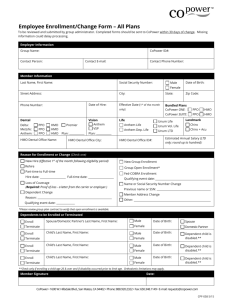

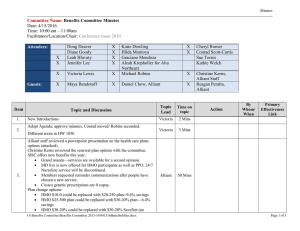

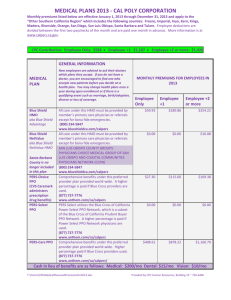

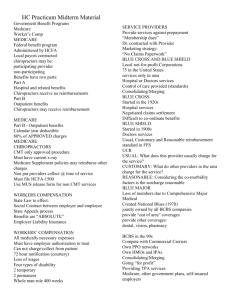

Health Care 101 Understanding the Basics Marianne Monfils, CSEA Bryce Van De Moere, Esq. TPA, SCEET Health Care Who Delivers the Package? Individual School Districts Jointly Managed Trust (JMT) Joint Powers Authority (JPA) Taft Hartley Trust Other risk pools (i.e. CALPERS, Medicare, etc.) 2 What are the Main Plans? • Health Maintenance Organization (HMO) • Preferred Provider Organization (PPO) • Point of Service (POS) • Exclusive Provider Organization (EPO) 3 How Do They Differ? HMO A contract for prepaid medical services with medical groups and hospitals to provide comprehensive medical care according to a predetermined summary of benefits Access is restricted to a prescribed set of providers (aka “the Provider Network”) Requires that all services be authorized by a “Primary Care Physician (PCP)” or “Gatekeeper” 4 How Do They Differ? HMO (continued) Access to non-HMO providers is restricted to “in network” physicians with the exception of emergency services (ER) When utilizing services you must follow the instructions of your district’s “Summary of Benefits” Less costly as a portion of the physician compensation is provided on a pre-paid, “capitation” basis 5 How Do They Differ? PPO A managed care plan that contracts with physicians and hospitals on a “fee for service (FFS)” basis. Contract providers exchange discounted services for increased volume No PCP or “Gatekeeper” required Access to all providers within the carrier’s network allowed without prior authorization Reduced benefits for non-network utilization (i.e. “Out of Network” (OON) and “Out of Area” (OOA)) 6 How Do They Differ? POS A managed care plan that allows members to choose, at the point where service begins, to receive services from an HMO or PPO plan of benefits Three levels of benefits available to participants: 1. HMO: in-network only 2. PPO: in-network 3. PPO: out-of-network POS plans are generally more costly than an HMO but not as expensive (premium) as a PPO 7 How Do They Differ? EPO A managed care plan where services are covered only if you go to physicians or hospitals in the plan’s network (except for emergency services). Services are usually confined to one or two medical groups in a specific geographic location. 8 Prescription Drugs Generic Brand Non-Formulary Mail Order 9 How are the Plans Funded? Fully Insured Self Insured 10 How Do They Differ? Fully Insured Plans The Insurance Company takes the risk The Group may be pooled with others The Group is experienced rated All services come from the selected carrier, such as the network, billing, claim payments, etc. 11 How Do They Differ? Self Insured Plans The Employer or Group assumes the full risk Benefits are administered by the Employer or Group The Employer or Group assumes the full risk Benefits are administered by the Employer or Group, or may be handled through an Administrative Service Only (ASO) agreement with an Insurance Carrier or Third party Administrator (TPA) Mixture of Specific & Aggregate Stop-Loss contracts are purchased to cover the costs when claims reach a certain level 12 Components of Rates Medical Loss Ratio Paid Claims Incurred But Not Reported (IBNR) Administrative Expense Margin Medical Trend Profit 13 Medical Loss Ratio Dictates how much of the health care premium dollar must be spent on medical services for the member. 14 Paid Claims Claims that result in a payment during a specific period of time. 15 IBNR Claims that have not been reported to the Insurer as of some specific date for services that have been provided. The estimated value of these claims is a component of an Insurer’s current liabilities. 16 Administrative Expense Billing/Eligibility Claim Paying Services Medical Network Identification Cards Communication Materials Client services Stop Loss Premium Underwriting and Actuarial Services State and Federal Compliance (ex. HIPAA, COBRA, AFA) 17 Margin The amount necessary to ensure that the Insurance Company will have a profit. Sometimes this is referred to as the “fudge factor”. 18 Medical Trend The calculation made which reflects inflation in overall medical costs. This includes providers, hospitals, equipment and new technology to name a few. It is built into the renewal rate for a Group. 19 Profit In most plans, the profit margin is in the range of… 4% - 6% 20 What is the Basis for Rate Changes? Hospital Costs Utilization Opt Outs Demographics Plan Design Trend Formularies Wellness Programs Margin Quality of Health care Disease Management Programs Rx Plan 21 For more Information on how Health Care Reform affects you, please refer to http://www.healthcare.gov 22