Chapter 14 PowerPoint

advertisement

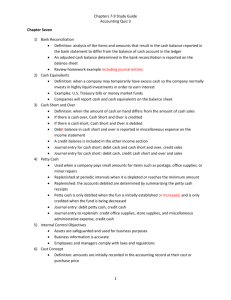

Distributing Dividends and Preparing a Worksheet for a Merchandising Business STOCKHOLDERS’ EQUITY ACCOUNTS USED BY A CORPORATION page 405 3110 3120 3130 3140 2 (3000) STOCKHOLDERS’ EQUITY Capital Stock Retained Earnings Dividends Income Summary LESSON 14-1 6. Stockholders’ Equity and Dividends Retained earnings – an amount earned by a corporation and not yet distributed to stockholders Dividends – earnings distributed to stockholders (temporary account similar to drawing account for a sole proprietorship) Board of Directors – a group of persons elected by the stockholders to manage a corporation Declaring a dividend – action by the board of directors to distribute corporate earnings to stockholders (usually declared one date and paid on a later date) 3 DECLARING A DIVIDEND page 406 December 15. Hobby Shack’s board of directors declared a quarterly dividend of $2.00 per share; capital stock issued is 2,500 shares; total dividend, $5,000.00. Date of payment is January 15. Memorandum No. 79. 2 4 3 1 5 1. Write the date. 2. Write the title of the account debited. 3. Write the memorandum number. 4 LESSON 14-1 6 4. Write the debit amount. 5. Write the title of the account credited. 6. Write the credit amount. PAYING A DIVIDEND page 407 January 15. Paid cash for quarterly dividend declared December 15, $5,000.00. Check No. 379. 1 1. 2. 3. 4. 5. 5 2 3 Write the date. Write the account title. Write the check number. Write the debit account. Write the credit amount. LESSON 14-1 4 5 RECORDING A TRIAL BALANCE ON A WORK SHEET page 410 1 1. Account title 2. Account balance 3. Total, prove, and rule the debit and credit columns 2 3 6 LESSON 14-2 ANALYZING AND RECORDING SUPPLIES ADJUSTMENTS Adj. (a) Dec. 31 Bal. (Adj Bal. Adj. (b) Dec. 31 Bal. (Adj Bal. 7 Supplies Expense—Office 2,730.00 Supplies—Office 3,480.00 Adj. (a) 750.00) 2,730.00 Supplies Expense—Store 2,910.00 Supplies—Store 3,944.00 Adj. (b) 1,034.00) LESSON 14-2 2,910.00 page 411 RECORDING SUPPLIES ADJUSTMENTS ON A WORK SHEET page 412 3 2 3 1 1. Write the debit amounts in the Adjustments Debit column. 2. Write the credit amounts in the Adjustments Credit column. 3. Label the two parts of the Supplies—Office adjustment with small letter a and small letter b in parentheses. 8 LESSON 14-2 ANALYZING AND RECORDING A PREPAID INSURANCE ADJUSTMENT page 413 3 1 3 2 1. Enter the amount of insurance used in the Adjustments Credit column. 2. Enter the same amount in the Adjustments Debit column. 3. Label the two parts of the adjustment with a small letter c in parentheses. 9 LESSON 14-2 7. Planning and Adjusting Merchandise Inventory Merchandise Inventory (asset) – the amount of goods on hand for sale to customers - Purchases of merchandise are recorded to purchases account - Sales of merchandise are recorded to sales account (changes to merchandise happen so often that the merchandise inventory account is only affected once per fiscal period, when doing the worksheet) 10 page 416 ANALYZING AND RECORDING A MERCHANDISE INVENTORY ADJUSTMENT 3 2 3 1 No direct temporary account (expense) so Income Summary is used for the adjustment 1. Write the debit amount. 2. Write the credit amount. 3. Label the two parts of this adjustment with a small letter d in parentheses. 11 LESSON 14-3 ANALYZING AN ADJUSTMENT WHEN ENDING MERCHANDISE INVENTORY IS GREATER THAN BEGINNING MERCHANDISE Merchandise Inventory INVENTORY Jan. 1 Bal. Adj. (d) (New Bal. 294,700.00 4,200.00 298,900.00) Income Summary Adj. (d) 12 LESSON 14-3 4,200.00 page 417 8. Planning and Adjusting Allowance for Uncollectible Accounts Uncollectible Accounts – accounts receivable that cannot be collected (customer that will not pay) - - This risk is recorded as an expense in same accounting period revenue is earned (Concept: Matching expenses with revenue) Since we do not know which accounts receivable, an estimate is calculated and expensed Expense 13 Asset Asset (contra account) 8. Planning and Adjusting Allowance for Uncollectible Accounts Two objectives of estimating this: - 1. Reports Balance Sheet amount for Accts. Rec. that reflect what is expected to be collected in future - 2. Recognizes the expense for uncollectible amounts in same fiscal period Allowance method of recording losses from uncollectible accounts – crediting the estimated value of uncollectible amounts to a contra account Book value – the difference between an asset’s account balance and its related contra account 14 Book value of accounts receivable – difference between accounts receivable and allowance for uncollectible accounts ESTIMATING UNCOLLECTIBLE ACCOUNTS EXPENSE 15 page 420 Many companies use a percentage of total sales method – based on experience Total Sales on Account × Percentage = Estimated Uncollectible Accounts Expense $124,500.00 × 1% = $1,245.00 LESSON 14-4 page 421 ANALYZING AND RECORDING AN ADJUSTMENT FOR UNCOLLECTIBLE ACCOUNTS EXPENSE 3 1 3 2 1. Enter the estimated uncollectible amount. 2. Enter the same amount in the Adjustments Debit column. 3. Label the two parts with a small letter e in parentheses. 16 LESSON 14-4 9. Planning and Adjusting for Depreciation Current assets – cash and other assets expected to be exchanged for cash or consumed in one year Plant assets – assets that will be used for a number of years in the operation of a business - three major types: equipment, buildings, land Depreciation expense – the portion of a plant asset’s cost that is transferred to an expense account in each fiscal period during a plant asset’s useful life 17 Depreciation Three factors in calculating annual amount of depreciation: 1. Original cost 2. Estimated salvage value – the amount an owner expects to receive when a plant asset is removed from use (residual value or scrap value) 3. Estimated useful life (physical depreciation <wear and weather> and functional depreciation <inadequate or obsolete>) 18 Straight-Line Depreciation Straight-Line depreciation – charging an equal amount of depreciation expense for a plant asset each year Original Cost $1,250.00 Estimated Total Depreciation Expense $1,000.00 19 Estimated Salvage Value – – $250.00 ÷ Years of Estimated Useful Life ÷ 5 = Estimated Total Depreciation Expense = $1,000.00 = Annual Depreciation Expense = $200.00 Accumulated Depreciation Accumulated depreciation – the total amount of depreciation expense that has been recorded since the purchase of a plant asset 20X2 Accumulated Depreciation 20X3 + Depreciation = Expense $400.00 + $200.00 Asset (contra account) 20 20X3 Accumulated Depreciation = $600.00 Calculating Book Value Book value of a plant asset – the original cost of a plant asset minus accumulated depreciation 21 Original Cost – Accumulated Depreciation = Ending Book Value $1,250.00 – $600.00 = $650.00 ANALYZING AND RECORDING ADJUSTMENTS FOR DEPRECIATIONpage 425 EXPENSE 3 2 3 1 1. Write the debit amounts. 2. Write the credit amounts. 3. Label the adjustments. 22 LESSON 14-5 10. Calculating Federal Income Tax and Completing a Work Sheet Corporations anticipating annual federal taxes ≥ $500 required to pay estimated taxes quarterly (April, June, September, December) Corporations calculate federal income tax owed at the end of the fiscal year and file annual return 23 10. Calculating Federal Income Tax and Completing a Work Sheet In order to adjust federal income tax, first determine net income before income tax expense 1. 2. 3. 4. Complete all other adjustments on the work sheet Extend all amounts except Federal Income Tax Expense Separately, total Income Statement columns Calculate the difference between the Income Statement Debit total and Income Statement Credit total. (Difference represents net income prior to federal income tax) 24 FEDERAL INCOME TAX EXPENSE ADJUSTMENT Total of Income Statement Credit column Less total of Income Statement Debit column before federal income tax Equals Net Income before Federal Income Tax 25 LESSON 14-6 page 427 $ 500,253.10 –396,049.91 $ 104,203.19 10. Calculating Federal Income Tax and Completing a Work Sheet The amount of federal income tax expense is calculated using a tax rate table provided by IRS 26 RECORDING THE FEDERAL INCOME TAX ADJUSTMENT page 429 3 1 1 1. Calculate the amount of federal income tax expense adjustment. 27 2 LESSON 14-6 3 2. Total and rule the Adjustments columns. 3. Extend account balances. COMPLETING A WORK SHEET 1 page 430 1 2 4 1. 2. 3. 4. 5. 28 5 Total the Income Statement and Balance Sheet columns. Calculate and enter the net income after federal income tax. Extend the net income amount. Calculate the column totals. Rule double lines. LESSON 14-6 3 A COMPLETED 8-COLUMN WORK SHEET 29 LESSON 14-6 page 432 A 10-COLUMN WORK SHEET 1 2 3 page 434-435 5 4 6 1. 2. 3. 4. 30 Trial balance Adjustments Extend adjusted balances Total, prove, and rule LESSON 14-6 5. Extend balances 6. Calculate net income; total, prove and rule