file

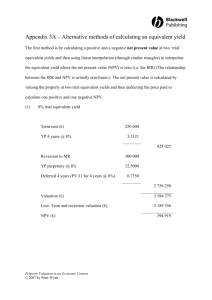

advertisement

ERES 2012 Reversionary Freeholds: Valuation Methods Revisited Nick French Professor in Real Estate & DTZ Fellow in Commercial Property Department of Real Estate & Construction Oxford Brookes University Email: nick.french@brookes.ac.uk Agenda Valuation Methods – UK (Investment Approach) Term and Reversion Method – differential yields Term and Reversion Method – equivalent yields Hardcore/Layer Method – differential yields Hardcore/Layer Method – equivalent yields DCF Method – Target Rate and ARY in perp Valuation Methods in Practice Pilot Study - Survey Initial Results RICS Guidance DCF - guidance from the RICS and IVSC Market Uncertainty 2012 Property Forecasts “In this world nothing can be said to be certain, except death and taxes” Benjamin Franklin (1789) Comment: Advice on Valuation Uncertainty is now a prerequisite “It will be about the Euro in 2012. As long as it continues as it is, banks won’t lend and occupiers won’t make decisions” Anthony Leonard, Hines (2012) Comment: There is a stagnation in the market due to uncertainty The fortunes of secondary/tertiary assets will depend on who owns it. If owned by good asset managers then they will continue to perform. If not, they will continue to fall in value” James Scott, Commercial Estates (2012) Comment: Value will be determined by cash flows - DCF Market Uncertainty 2012 Property Forecasts “On a micro-level, a lot of tertiary and secondary stock (in the M4 corridor) will become worthless” Miff Chichester, St Congar Properties (2012) Comment: Reversionary value will be critical NOT YP perp “The pressure on the banks in terms of capital requirements and liquidity is going to become very intensive. They will have to make more sales” Ian Marcus, Credit Suisse (2012) “We may have reached the limits of trying to adapt traditional (valuation) methods” Tim Havard, Oakbrook Consultancy (2012) Comment: Valuers will need to be able to assess value from first principles and NOT by comparison The Red Book Valuation Approaches There are now THREE approaches to valuation: MARKET APPROACH COMPARABLE METHOD COST APPROACH CONTRACTORS METHOD This incorporates Depreciated Replacement Cost INCOME APPROACH INVESTMENT METHOD (implicit and explicit) RESIDUAL METHOD PROFITS or ACCOUNTS METHOD Valuation and Worth VALUATION - the process of determining market value. An estimation of the price of exchange in the market place using market information and expectations CALCULATION OF WORTH – The process of determining the worth of a property asset or business based on specified forecasts of the future that may differ from market expectations MAREKT VALUE and INVESTEMNT VALUE (WORTH) TERM AND REVERSION CASH FLOW REVERSION MR Rent Passing TERM 1st review perp LAYER CASH FLOW RERVERSION MR Rent Passing TERM 1st review perp VALUATION EXAMPLE Rent Passing £750,000, MR £1m, ARY 8%, TR 10.75% Term and Reversion Layer Short – cut DCF Full DCF (not illustrated) £ 11,855,726 £ 11,855,726 £ 11,953,848 £ 11,953,848 Each of the methods produce similar answers (DCF 0.83% higher) and the choice of method in “normal” circumstances will not mis-price the asset. However in certain situations (e.g. Overrenting and recessionary markets) traditional methods, poorly adapted, could produce erroneous answers. IMPLICIT VALUATION Term and Reversion Method Rent Passing £ 750,000 YP 3 years @ 8.00% 2.58 MR YP perp @ 8.00% £1,932,823 £ 1,000,000 12.50 PV 3 years @ 8.00% 0.79 £9,922,903 £11,855,726 IMPLICIT VALUATION Layer Method Rent Passing (layer) £ 750,000 YP perp @ 8.00% 12.50 £9,375,000 Top Slice £ 250,000 YP perp @ 8.00% 12.50 PV 3 years @ 8.00% 0.79 £2,480,726 £ 11,855,726 EXPLICIT VALUATION Short Cut DCF Method Rent Passing £750,000 YP 3 years @ 10.75% 2.45 £1,840,785 MR (grown 3 yrs at 3.2%) £1,099,016 YP perp @ 8.00% 12.50 PV 3 years @ 10.75% 0.74 11,953,848 £10,113,063 £ Survey Results All valuations were Layer with adjustment to yields on BOTH layer & top slice Total number of respondents Number involved in Valuation only Number involved in other tasks Number not doing valuations 12/25 7 4 1 Do you feel that you have sufficient evidence of ARYs? Do you feel that you have sufficient evidence to adjust yields? If you undertake valuations, do you feel that you have sufficient guidance from the RICS? Yes No 1 n/a Yes No 6 0 0 7 1 6 n/a Yes No 4 0 1 0 4 0 1 0 4 0 1 n/a Survey Results The majority of all respondents felt there was insufficient guidance from the RICS on method All respondents felt there was adjustments to ARY were made arbitrarily 69% of all responding valuers felt there was sufficient guidance on valuations from the RICS Comment - “Often valuations are undertaken in isolation of any evidence” Comment - “Valuations are presented as just numbers on spreadsheet/software without any explanation” Comment - “Valuation methods (by generic software) are being often made by individuals who are not trained and who do not understand value”