Tax Deferred Business or Property Sale

advertisement

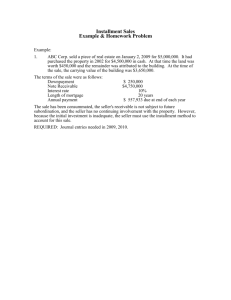

Installment Sales The Challenge With Selling a Business or Property for Cash Challenge: Individuals selling a business or personal property for a lump sum are oftentimes faced with having to recognize the entire gain as taxable in the year of the sale. Solution: By making the sale and having part of the proceeds payable over the following tax year(s), the seller can recognize the taxable gain in the tax year the installment payment is received or deemed received. Broker Use Only Market Data* 210,000 businesses sold annually out of 1,122,000 for sale. Level 1 businesses sell for <$500,000. Level 2-3 range, or $500,000 to $2.5 million in value (Market = $58 - $134 Billion). Level 4-5 range from >$2.5 - $50 million (Market = $138 - $600 Billion). Level 6 sells for $50 million+ *Data obtained from the 2004 Business Ref. Guide. Broker Use Only What is an Installment Sale? An Installment sale is defined in Sec. 453 of the Internal Revenue Code of 1986 as “a disposition of property where at least 1 payment is to be received after the close of the taxable year in which the disposition occurs”. In general, Installment Sales permit sellers to defer gains on certain property dispositions to the tax year in which the related sale proceeds are received. Broker Use Only How does a Cash Sale work? $100 Selling Price with a Basis of $10. Seller recognizes taxable profit of $90 (or 90% of selling price) immediately. Broker Use Only How does an Installment Sale work? $100 Selling Price with a Basis of $10 (gross profit of $90, or 90% of selling price). Selling price paid in installments of $10/year for 10 years. Seller recognizes taxable gain of $9 (90% of $10) each year a distribution is received. For simplicity, example does not take into account interest in the Installment Obligation. Broker Use Only Benefits of an Installment Sale No direct relationship between the Buyer and Seller for the assigned periodic payment obligation. Security – The Seller is not directly dependent on the solvency or financial performance of the Buyer. Broker Use Only Installment Sales Broker Use Only Installment Sales-Continued The Buyer assigns the obligation to an Assignment Company to make periodic payments.* An Assignment Company funds the payment liability by purchasing an annuity from Allstate Life (part of the Allstate Corporation, headquartered in Northbrook, IL and a Fortune 100 Company). In the event the Assignment Company fails to make payments, ALIC shall make the scheduled annuity payments to Seller pursuant to the Agreement to Pay. *See Revenue Rulings 75-457 and 82-122 and Tax Court decisions in Wynne v. Commissioner (47 B.T.A. 731 (1942), nonacq. 1943 C.B.42) and Cunningham v. Commissioner (44 T.C. 103 (1965), acq. 1966-2 C.B. 4) for substituting obligors. Broker Use Only Design Mechanics Sales agreement between the Buyer and the Seller includes language allowing for installment sale. Terms of an Installment Agreement govern payment schedule. Can be paid period certain or period certain and life. Only restriction on payment streams – cannot be life/life contingent only; needs period certain. Broker Use Only Target Market* Target value range is $500,000 to $50,000,000, or Level 2 through Level 5. Businesses sold for less than $500,000, or Level 1, and over $50,000,000, or Level 6, are probably not a target market. *Data obtained from the 2004 Business Ref. Guide. Broker Use Only Some Restrictions to Consider Sales not eligible for Installment Treatment:* Sales to related persons where the related person disposes of the property within 2 years Related persons as defined under IRC 267(b) Sale of inventory Depreciation Recapture The portion of the sale that represents amounts previously deducted for depreciation are includible as ordinary income Sales resulting in a loss Sale of stock or securities traded on an established securities market Sales of personal property by a person who regularly sells or otherwise disposes of the same type of personal property (Dealer) *Internal Revenue Service Publication 537. Broker Use Only Assignment Guidelines Minimum case size is $100K. No life-only contingent payment streams. Purchase agreement is strictly between Buyer and Seller: neither the Assignment Company nor Allstate should be mentioned in this document. Periodic payments may not be secured or pledged. Periodic payment streams assumed by the Assignment Company must not be changed from the periodic payments owed by the Buyer prior to the assignment. The periodic payment streams are non-transferable and noncommutable. The Seller cannot assign the payment stream. The Seller’s estate must be the beneficiary. A representation and acknowledgement statement must be signed by the Buyer and Seller. Broker Use Only Reporting Requirements The Seller is responsible for reporting any applicable Installment Sale income to the Internal Revenue Service and should consult with his or her own independent tax advisor for details. Broker Use Only