PowerPoint Presentation#REF! - AFOA American Fats and Oils

advertisement

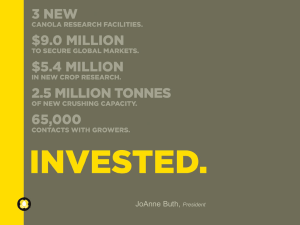

Transitions in the Canadian Market James Rea AVP Bulk Product Sales American Fats & Oils Association Annual Meeting 2012 Agenda Major Transitions • Deregulation of the Canadian Wheat Board • Rationalization of Origination Assets/Players • Canola and the Expansion of the Canola Processing Industry • Acreage – Crops and Returns Deregulation Deregulation of the Market • Canadian Wheat Board monopoly ends after 77 years (1935-2012) • Open Market as of August 1, 2012 • Canadian Wheat Board’s Participation Going Forward? • Wheat/Barley account for 37 MMT or ~50% of Cdn Grain/Oilseed production Rationalization - Grain Handling Capacity Western Canada Crop Year No. of Elevators 1990-1991 1999-2000 2010-2011 1,567 969 340 Down 78% No. of 100 Capacity in Rail Car MMT Loaders 14 3 12 50 11 106 Down 3MMT Dramatic increase in handling and loading efficiency over 2 decades Rationalization of Major Asset Owners 1998 2001 2007 2012 Today Manitoba Pool Elevators 1926-1998 Alberta Wheat Pool 1923-1998 Agricore Cooperative Limited 1998-2001 United Grain Growers Limited 1917-2001 United Grain Growers Limited 1917-2001 Agricore United 2001-2007 Saskatchewan Wheat Pool 1923-2007 Saskatchewan Wheat Pool 1923-2007 Saskatchewan Wheat Pool 1923-2007 Viterra 2007-2012 Glencore 1974- Richardson International 1857- Richardson International 1857- Richardson International 1857- Richardson International 1857- Richardson International 1857- Cargill 1865- Cargill 1865- Cargill 1865- Cargill 1865- Cargill 1865- Rationalization - Country Elevators Approximate Elevator Capacity (mt) Pre-Glencore Capacity Distribution Conventional Elevator Capacity 2,500,000 50-56 Car Loader Capacity 2,000,000 100+ Car Loader Capacity 1,500,000 1,000,000 500,000 - Viterra Richardson Cargill N u m b e # of 100+ Car Elevators # of 50+ Car Elevators 5 0 39 25 31 6 12 15 LDC 8 2 Paterson 4 3 P&H 4 9 Other 4 11 Rationalization - Country Elevators u m b e Approximate Elevator Capacity N (mt) Post-Glencore Capacity Distribution 05 2,000,000 Conventional Elevator Capacity 50-56 Car Loader Capacity 1,500,000 100+ Car Loader Capacity 1,000,000 500,000 - RichardsonGlencore Cargill N u m b e # of 100+ Car Elevators # of 50+ Car Elevators 5 0 41 11 29 20 12 15 LDC 8 2 Paterson 4 3 P&H 4 9 Other 4 11 Final production not yet known Crush and the Canola S&D Crop Year 2008/09 2009/10 2010/11 2011/12 2012/13 Acreage Seeded 16,160 16,125 17,608 18,645 21,337 Acreage Harvested 16,048 15,680 16,922 18,010 20,852 35 36.2 33.3 35.5 28.2 1,744 1,944 2,688 2,198 793 12,643 12,888 12,773 14,500 13,336 Imports 120.5 127.9 223.7 92 100 Supply 14,507 14,959 15,685 16,790 14,230 Domestic 4,280 4,788 6,310 7,000 6,500 377 320 73 268 300 7,907 7,163 7,104 8,729 6430 12,564 12,271 13,487 15,997 13,232 1,944 2,688 2,198 793 1,000 15.47% 21.91% 16.30% 4.96% 4.06% Yield (Bu/Acre) Carry In Production Seed/Feed Exports Disposition Carryout Stocks/use Canola Crush Capacity (MMT) Canada/U.S. North - Approx 2008 2012 Current 2016 Forecast ADM 2.2 2.5 2.7 Bunge 1.8 2.5 3.0 Richardson 0.4 1.3 2.1 Cargill 0.8 1.6 2.4 LDM 0.0 0.9 0.9 Viterra/Glencore 0.3 0.3 0.3 Other 0.0 0.3 0.7 Total 5.5 9.4 12.1 Canadian Crush and Oil Production 7000000 6000000 2012 Canadian Crush Capacity ~ 7.5MMT 5000000 4000000 Crush 3000000 2000000 1000000 0 Oil Production CANOLA OIL EXPORTS TOTAL CANOLA OIL EXPORTS FROM CANADA 2006 2007 2008 United States Other Mexico 729,975 4,332 29,784 764,324 4,672 31,202 1,048,300 10,906 22,548 1,002,404 4,208 3,984 1,092,071 22,643 5,126 1,520,557 48,959 54,477 EU 290,368 56,161 211 8 28,015 182,675 China Asia - non China 65,832 110,433 280,913 128,875 232,792 107,924 441,267 96,552 988,114 109,411 578,395 154,729 Totals 2009 2010 2011 1,230,724 1,266,147 1,422,681 1,548,423 2,245,380 2,539,792 Growth in Canadian Canola Acres 25,000 20,000 15,000 10,000 5,000 0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 • Expecting canola acres to remain in the 19-21 million range for the next 3-5 yrs Acreage Shift 2004 - 2012 30000 25000 20000 Wheat Oats Barley Canola 15000 Soybeans Dry Peas Corn 10000 Other 5000 0 2004 000’s Acres 2012 Return Per Acre Commodity Per Acre Return Acres (Million) $110 - $150 21.3 Wheat(excl Durum) $30 - $90 19.0 Peas $70 - $80 3.2 Barley $20 - $80 7.4 Durum $30 - $90 4.6 Corn $230 - $290 3.6 Oats $30 - $70 3.0 $200 - $290 4.3 Canola Soy Beans Summary • 2012/13 – Canadian Open Market Volumes Increase Dramatically • Grain and Oilseed handling in Canada has been extensively rationalized over the past 20 years • Strong Oil Demand Driving Investments in Canola Processing • Canadian Canola acres have doubled in the past 10 years as Farm-gate returns advance Canola seed production