The View From Massachusetts - State Coverage Initiatives

advertisement

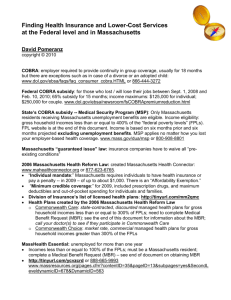

Policy and Politics of Cost Containment: The View From Massachusetts Sarah Iselin Blue Cross Blue Shield of Massachusetts Foundation August 5, 2010 • Mission: expand access to health care • Improving access to coverage • Reducing barriers to care • Founded in 2001 by Blue Cross Blue Shield of Massachusetts • $90M Endowment • Independent, private foundation governed by own board of directors • www.bluecrossfoundation.org July 7, 2010 The Massachusetts Health Care ‘Train Wreck’ The future of ObamaCare is unfolding here: runaway spending, price controls, even limits on care and medical licensing. We have the lowest rate of uninsurance in the country… Massachusetts: Uninsured as % of Population 11.30% 10.20% 10.4% 9.2% 5.4% 2.7% 2003 2004 2005 2006 2007 2009 Sources: Current Population Survey, 2003-2008, US Census Bureau Division of Health Care Finance and Policy …but the highest costs per capita in the world… $7,000 $6,000 Massachusetts United States $5,000 $4,000 France $3,000 Germany Australia Canada United Kingdom $2,000 $1,000 04 03 20 02 20 00 01 20 20 99 20 97 98 19 19 96 19 95 19 94 19 93 Sources: Commonwealth Fund (2008), CMS (2007), U.S. Census (2009). Note: U.S. dollars are current-year values. Other currencies are converted based on purchasing power parity. 19 92 19 91 19 89 90 19 19 88 19 87 19 85 86 19 19 84 19 82 83 19 19 81 19 19 19 80 $0 …and per capita health care spending is projected to nearly double by 2020. Massachusetts Per Capita Health Care Expenditures: 1991-2020 Note: The health expenditures are defined by residence location and as personal health expenditures by CMS, which exclude expenditures on administration, public health, and construction. Data for 2005 – 2020 are projected assuming 7.4% growth through 2010 and then 5.7% growth through 2020. Source: Centers for Medicare & Medicaid Services (CMS), Office of the Actuary, National Health Statistics Group, 2007. Projections by the Division of Health Care Finance and Policy. Additional Insured: September 2009 Change since June 20, 2006 Total Additional Insured: 364,000 Private Group Individual Purchase Private Group 11% Commonwealth Care 41% MassHealth Commonwealth Care Individual Purchase 14% MassHealth 34% Source: Division of Health Care Finance and Policy, February 2010 Though the quality of MA health care is among the best in the U.S., even we can improve Research on health care in Massachusetts highlights the problems of preventable illness and insufficient emphasis on primary and preventive care. • Fewer than half of all adults over age 50 receive recommended preventive and screening care.* • Fewer than half of adult diabetics receive recommended preventive care.* • Nearly half of emergency department visits are potentially preventable.** • 8 percent of hospitalizations and 7-10 percent of readmissions could have been avoidable with effective ambulatory care.** * Cantor et al. 2007 ** DHCFP, MA Health System Data Reference 2009 Cost Conversation Begins in Earnest with Ch. 305 • Ch. 305: “An Act To Promote Cost Containment, Transparency And Efficiency In The Delivery Of Quality Health Care” (August 2008) Major Provisions: • Special Commission on the Health Care Payment System • Annual Division of Health Care Finance and Policy report and hearings on health care costs with Attorney General • Study on health plan and hospital reserves/surpluses Creation of the Special Commission • Created the Special Commission on the Health Care Payment System to investigate reforming and restructuring the payment system in order to: • Provide incentives for efficient and effective patientcentered care. • Reduce variations in the quality and cost of care. FFS payment drives health care cost growth and overuse of services Providers are paid for each service they produce. • Incentives for increased volume. Providers have a financial incentive to increase the number of services they produce. • Incentives to deliver more costly services. Providers have a financial incentive to deliver services with higher financial margins – often more costly services. • Little or no incentive for achieving positive results or for care coordination. Providers have no financial incentive to deliver the most effective care or to coordinate care. • Little or no incentive to deliver preventive services and or other services with low financial margins. Providers have little incentive to provide services with low financial margins—including preventive care and behavioral health care. Special Commission’s Recommendation Current Fee-for-Service Payment System The Problem Care is fragmented instead of coordinated. Each provider is paid for doing work in isolation, and no one is responsible for coordinating care. Quality can suffer, costs rise and there is little accountability for either. $ $ $ $ Patient-Centered Global Payment System The Solution Global payments made to a group of providers for all care. Providers are not rewarded for delivering more care, but for delivering the right care to meet patient’s needs. $ Primary Care Hospital Specialist Home Health Hospital Specialist Primary Care Home Health Government, payers and providers will share responsibility for providing infrastructure, legal and technical support to providers in making this transition. Why Payment Reform, Why Now? • Special Commission unanimously endorsed recommendations to promote high-quality, cost-effective care through payment reform • Five of six most promising options analyzed by RAND study on health care cost control options for MA involve changing payment approaches • Health Care Quality and Cost Council endorsed Special Commission recommendations in “Roadmap to Cost Containment” • Meltdown of economy: unemployment rate, rising health insurance premiums impeding recovery, state budget deficit, loud small business concerns about health care costs • Governor running for reelection against former head of major insurer Governor Patrick using Division of Insurance authority to disapprove premium increases Price increases driving most of the increase in health care costs AG Report: Variation in Hospital Prices Source: Office of the Attorney General, “Report on Examination of Health Care Cost Trends and Cost Drivers” (March 16, 2010) AG Report: Variation in Physician Prices Source: Office of the Attorney General, “Report on Examination of Health Care Cost Trends and Cost Drivers” (March 16, 2010) Attorney General Report Findings • Payment differences are not correlated to quality, sickness of patients, payer mix, teaching status, or underlying costs • Variation in total expense per member is not correlated to method of payment—risk sharing providers sometimes are paid more than providers paid FFS • Payment differences are related to market leverage AG Report: Higher priced hospitals are gaining market share at the expense of lower priced hospitals April 14, 2010 Partners offers $40m to ease rates Partners HealthCare, whose Boston teaching hospitals have been blamed for helping to drive up medical spending, is offering $40 million toward reducing double-digit health insurance rate increases for small businesses, part of a broader package that will be unveiled today by Senate President Therese Murray. Largest health system in MA is being investigated at the state and federal levels June 18, 2010 Partners report slams AG's hospital cost study Mass. Hospital Association Campaign So, what’s next? • Two cost bills since 2006 • Lots of studies and commissions • Payment reform bill planned for the next session • Special Commission recommendations or pilots/demos? • MassHealth pursuing payment reform in 1115 waiver renewal application • Lots of interest in PPACA opportunities around payment reform • Punch line • Near term – some payers moving ahead, fate of a bill unclear • Longer term – inevitability, but some will stall as long as possible…