Revenue Cycle 2.0 Tools

advertisement

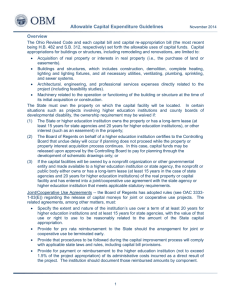

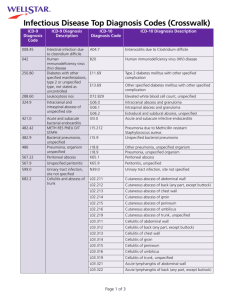

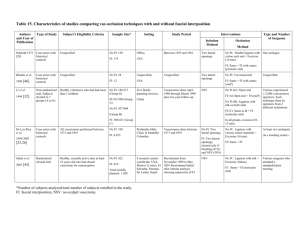

Are You Ready For Revenue Cycle 2.0? Presentation Summary & Tools Presented by: Daniel J. Marino The Healthcare Reality of Today • Healthcare costs continue to rise placing pressures on patients, employers and healthcare providers • Movement from volume-based reimbursement to valuebased contacts – Fee-for-services plus shared savings – Shared savings with PMPM care management fee – Risk-based contracts • The importance of data continues to rise – Process-driven outcomes – Performance and care results 2 Shift in Revenue Cycle Activities Present Future Based on fee-forservice encounters Based on clinical performance Encounter-based contract management Performance-based contract management Based on fee schedule Bundled payments Accounts receivable indicators “New” business metrics Consumer driven healthcare 3 New Generation of KPIs • New Generation of financial metrics include: - Tracking “Cost of Care” Clinical performance Patient satisfaction/engagement Beneficiary/program management Bundled payment indicators • PM systems tracking by value –based contract - Bundled service Shared savings Partial or full risk • A/R management reflecting performance incentive opportunity 4 Physician Key Performance Indicators Revenue Cycle Payment Analysis Patient Satisfaction Patient Access Key Performance Indicators Care and Outcomes Cost / Profitability Production 5 Focused Analytics Help Identify Where to Begin Stratify Data based PMPM, Cohorts Build the total cost of care model on per member, per month bases Indicators should include: • Allowed versus paid amount • Employee, spouse, child • With and without high cost claims 6 Top 10 Diagnoses by Total Cost Diagnosis Code 401.9 585.6 V58.11 174.9 205.02 V42.7 V58.0 280.9 824.8 823.82 Allowed Amount Paid Amount Patients Unspecified essential hypertension $1,537,106 $1,434,185 End stage renal disease $1,126,685 Description Encounter for antineoplastic Malignant neoplasm of breast Acute myeloid leukemia, in relapse $746,231 $758,427 $682,459 Liver replaced by transplant $651,863 Encounter for radiotherapy $593,219 Iron deficiency anemia, unspecified $590,289 Unspecified fracture of ankle, closed $576,856 Closed fracture of unspecified part of fibula with tibia $571,902 Encounters Paid per Encounter Paid per Patient 911 5,286 $271 $1,574 $1,089,893 $716,961 $715,286 $674,449 9 28 72 2 1,496 1,552 1,667 30 $729 $462 $429 $22,482 $121,099 $25,606 $9,935 $337,224 $634,463 8 309 $2,053 $79,308 $593,219 $565,894 18 75 766 1,198 $774 $472 $32,957 $7,545 $562,333 20 94 $5,982 $28,117 $560,723 3 58 $9,668 $186,908 * Diagnoses appeared in the primary, secondary or tertiary codes 7 Evaluating the High Cost Services Support Bundled Service Tracking Cancer Type Lung Colorectal Breast Allowed Amount $193,509 $377,167 $844,232 Paid Amount $179,059 $333,967 $797,865 Encounters 512 850 1946 • On a per encounter basis, colorectal cancer is the most expensive cancer type assessed, whereas breast cancer had the highest encounter rate *Figures provided are in Paid Amounts. *Disease categories based off of grouped diagnoses corresponding to condition. 8 Collected vs. Collectable • Similar to net collection rate, but allows for more accurate review — Collected: Payment received and line item posted (includes co-pay and deductible) — Collectable: The allowable amount as negotiated in contract (includes co-pay and deductible) • Great metric to evaluate overall revenue cycle performance • Forces you to ask specific questions and drill down to find answers • Dependent on knowing contract fee schedule • Allows for better contract negotiations 9 Collected vs. Collectable 90 Day CvC: Goal 92-94% Payments received in the next 3 months Allowable posted 4 months ago 180 Day CvC: Goal 95-97% Payments received in the next 6 months Allowable posted 7 months ago Annual CvC: Goal 97-99% Payments received in the next 12 months Allowable posted 13 months ago 10 Sample 90 Day CvC Report JANUARY, 2014 INSURANCE PLAN CHARGES ALLOWABLE COLLECTED (Coll./Allow.) % COLLECTED $1,639,044 $1,062,610 $1,043,451 98.20% $185,361 $145,090 $140,925 97.13% USHC $1,986,460 $1,267,667 $1,210,398 95.48% UNITED HEALTH $1,653,396 $1,283,729 $1,219,456 94.99% MEDICARE $4,532,591 $1,799,580 $1,679,789 93.34% CIGNA $1,146,525 $911,439 $847,316 92.96% OXFORD $1,318,334 $1,053,521 $960,497 91.17% HEALTHNET $579,508 $477,573 $418,675 87.67% HORIZON $258,003 $258,003 $195,264 75.68% SELF $272,173 $272,173 $188,777 69.36% $13,571,395 $8,531,385 $7,904,548 92.65% AETNA AMERIHEALTH TOTAL 11 End Uses of Clinical Information to Support Revenue Cycle Performance Program Management • Quality scorecards • Patient chart view through continuum of care • Use of referrals and ancillaries Physician Performance • • • Chronic disease registries Care gap management Patient satisfaction Financial Effectiveness • • • • Total cost of care reports Payer analytics Areas of improvement Domestic Utilization Mgmt 12 Contact Daniel J. Marino President/CEO dmarino@healthdirections.com Health Directions, LLC Two Mid America Plaza, Suite 1050 Oakbrook Terrace, IL 60181 Phone: 312-396-5400 dmarino@healthdirections.com www.healthdirections.com @HDirections 13