multiplier effect - Economics @ Tallis

advertisement

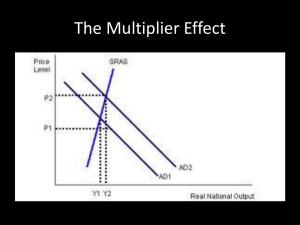

Aggregate Demand ECON 2 Aggregate Demand • Aggregate demand is the total demand for a country’s goods and services at a given price level and in a given time period • This includes spending by households, firms, the government and foreigners (who buy things in or from the UK) Calculating AD • Aggregate demand is made up of – Consumer Expenditure (C) – all spending by households on consumer products – Investment (I) – spending on capital goods – mainly by firms – Government Spending (G) – spending by central and local government on goods and services – Net exports (exports (X) – imports (I)) – the value of exports (goods and services sold abroad) minus imports (goods and services bought from abroad) Calculating AD • Formula: AD = C + I + G + (X – M) • C = £50bn. I = £15bn. G = £25bn. X = £10bn. M = £15bn. • Calculate AD The circular flow of income • CFI is a model that seeks to explain how the economy works and how changes in AD occur The circular flow of income (simple) Households Corporations Government The circular flow of income Leakages Injections Investment Exports Government Spending Output Expenditure Savings Income Taxes Imports Activity Between 2003 and 2006, New Zealand’s trade balance deteriorated, with imports growing more rapidly than exports. During this period, however, the country’s real GDP increased. 1. Are imports an injection or a leakage? Explain your answer 2. What does the information suggest about the relationship between I + G and S + T in New Zealand over the period 2003-06? The Multiplier The multiplier is concerned with how national income changes as a result of a change in an injection, for example investment. The multiplier was a concept developed by Keynes that said that any increase in injections into the economy (investment, government expenditure or exports) would lead to a proportionally bigger increase in National Income. This is because the extra spending would have knock-on effects creating in turn even greater spending. The size of the multiplier would depend on the level of leakages. It can be measured by the formula 1/(1-MPC) where the MPC is the marginal propensity to consume. The Multiplier Process • An initial change in aggregate demand can have a much greater final impact on the level of equilibrium national income. This is commonly known as the multiplier effect and it comes about because injections of demand into the circular flow of income stimulate further rounds of spending – in other words “one person’s spending is another’s income” – and this can lead to a much bigger effect on equilibrium output and employment. The Multiplier Process • Consider a £300 million increase in business capital investment – for example created when an overseas company decides to build a new production plant in the UK. This will set off a chain reaction of increases in expenditures. Firms who produce the capital goods that are purchased will experience an increase in their incomes and profits. If they in turn, collectively spend about 3/5 of that additional income, then £180m will be added to the incomes of others. • At this point, total income has grown by (£300m + (0.6 x £300m) – remember to include the original investment! The Multiplier Process • The sum will continue to increase as the producers of the additional goods and services realize an increase in their incomes, of which they in turn spend 60% on even more goods and services. • The increase in total income will then be (£300m + (0.6 x £300m) + (0.6 x £180m). • The process can continue indefinitely. But each time, the additional rise in spending and income is a fraction of the previous addition to the circular flow. Multiplier Effects • Multiplier effects can be seen when new investment and jobs are attracted into a particular town, city or region. The final increase in output and employment can be far greater than the initial injection of demand because of the inter-relationships within the circular flow. Multiplier effect Demand for retail Demand for services Demand for housing Building Work Demand for public services Demand for consumer goods The Multiplier and Keynesian Economics • The concept of the multiplier process became important in the 1930s when John Maynard Keynes suggested it as a tool to help governments to achieve full employment. This macroeconomic “demand-management approach”, designed to help overcome a shortage of business capital investment, measured the amount of government spending needed to reach a level of national income that would prevent unemployment. The Multiplier Effect • The higher is the propensity to consume domestically produced goods and services, the greater is the multiplier effect. The government can influence the size of the multiplier through changes in direct taxes. For example, a cut in the basic rate of income tax will increase the amount of extra income that can be spent on further goods and services. The Multiplier Effect • Another factor affecting the size of the multiplier effect is the propensity to purchase imports. If, out of extra income, people spend money on imports, this demand is not passed on in the form of extra spending on domestically produced output. It leaks away from the circular flow of income and spending. The Multiplier Effect The Multiplier and Capacity • Multiplier process also requires that there is sufficient spare capacity in the economy for extra output to be produced. If short-run aggregate supply is inelastic, the full multiplier effect is unlikely to occur, because increases in AD will lead to higher prices rather than a full increase in real national output. • In contrast, when SRAS is perfectly elastic a rise in aggregate demand causes a large increase in national output Differences in the size of the multiplier effect Differences in the size of the multiplier effect AD1 – AD2 is an outward shift of AD when SRAS is highly elastic. This leads to a large rise in national output and a large multiplier effect. AD3 – AD4 shows a further outward shift in AD, but where AS is inelastic – the multiplier effect is smaller because there is less spare capacity to meet the increase in demand. Question 1 • Terminal 5 cost £160 million to build. The MPC is 0.7. Calculate the effect of this investment through 3 processes of the multiplier. Assume there is enough spare capacity to satisfy any new increases. Question 2 • Prime Minister W. Steve has announced a £100bn increase in Government Spending. • Assume that the first two cycles of increase will have a MPC of 0.75, falling to 0.685, 0.571 and 0.466 in the 3rd, 4th and 5th increases. • Calculate the total effect of the multiplier – round figures to 2dp. • Comment on reasons why the 3rd, 4th and 5th increases may have fallen from the initial 0.75 MPC.