TM 661 Chapter 5 Solutions 1

advertisement

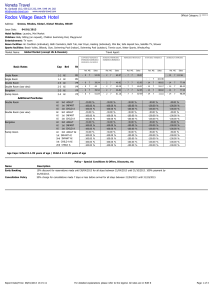

TM 661 Chapter 5 Solutions 1 5.4) Consider the net cash flows and salvage values for each of alternatives 1 and 2 having lives 3 and 5 years respectively. t 0 1 2 3 4 5 NCF-1 -60,000 35,000 35,000 35,000 SV-1 60,000 30,000 10,000 0 NCF-2 -100,000 30,000 30,000 30,000 30,000 30,000 SV-2 100,000 60,000 40,000 25,000 15,000 10,000 Soln: a. Least Common Multiple t NCF-1 NCF-2 0 -60,000 -100,000 1 35,000 30,000 2 35,000 30,000 3 -25,000 30,000 4 35,000 30,000 5 35,000 -60,000 6 -25,000 30,000 7 35,000 30,000 8 35,000 30,000 9 -25,000 30,000 10 35,000 -60,000 11 35,000 30,000 12 -25,000 30,000 13 35,000 30,000 14 35,000 30,000 15 35,000 40,000 d. 2-Year t 0 1 2 NCF-1 -60,000 35,000 45,000 NCF-2 -100,000 30,000 70,000 b. Shortest Life t NCF-1 0 -60,000 1 35,000 2 35,000 3 35,000 NCF-2 -100,000 30,000 30,000 55,000 c. Longest Life t NCF-1 0 -60,000 1 35,000 2 35,000 3 -25,000 4 35,000 5 45,000 NCF-2 -100,000 30,000 30,000 30,000 30,000 40,000 d. 4-Year t 0 1 2 3 4 NCF-2 -100,000 30,000 30,000 30,000 45,000 Chapter 5 1 NCF-1 -60,000 35,000 35,000 -25,000 65,000 TM 661 Chapter 5 Solutions 2 5-10) A firm has available 4 proposals A, B, C, D. Proposal is contingent on acceptance of either proposal C or proposal D. In addition, proposal C is contingent on proposal D, while proposal D s contingent on either proposal A or proposal B. The firm has a budget limitation of $500,000. The cash flows are as follows: Initial Costs A = 250,000 B = 350,000 C = 50,000 D = 38,000 Soln: Note we did not need to include the entire cash flow since only the initial costs affect the initial budget of $500,000. Alternative A, B, C, D A, B, C A, B, D A, C, D A, C A, B A, D B, C, D B, C B, D C, D A B C D Acceptable no no no yes no no yes yes no yes no no yes no no Reason exceeds budget exceeds budget exceeds budget C contingent on D exceeds budget C is contingent on D D is contingent on A or B A is contingent on C or D C is contingent on D D is contingent on A or B Chapter 5 2 TM 661 Chapter 5 Solutions 3 5-23) Two mutually exclusive proposals, each with a life of 5 years, are under consideration. MARR is 12%. Each proposal has the following cash flow profile. t 0 1 2 3 4 5 NCF-A -30,000 9,300 9,300 9,300 9,300 9,300 NCF-B -42,000 12,625 12,625 12,625 12,625 12,625 Soln: a. Net Present Worth A NPW = -30,000 + 9,300 (P/A, 12, 5) = -30,000 + 9,300 (3.6048) = $ 3,525 B NPW = -42,000 + 12,625 (3.6048) = $3,511 Choose A b. Incremental Method t 0 1 2 3 4 5 NCF-A -30,000 9,300 9,300 9,300 9,300 9,300 NCF-B -42,000 12,625 12,625 12,625 12,625 12,625 NCF (B-A) -12,000 3,325 3,325 3,325 3,325 3,325 Chapter 5 3 NPW = -12,000 + 3,325(3.6048) = -14 Choose A TM 661 Chapter 5 5-23) (Cont) t 0 1 2 3 4 5 NCF-A -30,000 9,300 9,300 9,300 9,300 9,300 NCF-B -42,000 12,625 12,625 12,625 12,625 12,625 Soln: c. Equivalent Annual Worth A EUAW = -30,000 (A/P, 12, 5) + 9,300 = -30,000 (0.2774) + 9,300 = $ 978 B EUAW = -42,000 (0.2774) + 12,625 = $ 974 Choose A Chapter 5 4 Solutions 3 TM 661 Chapter 5 Solutions 5 5-36) An aluminum extrusion plant manufactures a particular product at a variable cost of $0.04 per unit, including material costs. The fixed costs associated with manufacturing the product equal $30,000 per year. Determine the break-even value for annual sales if the selling price per unit is a) $0.40, b) $0.30, and c) $0.20. Soln: Let S = selling price Profit = SX - 30,000 - .04X = (S - .04)X -30,000 Since profit = 0 at breakeven X = 30,000 / (S - .04) a. X = 30,000 / (.4 - .04) = 83,333 b. X = 30,000 / (.3 - .04) = 115,384 c. X = 30,000 / (.2 - .04) = 187,500 Chapter 5 5 TM 661 Chapter 5 Solutions 6 5-37) Owners of a nationwide motel chain are considering locating a new motel in Snyder, Arkansas. The complete cost of building a 150-unit motel is $5 million. The firm estimates that the furnishings will cost $1,875,000 initially and every 5 years thereafter. Annual operating and maintenance cost for the facility is estimated to be $125,000. The average rate for a unit is anticipated to be $55 per day. A 15 year planning horizon is used by the firm in evaluating new ventures of this type. Salvage value is estimated at $1 million. Determine the breakeven if the daily occupancy is estimated to be 10%. Soln: I set up a spreadsheet showing revenues and costs. Revenues were based on an occupancy rate in cell C3. Net present worth is computed at 10%. I then just altered cell C3 until I got a NPV relatively close to 0. I compute an occupancy rate of 37.5%. Revenue = 150 units x % occupancy x $55 / unit x 365 days / yr. Occupancy rate = 0.375 MARR = 0.1 t 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Cost Refurbish -5,000,000 -1,875,000 -1,875,000 -1,875,000 1,000,000 Revenue 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 1,129,219 NPV = NCF -6,875,000 1,129,219 1,129,219 1,129,219 1,129,219 -745,781 1,129,219 1,129,219 1,129,219 1,129,219 -745,781 1,129,219 1,129,219 1,129,219 1,129,219 2,129,219 66,198 Chapter 5 6