Capital Markets

advertisement

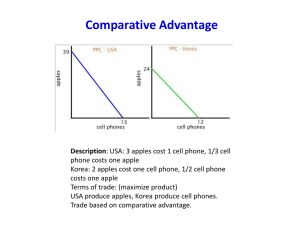

Capital Markets Chapter 24 Nominal and Real Interest Rates • Nominal return represents how much money you will receive after 1 year for giving up 1 dollar of money today • Real return represents how many goods you can buy if you give up the opportunity to buy 1 good today. • Nominal interest rate is money interest rate. Real interest rate is goods interest rate. Real Interest Rate • The real interest rate on the loan is defined as the future goods received relative to current goods foregone $1 i $1 i Pt+1 1 1 rt $1 Pt+1 Pt Pt 1 it 1 rt rt it t 1 1 t 1 Measuring the Real Interest Rate • 1. • 1. Long-term Use the yield on inflation protected securities. Short-term Use nominal interest minus consensus inflation forecast 2. Use nominal interest rate minus your own inflation forecast TIPS Bond • The US Treasury offers bonds whose principal and coupon payments increase with the inflation rate. • Investors are paid off in terms of real purchasing power. • Yield is equivalent to a real interest rate. Additional Information from U.S. Treasury Real & Nominal Interest Rates http://research.stlouisfed.org/fred2/categories/22 π10 Year Forecast Loanable Funds Market Loanable Funds Market • Consider the financial market at its broadest and most abstract. ▫ an amalgamation of the bond market and the lending market (banks, etc.) • Map the relationship between the interest rate and the quantity of funds that are lent. ▫ Supply curve represents the behavior of savers & lenders ▫ Demand curve represents the behavior of borrowers Supply Curve: Loanable Funds • Why does the supply curve slope up? ▫ When real interest rates offered by banks are high, savers are rewarded with more future consumption and are likely to be induced to save more. ▫ Caveat: If some savers are setting a target for their level of wealth at retirement, a higher interest rate reduces the amount they need to save. For this reason, many economists believe saving curve is very inelastic. Demand Curve: Loanable Funds • Why does the demand curve slope down? ▫ Firms borrow to finance investment projects. If the return on investment falls below the interest rate, the project is not worthwhile. The higher the interest rate, the fewer projects fall below the hurdle. ▫ Households borrow to finance housing. The higher are interest rates, the smaller is the house that the householders can buy with a mortgage payment that they can afford. Globalization and the Loanable Funds Market • Even ten years ago, we might have thought of the loanable funds market as being national in nature – especially for large economies. These days it appears that even the USA is part of a single global market. [China possible exception] • Only very large changes in large countries or international trends will have an impact on real interest rates. Competitive Market Equilibrium: Loanable Funds Market (Geometry) r DLF SLF r* LF* LF Ex. Investment Boom in Emerging Markets McKinsey Report r DLF SLF DLF' r** r* 2 1 LF* LF** LF Ex. US Consumers become thriftier r DLF SLF SLF' 1 r* r** 2 LF* LF** LF Savings • We divide savings into 2 parts: SPrivate +SPublic = S Private Saving (Household + Business Saving) Public Saving/Government Saving (Budget Surplus) National Saving Public Savings is part of the supply of loanable funds if positive and part of demand for loanable funds if negative (as usual). Government Surplus • Government surplus is gap between govt revenue and spending and can be positive or negative. • If net positive, it adds to the supply of loanable funds. • If net negative, it adds to the demand for loanable funds. Example: Government strikes a deal to raise taxes and cut spending r SLF DLF SLF' 1 r** r* 2 LF* LF** LF Ex.Japanese Government runs a deficit Budget Plan r DLF SLF DLF' 2 r** 1 r* LF* LF** LF National Economy • How do national economies relate to the global financial market? 1. Countries will face an external interest rate, rW, unaffected by national savings or investment. 2. International capital flows will make up the gap between savings and investment. http://www.bea.gov/national/nipaweb/SelectTable.asp?Selected=Y Competitive Market Equilibrium: Loanable Funds Market r SLF DLF r* KA LF* LF Investment Boom [r Doesn’t Rise, Gap made up by Capital Inflows] r DLF DLF' SLF 1 KA 2 rW LF* LF** LF Consumers become less thrifty (r does not fall, gap made up by capital inflows) r DLF SLF 1 rW 2 SLF' KA LF Savings Glut • Theory put forth by Fed Chairman explaining the U.S. trade deficit: Washington Post Article World Interest Rate Falls (Global Economy) r DLF SLF rW rW' 1 2 2 LF Net Capital Outflows = ‘Goods & Income Outflows • • • • Private Savings: Y + NFI -Tax – C Public Savings: Tax – G National Savings: S = Y+ NFI – C – G Capital Outflows: -KA = S – I S-I = NFI + (Y – C – G – I) = NFI +NX http://www.bea.gov/national/nipaweb/SelectTable.asp?Selected=Y US Current Account 1.00% 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 0.00% -1.00% -2.00% -3.00% -4.00% -5.00% -6.00% -7.00% NX NFI CA Ex Ante Rate and the Fisher Effect • Savings and investment decisions must be made before future inflation is known so they must be made on the basis of an ex ante (predicted) real interest rate. • Fisher Hypothesis: Ex ante real interest rate is determined by forces in the financial market. Money interest rate is just the real ex ante rate plus the market’s consensus forecast of inflation. it rt EA FORECAST t 1 Great Inflation of the 1970’s US Inflation Rates & Interest Rates 18.00 16.00 14.00 % 12.00 10.00 Interest Rates Inflation 8.00 6.00 4.00 2.00 Mar-03 Mar-00 Mar-97 Mar-94 Mar-91 Mar-88 Mar-85 Mar-82 Mar-79 Mar-76 Mar-73 Mar-70 Mar-67 Mar-64 Mar-61 Mar-58 Mar-55 0.00 Source: St. Louis Federal Reserve http://research.stlouisfed.org/fred2/ Great Inflation Download Fisher Effect: OECD Economies Great Inflation of 1970’s 20 18 Interest Rates-1984 16 14 12 10 8 6 4 2 0 0 2 4 6 8 10 12 Average Inflation 1970-1984 14 16 18 Loanable Funds Market Fisher Effect DLF SLF i* r* tE1 E t 1 LF* LF Ex Ante vs. Ex post • We can also examine the ex post real return on a loan as the money interest rate less the actual outcome for inflation. ExP ACTUAL t t t 1 i r • The gap between actual and forecast inflation determines the gap between the ex post (actual) and ex ante (forecast) return. rt ExP rt ExA FORECAST t 1 ACTUAL t 1 Unexpected Inflation Winners and Losers ▫ Higher than expected inflation means ex post real rates are lower than ex ante. Borrowers are winners/lenders are losers. ▫ Lower than expected inflation means ex post real rates are higher than ex ante. Lenders are winners/borrowers are losers. Inflation Risk • When inflation is variable, lenders will demand some premium for inflation risk. This will put cost on borrowers. • High inflation rates tend to be associated with unpredictable inflation. Learning Outcome • Calculate the relationship between inflation, expected inflation, interest rates and real interest rates. • Use the Loanable Funds model to analyze the effects of external events on savings, investment, and real interest rates in capital markets.