PARTNERS` CAPITAL A/C - e-CTLT

advertisement

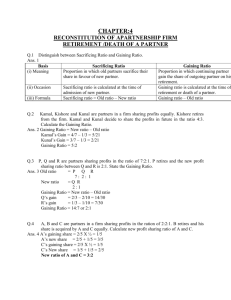

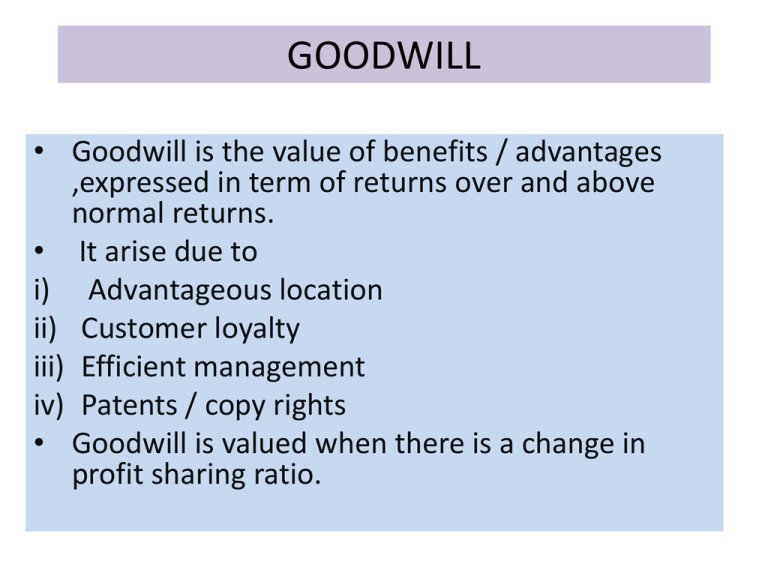

GOODWILL • Goodwill is the value of benefits / advantages ,expressed in term of returns over and above normal returns. • It arise due to i) Advantageous location ii) Customer loyalty iii) Efficient management iv) Patents / copy rights • Goodwill is valued when there is a change in profit sharing ratio. METHODS OF VALUATION OF GOODWILL Average profit method • Calculate average profit by adding profots for a No. of years (subtract loss) and divide by the No of years • The following should be adjusted: add – abnormal losses minus – abnormal profits , salary of partners , income from investments Super profit method • In this method, we calculate normal profit with normal rate on investment. Then we calculate super profit with following formula. • Super profit = actual profit/avg profit – normal profit • Normal profit = capital employed *normal rate/100 • Goodwill = super profit X No. of purchase years Capitalization method • In this method, we calculate capital employed with following formula • Capital employed = average profit or normal profit X 100/ Rate • Goodwill = capital employed – Net Assets SACRIFICING RATIO It is the ratio /portion of profit which a partner gives to another partner It is calculated when i) There is a change in profit sharing ii) A new partner is admitted to partnership. FORMULA:----Sacrificing ratio = old ratio – new ratio GAINING RATIO • Gaining ratio indicates the amount/ratio of gain of profits • It is calculated when:i) A partner retires or dies ii) change in profit ratio • Formula of calculating gaining ratio:G/R = new ratio – old ratio Difference between S/R and G/R Q.1 Distinguish between Sacrificing Ratio and Gaining Ratio. Ans. 1 Basis Sacrificing Ratio (i) Meaning Proportion in which old partners sacrifice their share in favour of new partner. (ii) Occasion (iii) Formula Sacrificing ratio is calculated at the time of admission of new partner. Sacrificing ratio = Old ratio – New ratio Gaining Ratio Proportion in which continuing partner gain the share of outgoing partner on his retirement. Gaining ratio is calculated at the time of retirement or death of a partner. Gaining ratio – Old ratio JOURNAL ENTRY When there is change in profit sharing agreement S/R or G/R is calculated Adjustment is done by passing a journal entry as follows GAINING PARTNE’S CAPITAL A/C Dr xxx TO SACRIFICING PARTNER’S CAPITAL A/C xxx PROBLEMS & SOLUTIONS 1) A:B::3:1. They decide to share future profits as 3:2. Goodwill of the firm is valued as Rs. 1,50,000. Pass entry to give effect to the above. S/R = OR – NR A’S Sacri. = 3/4 - 3/5 = (15-12)/20 = 3/20 B’s Sacri. = 1/4 – 2/5 = -(3/20)gain So , B will give share of goodwill to A Amt of goodwill will be calculated as G/W of firm * share of gain 1,50,000 * 3/20 = Rs. 22,500 Journal entry:----B’s Cap a/c-------------------Dr 22,500 to A’s Cap a/c--------------22,500 (being credit given to capital for loss of A’s profit share.) TREATMENT OF G/W APPEARING IN BOOKS • If g/w appears in books i.e. is shown on the asset side of balance sheet it means it g/w was valued or purchased. • Such G/W must be WRITTEN OFF when ever there is a change in profit ratio. • Journal Entry :-Partners’ Capital A/C ----------Dr To Goodwill A/C TREATMENT OF RESERVES • General reserves/Accumulated profits(losses). These are to be transferred to partners’ capital(current) account GENERAL RASERVE/PROFIT A/C ---------------Dr TO ALL PARTNERS’ CAPITAL A/C (being undistributed reserve/profit , transferred to capital a/c.) In case of losses(shown on asset side of B/S) PARTNERS’ CAPITAL A/C------------------------Dr TO PROFIT & LOSS A/C TREATMENT OF RESERVE Journal entry if reserve is not to be distributed Gaining partner capital a/c Dr to sacrificing partner capital a/c WORKMEN COMPENSTION RESERVE Workmen Compensation Reserve/Fund is a reserve created out of profits to make payment to workers for any injury/loss. Distribution of WCF When there is no claim WORKMEN COMPENSATION FUND-----------Dr TO ALL PARTNERS CAPITAL A/C (old ratio) When there is claim/liability against WCF It means that some payment has to be made against the fund WORKMEN COMPENSATION FUND-----------Dr TO ALL PARTNERS CAPITAL A/C (old ratio) This entry will be passed with the balance(excess) amount of fund. For e.g.:- WCF is Rs 20,000 and claim against it is Rs.8,000. A:B:: 2:1. Then journal entry will be WCF A/C ------------------------------- Dr 12,000 TO A’s CAPITAL A/C 8,000 TO B’s CAPITAL A/C 4,000 (being balance reserve distributed ) 20,000 - 8,000 = 12,000 (Total fund - claim = balance for distribution) INVESTMENT FLACTUATION FUND IFF is created out of profit to safeguard against losses due to change(fluctuation) in market price(value) of investment. When there is no change in mkt price of investment IFFUND-------------------------Dr TO PARTNERS’ CAPITAL A/C (Full amt. of fund transferred to cap.in old ratio) When there is a change in market value of investment i.e. market value is less than book value(there is loss in investment) IFFUND-------------------------Dr TO PARTNERS’ CAPITAL A/C (balance amt. of fund transferred to cap.in old ratio) For e.g. govt bonds appear in books at Rs.45.000 and IFF is recorded in b/s at Rs.15,000. The mkt value of govt. bonds is Rs.40,000 , then the amt of IFF to be distributed in capital a/cs’ will be Rs.10,000 (15,000-5,000)(IFF value – fall/(loss) in value of investment) EMPLOYEE PROVIDENT FUND EPF is created from the salary of employees’. It is given/paid to employees when they leave the organization. It will NOT BE DISTRIBUTED to PARTNERS ‘ CAPITAL as it is NOT create out of profits. It will appear in new balance sheet at same value. Revaluation account REVALUATION ACCOUNT