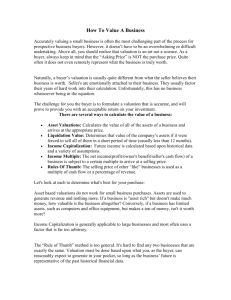

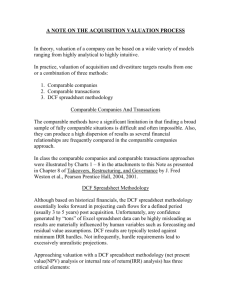

The valuation process

advertisement

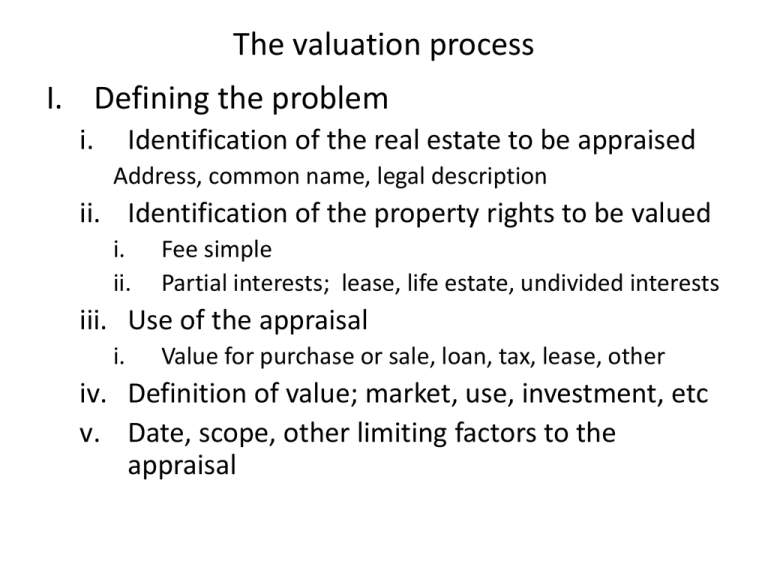

The valuation process I. Defining the problem i. Identification of the real estate to be appraised Address, common name, legal description ii. Identification of the property rights to be valued i. ii. Fee simple Partial interests; lease, life estate, undivided interests iii. Use of the appraisal i. Value for purchase or sale, loan, tax, lease, other iv. Definition of value; market, use, investment, etc v. Date, scope, other limiting factors to the appraisal The valuation process • Preliminary analysis, data selection and collection – General; local neighborhood, government, environmental, etc. – Specific; the site itself, improvements, depreciation, history of ownership and use, income and expenses, – Supply and demand; other properties around, demand studies, how long have they been on the market, The valuation process • Highest and best use – Vacant land – With improvements • Legal uses • Physically possible • Financially feasible (with non-monetary benefits) • Maximum income The valuation process 1. Cost approach 1. The idea is that you estimate the market value today with the estimated reproduction costs of improvements considered. The reproduction costs are depreciated to reflect physical depreciation, functional obsolescence, and external obsolescence 2. The depreciated reproduction costs are added to the market value of the land to obtain the estimated value of the land and improvements The valuation process • Cost approach; – The whole idea is that the buyer could buy the farm with the existing improvements or they could buy bare land and make the improvements – The buyer then looks at the farm with the buildings considering the utility of the buildings as well as their conditions and construction of new improvements The valuation process 2. Comparable Sales approach; – This approach provides the estimate of the value based on market prices paid and current market listings – You analyze and adjust the sales to reflect the conditions of the subject property . This analysis lets you estimate the market value for the subject. – The whole idea is based on the notion that an informed buyer would not pay more for a property than the cost of the existing property with the same utility The valuation process • Comparable sales can be tricky if the market is moving rapidly or if you can’t find good comparables. • Think of the example Fred used; $7,000 and just a few miles away it was $6 something. • Land is an unusual commodity. “The same utility” is a hard thing to measure some times. The valuation process 3. The income approach; • This is the third approach to estimating the market value of the subject property • The whole idea is to convert the anticipated benefits from ownership into a value estimate • Four basic steps: 1. Estimate net economic rent for comparable properties 2. Estimate relationship between rent and value for them 3. Estimate the net economic rent for the subject 4. Capitalize net rent for subject into an indication of value The valuation process • Income approach; • Four basic steps: 1. Estimate net economic income for comparable properties 2. Estimate relationship between income and value for them 3. Estimate the net economic income for the subject 4. Capitalize net income for subject into an indication of value The valuation process • Net income and net economic rent are used synonymously but the point is how much money can you earn from the property. • This creates issues when the purchase is for non-monetary reasons • Value = income/capitalization rate The valuation process • Reconciling the values found in the three different approaches takes some time and thought. • If we had the perfect markets and the perfect person analyzing them, we’d be OK • Remember that if you put garbage into the analysis that’s what you’ll get out • Never forget to ask yourself if this property really worth it