Introduction to Management Science

advertisement

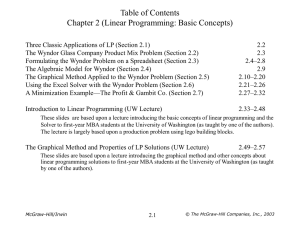

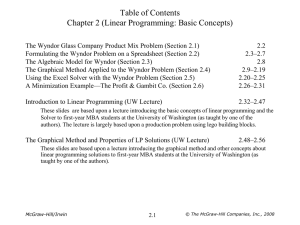

Table of Contents Chapter 1 (Introduction) Special Products Break-Even Analysis (Section 1.2) Power Notebooks Make or Buy Example 1.2 – 1.7 1.8 This slide provides an example of a make or buy decision, where modeling can be illustrated. This would lead into a discussion about developing a model, culminating in either a spreadsheet model, an algebraic model, and/or a graph of the costs of the two alternatives. 1.9 – 1.22 Advertising Problem (UW Lecture) An illustration of the management science approach to a problem. At the University of Washington, this is the very first lecture in the core MBA class on management science. While it includes some advanced topics (Solver, nonlinear objectives, etc.) it can be taught entirely on the spreadsheet in a very intuitive way, and has proven to be a good introduction to the power of Solver. The next several lectures then would need to “back up” and cover more of the fundamentals of linear programming, modeling, the Solver, etc. McGraw-Hill/Irwin 1.1 © The McGraw-Hill Companies, Inc., 2003 Special Products Break-Even Analysis • The Special Products Company produces expensive and unusual gifts. • The latest new-product proposal is a limited edition grandfather clock. • Data: – – – – If they go ahead with this product, a fixed cost of $50,000 is incurred. The variable cost is $400 per clock produced. Each clock sold would generate $900 in revenue. A sales forecast will be obtained. Question: Should they produce the clocks, and if so, how many? McGraw-Hill/Irwin 1.2 © The McGraw-Hill Companies, Inc., 2003 Expressing the Problem Mathematically • Decision variable: – Q = Number of grandfather clocks to produce • Costs: – Fixed Cost = $50,000 (if Q > 0) – Variable Cost = $400 Q – Total Cost = • 0, if Q = 0 • $50,000 + $400 Q, if Q > 0 • Profit: – Profit = Total revenue – Total cost • Profit = 0, if Q = 0 • Profit = $900Q – ($50,000 + $400Q) = –$50,000 + $500Q, if Q > 0 McGraw-Hill/Irwin 1.3 © The McGraw-Hill Companies, Inc., 2003 Analysis of the Problem $ $200,000 $160,000 Revenue = $900 x Profit $120,000 Cost = $50,000 + $400 x Fixed cost $80,000 Loss $40,000 0 40 80 120 160 200 x Break-even point = 100 units McGraw-Hill/Irwin 1.4 © The McGraw-Hill Companies, Inc., 2003 Management Science Interactive Modules • Sensitivity analysis can be performed using the Break-Even module in the Interactive Management Science Modules (available on your MS Courseware CD packaged with the text). – Here we see the impact of changing the fixed cost to $75,000. McGraw-Hill/Irwin 1.5 © The McGraw-Hill Companies, Inc., 2003 Special Products Co. Spreadsheet B C 3 4 D E F Data Unit Revenue 5 Fixed Cost Results $900 $50,000 6 Marginal Cost $400 7 Sales Forecast 300 Total Revenue $270,000 Total Fixed Cost $50,000 Total Variable Cost $120,000 Profit (Loss) $100,000 8 9 Production Quantity E 3 4 5 6 7 300 F Results Total Revenue Total Fixed Cost Total Variable Cost Profit (Loss) McGraw-Hill/Irwin =UnitRevenue*MIN(SalesForecast,ProductionQuantity) =IF(ProductionQuantity>0,FixedCost,0) Range Name Cell FixedCost C5 MarginalCost C6 ProductionQuantity C9 Profit F7 SalesForecast C7 TotalFixedCost F5 TotalRevenue F4 TotalVariableCost F6 UnitRevenue C4 =MarginalCost*ProductionQuantity =TotalRevenue-(TotalFixedCost+TotalVariableCost) 1.6 © The McGraw-Hill Companies, Inc., 2003 Special Products Co. Spreadsheet B C 3 4 D E F Data Unit Revenue 5 Fixed Cost Results $900 $50,000 6 Marginal Cost $400 7 Sales Forecast 300 Total Revenue $270,000 Total Fixed Cost $50,000 Total Variable Cost $120,000 Profit (Loss) $100,000 8 9 Production Quantity E 3 Total Revenue 5 Total Fixed Cost 7 Cell BreakEvenPoint F9 FixedCost C5 MarginalCost C6 ProductionQuantity C9 Profit F7 SalesForecast C7 =UnitRevenue*MIN(SalesForecast,ProductionQuantity) TotalFixedCost F5 =IF(ProductionQuantity>0,FixedCost,0) TotalRevenue F4 =MarginalCost*ProductionQuantity TotalVariableCost F6 UnitRevenue C4 Break-Even Point 100 F Results 4 6 Range Name 300 Total Variable Cost Profit (Loss) =TotalRevenue-(TotalFixedCost+TotalVariableCost) 8 9 Break-Even Point McGraw-Hill/Irwin =FixedCost/(UnitRevenue-MarginalCost) 1.7 © The McGraw-Hill Companies, Inc., 2003