Budget Hearing Presentation 9/14/09

advertisement

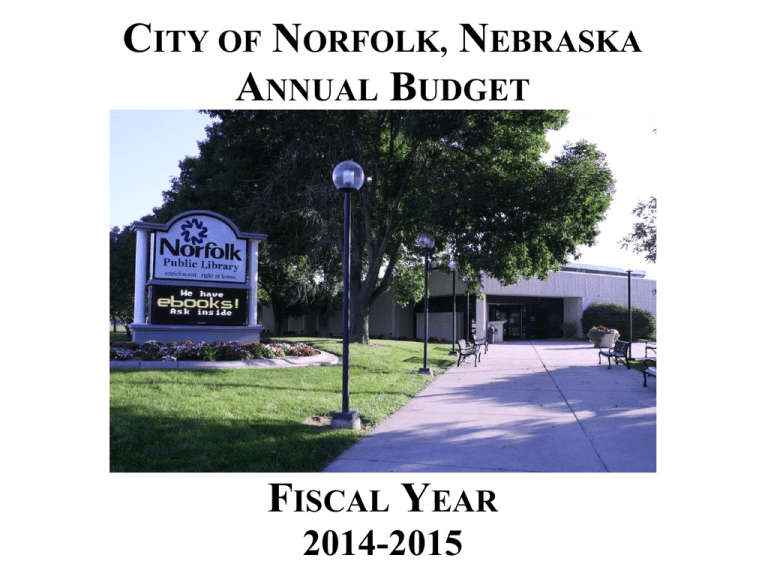

CITY OF NORFOLK, NEBRASKA ANNUAL BUDGET FISCAL YEAR 2014-2015 Capital Budget to Total Budget CAPITAL BUDGET TOTAL BUDGET 2014-2015 2013-2014 2012-2013 2011-2012 2010-2011 2009-2010 2008-2009 2007-2008 2006-2007 2005-2006 0 10,000,000 20,000,000 30,000,000 40,000,000 50,000,000 60,000,000 70,000,000 80,000,000 90,000,000 Funds with Over $1 Million Increase Dollar Percentage Budgeted Budgeted Increase Increase 2013-2014 2014-2015 (Decrease) (Decrease) LB840 Economic Development Fund 1,571,218 4,326,833 2,755,615 175.38% Special Assessments Fund 2,308,383 4,982,798 2,674,415 115.86% Community Dev. Block Grant Fund 1,539,911 2,987,413 1,447,502 94.00% Capital Construction Fund 4,805,422 5,855,837 1,050,415 21.86% 10,224,934 18,152,881 7,927,947 77.54% All Other Funds 62,610,536 62,812,757 202,221 0.32% TOTAL 72,835,470 80,965,638 8,130,168 11.16% FUND EXPENDITURE HIGHLIGHTS The following compares by major expenditure object the FY 2013-2014 budget with the FY 2014-2015 proposed budget: OBJECT BUDGET BUDGET FY 2013-2014 FY 2014-2015 Dollar Increase (Decrease) Percentage Increase (Decrease) Personnel 19,459,523 20,102,370 642,847 3.30% Operations & Maintenance 11,405,420 15,787,124 4,381,704 38.42% Capital Expenditure 19,425,672 19,455,667 29,995 0.15% Debt Service 3,181,016 3,458,596 277,580 8.73% Transfers 2,378,718 3,667,305 1,288,587 54.17% 16,985,121 72,835,470 18,494,576 80,965,638 1,509,455 8,130,168 8.89% 11.16% Fund Ending Balance TOTAL REVENUE HIGHLIGHTS The following compares by major revenue source the FY 2013-2014 budget with the FY 2014-2015 proposed budget: SOURCE BUDGET FY 2013-2014 BUDGET FY 2014-2015 Dollar Increase (Decrease) Percentage Increase (Decrease) Balance Brought Forward 29,501,356 30,926,798 1,425,442 4.83% Taxes 13,349,219 13,766,455 417,236 3.13% 204,975 216,300 11,325 5.53% 5,282,460 7,497,908 2,215,448 41.94% 12,409,320 12,825,265 415,945 3.35% 5,718,122 5,709,240 (8,882) (0.16%) 71,192 66,185 (5,007) (7.03%) Transfers 2,378,718 3,667,305 1,288,587 54.17% Proceeds of Debt 3,770,000 6,160,000 2,390,000 63.40% Special Assess. Levied 119,650 99,434 (20,216) (16.90%) Non-revenue Receipts 30,458 30,748 290 0.95% 72,835,470 80,965,638 8,130,168 11.16% Licenses & Permits Inter-Govern. Revenue Charges for Service Rent & Other Revenue Interest Income TOTAL Budgets by Fund Dollar Percentage Budgeted Budgeted Increase Increase FUND 2013-2014 2014-2015 (Decrease) (Decrease) General Fund 22,911,907 23,829,860 917,953 4.01% Sewer Fund 12,172,737 12,237,481 64,744 0.53% Group Insurance Fund 6,024,289 6,887,730 863,441 14.33% Water Fund 8,394,058 6,813,080 (1,580,978) (18.83%) Debt Service Fund 5,286,633 6,026,709 740,076 14.00% Capital Construction Fund 4,805,422 5,855,837 1,050,415 21.86% 59,595,046 61,650,697 2,055,651 3.45% All Other Funds 13,240,424 19,314,941 6,074,517 45.88% TOTAL 72,835,470 80,965,638 8,130,168 11.16% GENERAL FUND EXPENDITURE CHANGES The following compares by department the FY 2013-2014 budget with the FY 2014-2015 proposed budget: DEPARTMENT Administration Dollar Percentage BUDGET BUDGET Increase Increase FY 2013-2014 FY 2014-2015 (Decrease) (Decrease) 4,054,358 3,777,564 (276,794) (6.83%) 641,867 726,149 84,282 13.13% Street Maintenance 2,725,333 2,855,537 130,204 4.78% Park Maintenance 1,483,196 1,513,533 30,337 2.05% Housing 515,798 504,484 (11,314) (2.19%) Recreation 785,157 807,984 22,827 2.91% Library 1,408,376 1,453,154 44,778 3.18% Fire 4,034,857 4,176,075 141,218 3.50% Police 5,239,336 5,423,032 183,696 3.51% 20,888,278 21,237,512 349,234 1.67% Engineering TOTAL General Fund Revenues FY 2014-2015 Property Tax 1,839,941 9.51% Other Revenue 5,113,699 26.42% Sales Tax 7,681,455 39.68% NPPD Lease 4,721,540 24.39% SALES TAX BUDGETED BY FISCAL YEARS $11.00 $10.00 $9.00 $8.00 $7.00 TAXES ($MILLIONS) $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00 2006 2007 2008 2009 2010 Fiscal Year 2011 2012 2013 2014 2015 CITY OF NORFOLK, NE Major Revenue Trends Nebraska Public Power District (NPPD) Lease 5,000 4,500 3,500 3,000 2,500 2,000 1,500 1,000 500 2013-2014 Estimated 2012-2013 2014-2015 Budget Fiscal Year 2011-2012 2010-2011 2009-2010 2008-2009 2007-2008 2006-2007 0 2005-2006 Dollars (in thous.) 4,000 MUNICIPAL BUDGETED PROPERTY TAX COMPARISON The following is a yearly property tax comparison from FY 2005-2006 to FY 2014-2015: YEARS DEBT ECONOMIC GENERAL SERVICE DEVELOPMENT FUND FUND FUND TOTAL FY 2005-2006 238,724 690,676 - 929,400 FY 2006-2007 430,164 690,676 - 1,120,840 FY 2007-2008 475,001 690,676 - 1,165,677 FY 2008-2009 742,907 690,676 - 1,433,583 FY 2009-2010 1,497,907 690,676 - 2,188,583 FY 2010-2011 1,497,907 690,676 400,000 2,588,583 FY 2011-2012 1,497,907 690,676 400,000 2,588,583 FY 2012-2013 1,497,907 690,676 400,000 2,588,583 FY 2013-2014 1,497,907 690,676 400,000 2,588,583 FY 2014-2015 1,839,941 690,676 400,000 2,930,617 Assessed Valuation with % increase from the prior year 1,300,000 4.67% 3.31% 1,200,000 0.31% 0.02% 0.47% 1.13% Dollars (in thousands) 4.24% 4.14% 1,100,000 4.29% 9.03% 1,000,000 900,000 800,000 700,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Nebraska Cities of the First Class Bellevue Ralston Crete LaVista North Platte Plattsmouth Hastings Ogallala Papillion Schuyler South Sioux City Chadron Sidney Holdrege Wayne Fremont Nebraska City Alliance Blair Beatrice Lexington Columbus Seward Grand Island McCook Gering Norfolk 2013 2014 0.3 Norfolk Scottsbluff Kearney York Property Tax Rates (Dollars per $100 of assessed value) Table 7 Comparison of 2013 Property Tax Rates 0.7 0.6 0.5 0.4 0.2 0.1 0 GENERAL FUND REVENUE CHANGES The following compares by revenue source the FY 2013-2014 budget with the FY 2014-2015 proposed budget: SOURCE Taxes Dollar Percentage BUDGET BUDGET Increase Increase FY 2013-2014 FY 2014-2015 (Decrease) (Decrease) 10,288,871 10,658,196 369,325 3.59% Licenses & Permits 204,975 216,300 11,325 5.53% Intergovernmental Revenues 491,627 507,284 15,657 3.18% Charges for Service 1,883,031 1,951,015 67,984 3.61% Rent & Other Revenue 5,347,622 5,338,840 (8,782) (0.16%) 4,200 5,000 800 19.05% 700,000 680,000 (20,000) (2.86%) 18,920,326 19,356,635 436,309 2.31% Other Interest Income Non-Revenue Receipts TOTAL