Signaling

advertisement

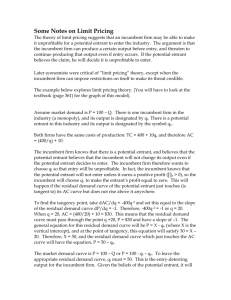

Signaling Games Microeconomics C Session #4 Amine Ouazad Outline 1. 2. 3. 4. Education as a signal What characterizes a signaling mechanism? Warranties as a signal Beer and quiche: Strategic Moves as Signals Education as a signal • What if students do not learn during their degree? – The three values of education: consumption value (Lazear 1975), human capital accumulation (Becker 1964), signaling value (Spence 1973). • Signaling value: – On the labor market, candidates know more about their productivity than potential employers, information is asymmetric. – Education is a costly enterprise, which is undertaken only by high productivity individuals. – Cost: opportunity cost of the degree, tuition fees, and other costs. • Intuition: – With higher risks of failure, and higher time spent investing in Signaling model • Simplify reality to gain insights. • Two types of job candidates: high and low productivity, noted H and L. – Fraction p of high productivity candidates in population. • Asymmetric information: candidate knows his type, but employer does not observe it. Signaling model • At a separating equilibrium, – Wh – eh > Wl – Wh – el < Wl High productivity ind. get education Low productivity ind. do not get educ. • At a pooling equilibrium, – pWh+(1-p)Wl – eh > Wl. High prod. ind. get educ. – pWh+(1-p)Wl – el > Wl. Low prod. ind. Get educ. – And somebody who is not educated is seen as lowproductivity by employers. • Remarks: – This is a Perfect Bayesian Equilibrium of the sequential game. – The candidate’s productivity is unaffected by education. Education only serves as a costly signal. Empirical evidence Human capital augmentation versus the signaling value of MBA education, Economics of Education Review, August 2012 Andrew Hussey Abstract Panel data on MBA graduates is used in an attempt to empirically distinguish between human capital and signaling models of education. The existence of employment observations prior to MBA enrollment allows for the control of unobserved ability or selection into MBA programs (through the use of individual fixed effects). In addition, variation in the amount of pre-MBA work experience allows for a test to distinguish between the models. In particular, a predominant signaling view is shown to predict smaller returns to the degree, the more pre-MBA work experience one has (controlling for total experience). Additionally, a unique feature of the data is that respondents were asked to report skills or abilities gained through their schooling, allowing us to determine the extent to which these purported skills are valued in the labor market. The combined evidence suggests that while human capital accumulation may contribute to the returns to an MBA, the majority of the returns is derived from the signaling/screening function of the degree. Difference can also be on the benefits’ side Of the cost-benefit analysis. • Signaling value of an MBA. It takes around 5 years to recoup the cost of an INSEAD MBA. Women who undertake an MBA are then more likely to stay at least 5 years on the labor market after the MBA (and empirically many do). The MBA convinces employers that the candidate is committed to the labor market. 2. What characterizes a signaling mechanism? (Abstract) 1. Asymmetric information. 2. The informed party chooses whether to invest in a costly signal. 3. The uninformed party infers the agent’s type by observing the costly signal in a separating equilibrium. 4. The cost of the signal is higher for a highquality/high-productivity agent. 5. With some parameters, a pooling equilibrium exists where every informed party invest in the costly signal but the signal is uninformative. 3. Warranties as a signal • Church’s “Consul” black leather shoes: £350 a pair. • It offers a full warranty. A worn out shoe is replaced for free, including shipping costs to Church’s workshops in England, as many times as needed. • Is this sufficient to convince the customer that the shoe is of high quality? – Marginal cost of an entire shoe: £200 (handmade in Northampton). – Cost of refitting the shoe on average £80. – Customers buy a new model after 2 years on average. 3. Warranties as a signal • Church wants to signal that the shoe is of ‘high-quality’, i.e. it will need no repair or at most 1 repair in 2 years. • Separating equilibrium: – High quality shoe-makers offer the warranty: ph – mc – (# of repairsh*cost)> pl – mc – Low quality shoe-makers do not offer the warranty: pl – mc > ph – mc – (# of repairsl*cost) • In a nutshell: – It costs more for a low-quality shoe-maker to offer the warranty – offering the warranty is not profitable for the shoe-maker. 4. Beer and Quiche: Strategic moves as signals • Recap: the entry game. – Sequential game. – Entrant and incumbent. • Uncertainty is about “toughness” or “softness” of the incumbent. • Can the tough incumbent signal his toughness by making a move prior to the entry of the entrant? – The cost of the signal has to be higher for the soft incumbent than for the tough incumbent. Signaling Toughness under Uncertainty • The beer & quiche model • An incumbent monopolist can be either tough or soft. • Prior to the entrant’s decision to enter or stay out, the incumbent gets to choose its “breakfast.” Specifically, the incumbent can have beer for breakfast or quiche for breakfast. Breakfasts are consumed in public. • A beer breakfast is less desirable than a quiche breakfast. • But costs differ according to type: a beer breakfast costs a tough incumbent less than a wimp incumbent. If Interested – Analyze This enter enter 1,-1 Incumbent quiche beer 3,0 out tough Entrant [½] Entrant soft enter [½] 2,2 quiche beer 1,0 out out 4,0 Nature enter -1,2 2,-1 Incumbent out 4,0 Beer & Quiche •Equilibrium: Tough incumbent drinks beer; soft incumbent eats quiche; entrant stays out against beer drinkers; and entrant enters against quiche eaters. •What are beer & quiche? Toughness Beer Excess Capacity High Output Low Costs Low Prices Deep Pockets Beat up Rivals & Previous Entrants