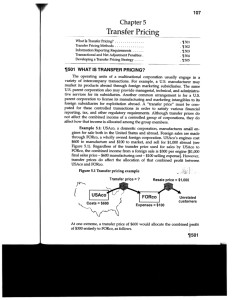

How to select the most appropriate transfer pricing method

advertisement

Transfer Pricing Issues in Indonesia Background Transfer Pricing is still a hot issue in Indonesia as Indonesian Directorate General of Taxes (DGT) continues to pursue obedience tax payers by tightening supervision of transfer pricing or transactions between Indonesian company with the subsidiaries and/or parent company located overseas. Since 2010, the DGT has been actively issuing tax regulation in relation to the related party transaction. This DGT step was considered normal given the fact that there are still many companies in Indonesia who hold the practice of transfer pricing in order to reduce the payment of taxes Type of transfer pricing transaction could occur over the sale price, purchase price, cost allocation, interest on shareholder loan, payment of royalty, technical assistance fee, or even sales or expenses over special purpose company 2 Definition of Related Party based on Indonesia Income Tax Law (Number 36 Year 2008) where a taxpayer directly or indirectly participates in 255 or more of the capital of another taxpayer, or where a company participates in 25% or more of the capital of two taxpayers, in which case the latter two taxpayer are also considered to be related; where a taxpayer directly or indirectly controls another taxpayer or where two or more taxpayers are under common control; where there is a family relationship by blood or marriage. 3 Indonesian Tax Regulations in relation to Transfer Pricing Indonesian DGT Regulation Number PER-43/PJ/2010 as recently amended by PER32/PJ/2011 which provides guidance on comparability analysis required in the transfer pricing documentation, preference towards internal comparable over external comparables and application of the most appropriate method as compared to the hierarchical approach in selecting transfer pricing methodology. PER-32 also mentioned that it will only applicable to transactions exceeding 10 billion Indonesia Rupiah with a single related party. Domestic related party transaction are also covered in the purview of the transfer pricing regulation if the related parties are effectively not taxed on the same basis Indonesian DGT Regulation Number PER-22/PJ/2013 is regulating about tax audit procedures. The regulation provides procedures on how to prepare and conduct tax audit including these issues: • application of arm’s length principle • identification of taxpayer’s business • how to choose the transfer pricing method 4 Implementation of Arm’s-Length Principle Indonesian DGT Regulation Number PER-32/PJ/2011 regulates that the arm’s-length principle should use the following steps: Perform a comparability analysis and identify comparables Determine the most appropriate transfer pricing method Apply the arm’s-length principle to the tested transaction based on the result of the comparability analysis and the selected transfer pricing method Document each step of the process used to determine the arm’s-length principle 5 Comparability Analysis In doing the comparability analysis, taxpayers should consider the comparability factors as regulated in the OECD guidelines, which are as follows: Characteristic of the industry Functions performed by parties involved Contractual terms Economic conditions Business strategies 6 Selecting the most appropriate Transfer Pricing Method In order to have the most appropriate transfer pricing method, the taxpayer should consider the following items: The strength and weakness of each transfer pricing method The appropriateness of the method based on the nature of the related party transaction, determined by a functional analysis Availability of valid information (on independent transaction) to apply the selected method The comparability level between related party transactions with independent transactions, including whether any appropriate adjustments would need to be made to eliminate any material differences between the compared transactions 7 The Obstacles during Tax Audit on Transfer Pricing Unavailability of the independent comparables The Indonesian Tax Office (ITO) still consider that Comparable Uncontrolled Price (CUP) is the most preferred method Not all of the ITO officer has the same level of transfer pricing knowledge, most of the times creating disputes during discussion. 8