Chapter 7: Cash and Receivables

advertisement

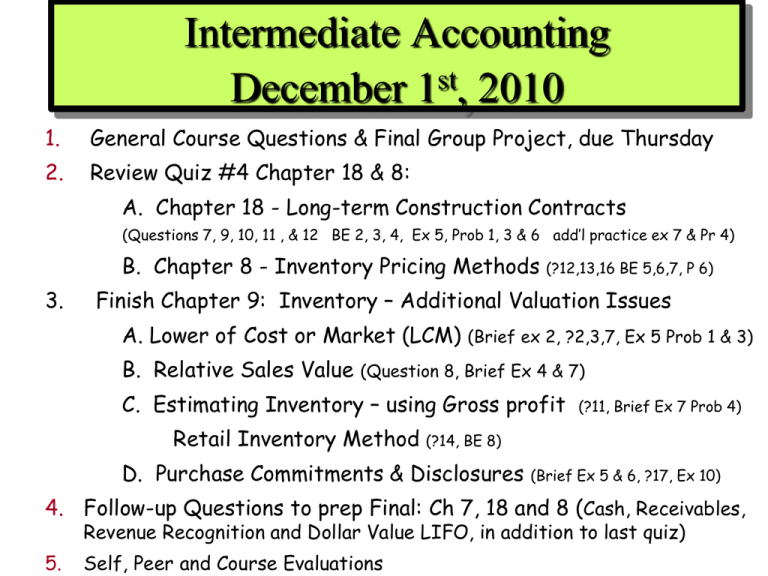

Intermediate Accounting December 1st, 2010 1. General Course Questions & Final Group Project, due Thursday 2. Review Quiz #4 Chapter 18 & 8: A. Chapter 18 - Long-term Construction Contracts (Questions 7, 9, 10, 11 , & 12 BE 2, 3, 4, Ex 5, Prob 1, 3 & 6 add’l practice ex 7 & Pr 4) B. Chapter 8 - Inventory Pricing Methods (?12,13,16 BE 5,6,7, P 6) 3. Finish Chapter 9: Inventory – Additional Valuation Issues A. Lower of Cost or Market (LCM) (Brief ex 2, ?2,3,7, Ex 5 Prob 1 & 3) B. Relative Sales Value (Question 8, Brief Ex 4 & 7) C. Estimating Inventory – using Gross profit (?11, Brief Ex 7 Prob 4) Retail Inventory Method (?14, BE 8) D. Purchase Commitments & Disclosures (Brief Ex 5 & 6, ?17, Ex 10) 4. Follow-up Questions to prep Final: Ch 7, 18 and 8 (Cash, Receivables, Revenue Recognition and Dollar Value LIFO, in addition to last quiz) 5. Self, Peer and Course Evaluations Inventory: Lower of Cost or Market (LCM) GAAP requires inventory to be stated at the lower of cost or market, abandoning the historical cost principle when the future utility (revenue producing ability) of the asset drops below it original cost. Market = Replacement Cost (the cost to replace by purchase or reproduction, not sales price) Thus, LCM is Lower of Cost or Replacement Cost and determined using “Designated Market” Loss should be recorded when loss occurs, not in the period of sale Restate asset at “designated” market to replace cost. 2 Determining Designated Market for use in assessing LCM Why use Replacement Cost (RC) for Market? Decline in the RC usually results in a decline in selling price. RC allows a consistent rate of gross profit. A reduction in RC may fail to indicate a reduction in utility, thus two additional valuation limitations are used to determine the Designated Market which is then compared to Cost to determine if a LCM write-down is needed. The Designated Market is the middle of the three: Replacement Cost (cost to replace or reproduce) Ceiling - net realizable value (NRV= selling price less disposal cost) and Floor - net realizable value less a normal profit margin. 3 Finding the Designated Market to Determine Lower of Cost or Market Item Historical Replacement Cost Cost Ceiling Floor (NRV) (NRV – profit) Final Inventory $ A $80,000 $88,000 $120,000 $104,000 $ B $90,000 $88,000 $100,000 $70,000 $ C $90,000 $88,000 $100,000 $90,000 $ D $90,000 $88,000 $87,000 $70,000 $ 4 Rational for Designated Market Ceiling and Floor Limitations •Ceiling – prevents overstatement of the value of obsolete, damaged, or shopworn inventories. •Floor – deters understatement of inventory and overstatement of the loss in the current period. Market Cost Ceiling = NRV Not > Replacement Cost Not < GAAP LCM Floor = NRV less Normal Profit Margin 5 Lower of Cost or Market - Individual Items •Illustration 9-5 6 Lower of Cost or Market - Individual Items •Illustration 9-5 $415,000 7 Recording Decline in Market Value (LCM) Individual Items Ending inventory (cost) $ 415,000 Ending inventory (LCM) 350,000 Adjustment to LCM Allowance Method Direct Method Loss on inventory $ 65,000 65,000 Allowance to reduce inventory to 65,000 market (contra inventory account) Cost of goods sold Inventory 65,000 65,000 8 Lower of Cost or Market – Balance Sheet Allowance Direct Current assets: Cash $ 100,000 $ 100,000 Accounts receivable 350,000 350,000 Inventory 770,000 705,000 Less: inventory allowance (65,000) Prepaids Total current assets 20,000 20,000 1,175,000 1,175,000 9 Lower of Cost or Market – Income Statement Allowance Sales $ Cost of goods sold 300,000 Direct $ 300,000 120,000 185,000 180,000 115,000 Selling 45,000 45,000 General and administrative 20,000 20,000 Total operating expenses 65,000 65,000 65,000 - Gross profit Operating expenses: Other revenue and expense: Loss on inventory Interest income 5,000 Total other 5,000 (60,000) 5,000 Income from operations 55,000 55,000 Income tax expense 16,500 16,500 Net income $ 38,500 $ 38,500 10 Lower of Cost or Market Application The lower of cost or market may be applied: 1. Either directly to each item * most conservative approach * generally required for tax purposes 2. To each category, or 3. To the total of the inventory Whichever method is selected, it should be consistently applied. 11 Lower of Cost or Market - Individual Items, Major Categories or Total Inventory 12 Lower of Cost or Market - Individual Items, Major Categories or Total Inventory 13 LCM Example Assume in each case that the selling expenses are $8 per unit and that the normal profit is $5 per unit. Calculate the limits for each case (ceiling and floor). Then enter the amount that should be used for the lower of cost or market. Designated Market -chose the middle one Selling Price Ceiling (NRV) Replace- Floor (NRV less ment $ profit) Cost cost/mkt a $ 54 $ 38 43 b $ 47 $ 36 40 c $ 56 $ 39 40 d $ 47 $ 42 40 1. 2. 3. 4. Lower of Compute the Designated Market Ceiling for each item which is its Net Realizable Value (NRV) (NRV = Selling price less costs to complete sale). Compute the Designated Market Floor for each item which is its NRV less any normal profit. Identify each item's Designated Market, which is the middle dollar amount, by circling it. Compare cost to designated market and use Lower of Cost or Designated market. Also Homework today: Brief Ex 2 14 Evaluation of LCM Rule Some Deficiencies: Expense are recorded when the loss in utility occurs. Profit on sale only recognized at the point of sale. Inventory may be valued at cost in one year and at market the next year. Net income in the year of loss is lower. Net income in subsequent period may be higher than normal if expected reductions in sales price do not materialize. LCM uses a “normal profit” in determining inventory values, which is a subjective measure. 15 Recording What ifthe theDecline MarketinValue Market Value Recovers? For subsequent increases in inventory value: o US GAAP prohibits the reversal of writedowns o IFRS requires the reversal of writedowns 16 Other Valuation Issues • Valuation at Net Realizable Value Permitted by GAAP under the following conditions: (1) there is a controlled market with a quoted price for all quantities, and (2) there are no significant costs of disposal (rare metals and agricultural products) or (3) it is too difficult to obtain cost figures (meatpacking) • Relative Sales Value – “Basket Purchase” • Purchase Commitments 17 Valuation Basis: Relative Sales Values • Appropriate basis when basket purchases are made. • Basket purchases involve a group of varying units. • The purchase price is paid as a lump sum amount. • The lump sum price is allocated to units on the basis of their relative sales values. • Quickest approach – determine the percentage total cost to total revenue and use it to allocate cost or gross profit Also Homework today: question 8 and Brief Ex 4 18 Relative Sales Values: Example Kirby Company buys three different lots (A, B and C) in a basket purchase, paying $297,500 for all three. The lots were sold as follows: Sales Price Cost Gross Profit A $75,000 _______ _________ B $150,000 _______ _________ C $200,000 _______ _________ Total $425,000 _______ _________ What is the cost of A, B and C and the gross profit for each lot? (Suggestion: determine the percentage total cost to total revenue and use it to allocate cost and/or gross profit) 19 Relative Sales Values: Example Kirby Company buys three different lots (A, B and C) in a basket purchase, paying $297,500 for all three. The lots were sold as follows: % Cost to Sales = $297.5k/$425K = 70% Sales Price Cost Gross Profit A $75,000 x 70% $ 52,500 $22,500 B $150,000 x 70% $105,000 $45,000 C $200,000 x 70% $140,000 $60,000 Total $425,000 $ 297,500 $127,500 What is the cost of A, B and C and the gross profit for each lot? 20 Relative Sales Values: Example 2 Crawford Furniture Company purchased a carload of wicker chairs. The manufacturer sold the chairs to Crawford for a lump sum of $60,000, because they want to discontinue these items. The three types of chairs and their estimated selling prices are listed below. Given the 2011 sales below, determine how much gross profit Crawford should recognize in 2011 and what amount they should report as unsold chair inventory. Estimated Unit Sales Total Selling # of Chairs Price Price Unit Sales in 2011 Lounge Chairs 400 90 $ 36,000 200 Arm Chairs 300 80 $ 24,000 100 Straight Chairs 800 50 $ 40,000 120 2011 Gross Profit Realized Inventory December 31, 2011 220 $ 100,000 (Suggestion: determine the percentage total cost to total revenue and use it to allocate cost and gross profit) 21 Relative Sales Values: Example 2 Crawford Furniture Company purchased a carload of wicker chairs. The manufacturer sold the chairs to Crawford for a lump sum of $60,000, because they want to discontinue these items. The three types of chairs and their estimated selling prices are listed below. Given the 2011 sales below, determine how much gross profit Crawford should recognize in 2011 and what amount they should report as unsold chair inventory. Estimated Unit Sales Total Selling # of Chairs Price Price Unit Sales in 2011 2011 Gross Profit Realized Inventory December 31, 2011 Lounge Chairs 400 90 $ 36,000 60% 200 $ 7,200 $ 10,800 Arm Chairs 300 80 $ 24,000 60% 100 $ 3,200 $ 9,600 Straight Chairs 800 50 $ 40,000 60% 120 $ 2,400 $ 20,400 220 $ 100,000 $ 12,800 $ 40,800 22 Purchase Commitments • Cancellable contracts – No entry or disclosure required • Formal, non-cancelable contracts – Seller retains title, buyer recognizes no asset but should disclose contract details in footnote – If execution of the contract is expected to result in a loss, buyer must record the loss in the period the market prices decreased: DR Unrealized Holding Loss CR Est liability on purchase commitment Homework today: Brief Ex 5 & 6 23 Inventory Estimation Techniques • Inventory estimation used when: – a fire or other catastrophe destroys either inventory or inventory records – taking a physical inventory is impractical – auditors only need an estimate of the company’s inventory • Gross Profit Method • Retail Sales Method 24 Estimate Inventory Using Gross Profit 1. 2. 3. Calculate Cost of Goods Available for Sale (CGA) Estimate Cost of Goods Sold (CGS) using Sales and estimate of Gross Profit Deduct Estimate of CGS from CGA to get Estimate of Ending Inventory 25 Estimate Inventory Using Gross Profit Whitsunday Company’s warehouse burned and its inventory was completely destroyed. The accounting records were kept in the office building and escaped harm. The following information was available: Net sales $426,000 Beginning inventory 80,000 Net purchases 300,000 Average gross profit on sales 20% Use the above information to estimate the ending inventory lost in the fire using the gross profit method. 1. 2. 3. Calculate Cost of Goods Available for Sale (CGA) Estimate Cost of Goods Sold (CGS) using Sales and estimate of Gross Profit Deduct Estimate of CGS from CGA to get Estimate of Ending Inventory 26 Estimate Inventory Using Gross Profit Whitsunday Company’s warehouse burned and its inventory was completely destroyed. The accounting records were kept in the office building and escaped harm. The following information was available: Net sales $426,000 Beginning inventory 80,000 Net purchases 300,000 Average gross profit on sales 20% Use the above information to estimate the ending inventory lost in the fire using the gross profit method. 1. 2. 3. Calculate Cost of Goods Available for Sale (CGA) $380,000 Estimate Cost of Goods Sold (CGS) using Sales and estimate of Gross Profit: (CGS 80% if Gross Profit is 20%) Sales x CGS % = CGS: $426,000 x 80% = $340,800 Deduct Estimate of CGS from CGA to get Estimate of Ending Inventory $380,000 – 340,800 = $39,200 27 Gross Profit Method to Determine EI Beginning inventory Net purchases Cost of goods available for sale Estimated cost of goods sold: Net sales 426,000 Less: Est gross profit (85,200) Estimated ending inventory $80,000 300,000 380,000 (340,800) $39,200 28 Example 2: Estimate Inventory Using Gross Profit On December 31, 2010 Carr Company's inventory burned. Sales and purchases for the year had been $1,400,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2010) was $170,000; in the past Carr's gross profit has averaged 40% of selling price. Compute the estimated cost of inventory burned. 1. 2. 3. 29 Example 2: Estimate Inventory Using Gross Profit On December 31, 2010 Carr Company's inventory burned. Sales and purchases for the year had been $1,400,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2010) was $170,000; in the past Carr's gross profit has averaged 40% of selling price. Compute the estimated cost of inventory burned. 1. 2. 3. Calculate Cost of Goods Available for Sale (CGA) $1,150,000 Estimate Cost of Goods Sold (CGS) using Sales and estimate of Gross Profit: (CGS 60% if Gross Profit is 40%) Sales x CGS % = CGS: $1,400,000 x 60% = $840,000 Deduct Estimate of CGS from CGA to get Estimate of Ending Inventory $1,150,000 – 840,000 = $310,000 30 Gross Profit Method Example 2 On December 31, 2010 Carr Company's inventory burned. Sales and purchases for the year had been $1,400,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2010) was $170,000; in the past Carr's gross profit has averaged 40% of selling price. Compute the estimated cost of inventory burned. BI + Net Purchases = COGA -Estimated COGS: Net Sales less estimated gross profit Estimated Ending inventory 31 Retail Inventory Method This inventory estimation technique is used when: – a fire or other catastrophe destroys either inventory or inventory records – taking a physical inventory is impractical – auditors only need an estimate of the company’s inventory Appropriate for retail concerns with: • • high volume sales and different types of merchandise • Assumes an observable pattern between cost and prices. 32 Retail Inventory Method Steps: 1. Determine ending inventory at retail price 2. Convert this amount to a cost basis using a cost-to-retail ratio BI (at retail) + Net Purchases (at retail) – Net sales = EI (at retail) EI (at retail) X Cost-to-Retail ratio = estimated “EI” (at cost) 33 Retail Inventory Method: Example Given for the year 2002: Beginning inventory Purchases (Net) Sales (Net) at cost $2,000 $10,000 at retail $3,000 $15,000 $12,000 What is ending inventory, at retail and at cost? 34 Retail Inventory Method: Example at cost Beginning inventory Purchases (Net) Goods available for sale less: Sales (Net) Ending inventory (at retail) Times: cost to retail ratio Ending inventory at cost COGS $ 2,000 $10,000 $12,000 at retail $ 3,000 $15,000 $18,000 ($12,000) $6,000 x 35 Intermediate Accounting November 30th, 2010 1. General Course Questions & Final Group Project, due Thursday 2. Questions before final 30 minute Quiz: A. Chapter 18 - Long-term Construction Contracts (Questions 7, 9, 10, 11 , & 12 BE 2, 3, 4, Ex 5, Prob 1, 3 & 6 add’l practice ex 7 & Pr 4) B. Chapter 8 - Inventory Pricing Methods (?12,13,16 BE 5,6,7, P 6) 4. Chapter 8 Dollar Value LIFO (homework: ?14, 17-20, BE 9, Ex 26, Prob 11 & Case 9) 5. Chapter 9: Inventory – Additional Valuation Issues A. Lower of Cost or Market (LCM) (Brief ex 2) B. Relative Sales Value (Question 8, Brief Ex 4) C. Estimating Inventory – using Gross profit (question 11, Brief Ex 7) D. Purchase Commitments (Brief Ex 5 & 6) 36 6. Extra Credit Session - Columbia Sportswear Annual Report Project