TM 661 Chapter 2 Solutions 1

advertisement

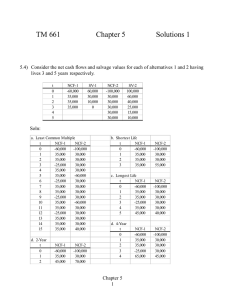

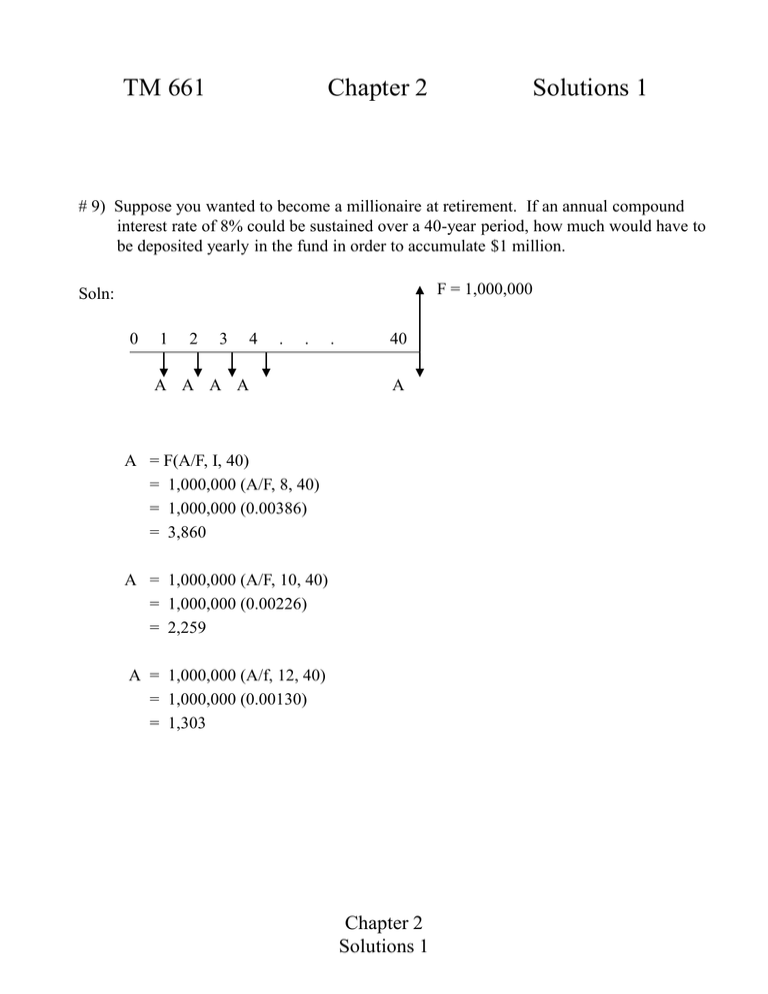

TM 661 Chapter 2 Solutions 1 # 9) Suppose you wanted to become a millionaire at retirement. If an annual compound interest rate of 8% could be sustained over a 40-year period, how much would have to be deposited yearly in the fund in order to accumulate $1 million. F = 1,000,000 Soln: 0 1 2 3 4 . . A A A A . 40 A A = F(A/F, I, 40) = 1,000,000 (A/F, 8, 40) = 1,000,000 (0.00386) = 3,860 A = 1,000,000 (A/F, 10, 40) = 1,000,000 (0.00226) = 2,259 A = 1,000,000 (A/f, 12, 40) = 1,000,000 (0.00130) = 1,303 Chapter 2 Solutions 1 TM 661 Chapter 2 Solutions 2 14. Kim deposits $1,000 in a savings account; 4 years after the deposit, half of the account balance is withdrawn. $2,000 is deposited annually for an 8-year period, with the first deposit occurring 2 years after the withdrawal. The total balance is withdrawn 15 years after the initial deposit. If the account earned interest of 8% compounded annually over the 15 year period, how much was withdrawn at each withdrawal point? F Soln: 500(1.08)4 0 1 2 3 4 5 1,000 6 7 13 2,000 2,000 2,000 15 At year 4, value in the account is given as F = 1,000(F/P, 8, 4) = 1,000(1.08)4 = 1,360 Leaving half in the account leaves 680 in period 4. Then in year 15, the total amount in the account is given by = 680(F/P, 8, 11) + 2,000(F/A, 8, 8)(F/P, 8, 2) = 680(1.08)11 + 2,000(10.6366)(1.08)2 = $ 26,399 Chapter 2 Solutions 2 TM 661 Chapter 2 Solutions 3 27) Dr. Shieh deposits $3,000 in a money market fund. The fund pays interest at a rate of 12% compounded annually. Just 3 years after making the single deposit, he withdraws one third the accumulated money in his account. Then 5 years after the initial deposit, he withdraws all of the accumulated money remaining in the account. How much does he withdraw 5 years after his initial deposit? Soln: F 1/3 accum. 1 2 3 4 5 3,000 Amount accumulated by year 3. F = 3,000(F/P, 12, 3) = 3,000 (1.12)3 = 4,215 Withdrawing 1/3 leaves $2,810 which then earns interest for two more years F5 = 2,810 (F/P, 12, 2) = 2,810 (1.12)2 = $3,525 Chapter 2 Solutions 3 TM 661 Chapter 2 Solutions 4 38. Lynne borrows $15,000 at 1.5% per month. She desires to repay the money using equal monthly payments over 36 months. Lynne makes four such payments and decides to pay off the remaining debt with one lump sum payment at the time for the 5th payment. What should be the size of the payment if interest is truly compounded at a rate of 1.5% per month. Soln: 15,000 1 2 3 36 A A A A A = 15,000 (A/P, 1.5, 36) = 15,000 (.0362) = 543 After making 4 payments of 543, Lynne wishes to pay off the loan in the 5th payment. 15,000 1 543 2 3 4 5 X 15,000 = 543 (P/A, 1.5, 4) + X (1.015)-5 15,000 = 543 (3.8544) + X (.9283) X = $ 13,905 Chapter 2 Solutions 4 TM 661 Chapter 2 Solutions 5 47) A person borrows $10,000 and wishes to pay it back witn 9 equal annual payments. What will the payments be if the interest used is 12% compounded (a) annually, (b) semi-annually, and (c) continuously? 15,000 Soln: 1 2 3 . . . 9 A a) ieff = 12% A = 10,000(A/P, 12, 9) = 10,000 (0.1877) = $1,877 b) ieff = (1+.06)2 - 1 = .1236 A = 10,000(A/P, 12.36, 9) = 10,000 (0.1903) = $1,903 c) ieff = e.12 - 1 = .1275 A = 10,000(A/P, 12.75, 9) = 10,000 (0.1931) = $1,931 or = 10,000(A/P, 12, 9)cont = 10,000(0.1931) = $1,931 formula p. 61 or table Appendix B, p. 450 Chapter 2 Solutions 5 TM 661 Chapter 2 Solutions 6 54) A firm buys a new computer that costs $100,000. It may either pay cash now or pay $20,000 down and $30,000 per year for 3 years. If the firm can earn 15% on investments, which option should the firm choose? Soln: or 100 20 1 2 3 30 30 30 for alternative b) compute Present Worth = 20 + 30 (P/A, 15, 3) = 20 + 30 (2.2832) = 88.497 Based on the firm’s time-value-of-money, alternative b) is cheaper. Chapter 2 Solutions 6 TM 661 Chapter 2 Solutions 7 62) Consider the following cash flow t At 0 -10,000 1 6,500 2 6,000 3 5,500 4 5,000 5 4,500 6 4,000 7 3,500 8 3,000 At 10% annual compound interest, compute the equivalent uniform annual cash flow. Soln: We are given a gradient cash flow decreasing at 500 per period. The present worth consists of the present worth of the annuity (6,500) less the present worth of the gradient (-500). P = -10,000 + 6,500 (P/A, 10, 8) - 500(P/G, 10, 8) = -10,000 +6,500 (5.3349) - 500 (16.0287) = 16,662 A = 16,662 (A/P, 10, 8) = 16,662 (0.1874) = $3,123 Alternatively, A = -10,000 (A/P, 10, 8) + 6,500 - 500 (A/G, 10, 8) = -10,000 (0.1874) + 6,500 -500 (3.0045) = $3,124 Chapter 2 Solutions 7 TM 661 Chapter 2 Solutions 8 67) Ms. Torro-Tamos borrows $7,000 and repays the loan with 4 quarterly payments of $600 during the first year and 4 quarterly payments of $1,500 during the second year. Determine the effective interest rate for this transaction. 7,000 Soln: 1 2 3 4 5 6 7 8 600 1,500 7,000 = 600 (P/A, i, 4) + 1,500 (P/A,i, 4)(P/F, i, 4) i 1.0% 2.0% 3.0% 4.0% 3.5% 3.6% NPV(i) (966.00) (561.00) (184.00) 167.00 (5.16) 29.90 The quarterly interest rate is roughly 3.5% per quarter. ieff = (1 + .035)4 - 1 = .1475 = 14.75% Chapter 2 Solutions 8