PPTX

advertisement

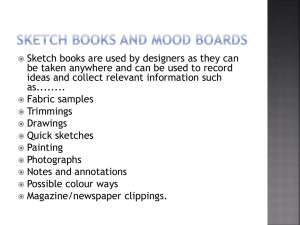

Analyzing Nonlinear Time Series with Hilbert-Huang Transform Sai-Ping Li Lunch Seminar December 7, 2011 Introduction Hilbert-Huang Transform Empirical Mode Decomposition Some Examples and Applications Summary and Future Works Some Examples of Wave Forms Stationary and Non-Stationary Time Series Time series: random data plus trend, with best-fit line and different smoothings Examples of Non-Stationary Time Series Tidal data of Kahului Harbor, Maui, October 4-9, 1994. Blood pressure of a rat. Earthquake data of El Centro in 1985. Difference of daily Non-stationary annual cycle and 30year mean annual cycle of surface temperature at Victoria Station, Canada. Consider the non-dissipative Duffing equation: 𝑑2 𝑥 𝑑𝑡 2 + 𝑥 + 𝜖𝑥 3 = 𝛾 cos 𝜔𝑡 γ is the amplitude of a periodic forcing function with a frequency ω. If 𝜖 = 0, the system is linear and the solution can be found easily. If 𝜖 ≠ 0, the system becomes nonlinear. If 𝜖 is not small, perturbation method cannot be used. The system is highly nonlinear and new phenomena such as bifurcation and chaos can occur. Rewrite the above equation as: 𝑑2 𝑥 𝑑𝑡 2 + 𝑥(1 + 𝜖𝑥 2 ) = 𝛾 cos 𝜔𝑡 The quantity in the parenthesis above can be regarded as a varying spring constant, or varying pendulum length. The frequency of the system can change from location to location, and also from time to time, even within one oscillation cycle. Numerical Solution for the Duffing Equation Left: The numerical solution of x and dx/dt as a function of time. Right: The phase diagram with continuous winding indicates no fixed period of oscillations. Financial Time Series Stylized Facts : Stylized Facts : An Empirical data analysis method: Hilbert-Huang Transform Empirical Mode Decomposition (EMD) + Hilbert Spectral Analysis (HSA) The Hilbert-Huang Transform Empirical Mode Decomposition: Based on the assumption that any dataset consists of different simple intrinsic modes of oscillations. Each of these intrinsic oscillatory modes is represented by an intrinsic mode function (IMF) with the following definition: (1) in the whole dataset, the number of extrema and the number of zero-crossings must either equal or differ at most by one, and (2) at any point, the mean value of the envelope defined by the local maxima and the envelope defined by the local minima is zero. Example: A test Dataset Identify all local extrema, then connect all the local maxima by a cubic spline line in the upper envelope. Repeat the procedure for the local minima to produce the lower envelope. The upper and lower envelopes should cover all the data between them. Their mean is designated as 𝑚1 . The difference between the data 𝒙 𝒕 and the mean 𝒎𝟏 is the first component 𝒉𝟏 , i.e., 𝒉𝟏 = 𝒙 𝒕 − 𝒎𝟏 The data (blue) upper and lower envelopes (green) defined by the local maxima and minima, respectively, and the mean value of the upper and lower envelopes given in red. The data (red) and ℎ1 (blue). Repeat the Sifting Process: Left: Repeated sifting steps with 𝒉𝟐 and 𝒎𝟐 . Right: Repeated sifting steps with 𝒉𝟑 and 𝒎𝟑 . The Sifting Process for the first IMF: 𝒉𝟏 = 𝒙 𝒕 − 𝒎𝟏 In the next step, 𝒉𝟏𝟏 = 𝒉𝟏 − 𝒎𝟏𝟏 Repeat Sifting, ● ● ● 𝒉𝟏𝒌 = 𝒉𝟏(𝒌−𝟏) − 𝒎𝟏𝒌 And is designated as, 𝒄𝟏 = 𝒉𝟏𝒌 The first IMF component 𝒄𝟏 after 12 steps. Separate 𝒄𝟏 from the original data, and call the residue 𝒓𝟏 , 𝒓𝟏 = 𝒙 𝒕 − 𝒄𝟏 The original data (blue) and the residue 𝒓𝟏 . The procedure is repeated to get all the subsequent 𝒓𝒋 ’s , 𝒓𝟐 = 𝒓𝟏 − 𝒄𝟐 ● ● ● 𝒓𝒌 = 𝒓(𝒌−𝟏) − 𝒄𝒌 The original dataset is decomposed into a sum of IMF’s and a residue, 𝒙 𝒕 = 𝒏 𝒋=𝟏 𝒄𝒋 + 𝒓𝒏 A decomposition of the data into n-empirical modes is achieved, and a residue 𝒓𝒏 obtained which can either be the mean trend or a constant. A test dataset shown in the above. On the right is the original dataset decomposed into 8 IMF’s and a trend (𝒄𝟗 ). Empirical Mode Decomposition Example: Gold Price Data Analysis Statistics: LME gold prices res. IMF8 IMF7 IMF6 IMF5 IMF4 IMF3 IMF2 IMF1 data 1400 0 50 -50 50 -50 50 -50 100 -100 100 -100 100 -100 100 -100 200 -200 900 0 1968M1 1976M5 1984M9 1992M1 Date 2000M5 2008M9 Composition: LME monthly gold prices • Dividing the components into high, low and trend by reasonable boundary (12 months), and analyze the factors or economic meanings in different time scales. • Boundary: 12 months Mean period ≧ 12 months Trend Low frequency term Mean period < 12 months High frequency term Composition of LME Gold Prices Trend: inflation Pearson Kendall correlation correlation Trend of CPI 0.939 0.917 Trend of PPI 0.906 0.917 • We assume the gold price trend relates to inflation at first. • US monthly CPI and PPI are used to quantify the ordering of inflation. • Since the gold price trend hold high correlation with trend of CPI and PPI, the economic meanings of trend can be described by “inflation”. Low frequency term: significant events 2008/09: Lehman Brothers bankruptcy 1979/11~1980/01: Iranian hostage crisis 1980/09: Iran/Iraq War 2007/02: USA Subprime Mortgage Crisis 1987/10: New York Stock Market Crash 1996 to 2006: Booming economic in USA 1982/08: Mexico External Debt Crisis 1973/10: 4th Middle East War • The six obvious variations correspond to six significant events. • The six significant events include wars, panic international situation, and financial crisis. data C1 20 0 -20 C2 1500 1000 500 20 0 -20 Residue C7 C6 C5 C4 C3 50 0 -50 50 0 -50 50 0 -50 50 0 -50 200 0 -200 1500 1000 500 2-Jan-07 2-Jan-08 2-Jan-09 Day 4-Jan-10 30-Dec-10 Example: Electroencephalography (EEG) and Heart Rate Variability (HRV) Example: Electroencephalography (EEG) Active Wake Stage Example: Electroencephalography (EEG) Stage I: Light Sleep Stage II Stage III Slow Wave Sleep Stage IV Quiet Sleep Example: Electroencephalography (EEG) Left: A dataset of active wake stage. Right: Its corresponding IMF’s after EMD. Electrocardiography (ECG) Example: Heart Rate Variability (HRV) Example: Heart Rate Variability (HRV) Left: Original dataset Right: HRV after EMD Relation of EEG and HRV of an Obstructive Sleep Apnea (OSA) patient using EMD analysis Partial List of Application of HHT • • • • • • • • • • • Biomedical applications: Huang et al. [1999] Chemistry and chemical engineering: Phillips et al. [2003] Financial applications: Huang et al. [2003b] Image processing: Hariharan et al. [2006] Meteorological and atmospheric applications: Salisbury and Wimbush [2002] Ocean engineering:Schlurmann [2002] Seismic studies: Huang et al. [2001] Solar Physics: Barnhart and Eichinger [2010] Structural applications: Quek et al. [2003] Health monitoring: Pines and Salvino [2002] System identification: Chen and Xu [2002] Comparison of Fourier, Wavelet and HHT Problems related to Hilbert-Huang Transform (1) Adaptive data analysis methodology in general (2) Nonlinear system identification methods (3) Prediction problem for non-stationary processes (end effects) (4) Spline problems (best spline implementation for the HHT, convergence and 2-D) (5) Optimization problems (the best IMF selection and uniqueness) (6) Approximation problems (Hilbert transform and quadrature) (7) Other miscellaneous questions concerning the HHT……. Application: Price Fluctuations in Financial Time Series 𝑑𝑆𝑡 = 𝜇𝑡 𝑆𝑡 𝑑𝑡 + 𝜎𝑡 𝑆𝑡 𝑑𝑊𝑡 ⇒ 𝑑𝑆𝑡 /𝑆𝑡 = 𝜇𝑡 𝑑𝑡 + 𝜎𝑡 𝑑𝑊𝑡 ⇒ 𝑑ln(𝑆𝑡 ) = 𝜇𝑡 𝑑𝑡 + 𝜎𝑡 𝑑𝑊𝑡 All parameters are time dependent. 𝜇𝑡 is the drift, 𝜎𝑡 is the volatility and 𝑑𝑊𝑡 is a standard Wiener process with zero mean and unit rate of variance. Stoppage Criterion: The criterion to stop the sifting of IMF’s. Historically, there are two methods: (1) The normalized squared difference between two successive sifting operations defined as 𝑆𝐷𝑘 = 𝑇 |ℎ 2 𝑡=0 𝑘−1 𝑡 −ℎ𝑘 (𝑡)| 2 𝑇 ℎ 𝑡=0 𝑘−1 If this squared difference 𝑆𝐷𝑘 is less than a preset value, the sifting process will stop. (2) The sifting process will stop only after S consecutive times, when the numbers of zero-crossings and extrema stay the same and are equal or differ at most by one. The number S is preset. Orthogonality: The orthogonality of the EMD components should also be checked a posteriori numerically as follows: let us first write equation 𝒙 𝒕 = 𝒏 𝒋=𝟏 𝒄𝒋 as + 𝒓𝒏 𝒏+𝟏 𝒙 𝒕 = 𝒄𝒋 𝒋=𝟏 Form the square of the signal as 𝒏+𝟏 𝒙𝟐 𝒕 = 𝒏+𝟏 𝒏+𝟏 𝒄𝒋 𝟐 + 𝟐 𝒋=𝟏 𝒄𝒋 𝒕 𝒄𝒌 𝒕 𝒋=𝟏 𝒌=𝟏 And define IO as 𝑻 𝒏+𝟏 𝒏+𝟏 𝒄𝒋 𝒕 𝒄𝒌 𝒕 /𝒙𝟐 𝒕 𝑰𝑶 = 𝒕=𝟎 𝒋=𝟏 𝒌=𝟏 If the IMF’s are orthogonal, IO should be zero.