Lecture 6

Lecture 6: Strategic commitment & applications to entry and exit (II)

Entry, Capacity and Price Competition: Gelman & Salop, 1983,

Bell Journal of Economics, 14: 315-325. Simplified version in section 8.4.4, Shy, 198-200.

Paper examines the role of precommitment in strategic interaction between a dominant incumbent firm and an entrant

•A “small” competitor partially offsets its demand disadvanatge by engaging in capacity limitation and discount pricing.

•Strategy credibly reduces the threat posed to the dominant incumbent firm and makes retaliation more costly

•This is an example of “Judo” economics in which a small firm uses its rival’s large size to its own advantage

1

Model in General:

•Homogeneous Products

•Incumbent is at least as efficient as entrant, i.e., c

1

c

2

.

•Two-stage game

•Stage 1: Entrant chooses capacity (k

2

) & price (p

2

).

•Stage 2: Incumbent chooses price (p

1

).

•If incumbent matches price, it takes the whole market (and it has the capacity to serve the whole market.)

•Without capacity or if k

2

=

, incumbent takes the whole market.

2

Incumbent has two strategies: (I) Deter entry & (II) accommodate entry.

•Deterrence profits:

D

(p

1

=p

2

) = (p

2

-c

1

)D(p

2

)

•Accommodation Profits: The incumbent chooses p

1

> p

2

, and allows the entrant to sell all of its output. The incumbent is then a monopolist on the residual demand curve. (They assume reservation-price rationing so that the entrant gets the k

2 consumers with the highest valuation.)

A

= (p*

1

-c

1

)[D(p*

1

)-k

2

] (where p*

1 is the monopoly price)

3 k

2

•Hence the entrant chooses so that

D

A

.

•As p

2 increases,

D increases. As k

2 increases,

A decreases.

•Thus there is a tradeoff between p

2 and k

2

. If the entrant chooses to large a capacity or too high a price, the incument will respond by deterring entry.

•Hence the entrant underinvests in order not to provoke a response from the incumbent. This is an example of a

“puppy-dog” strategy.

4

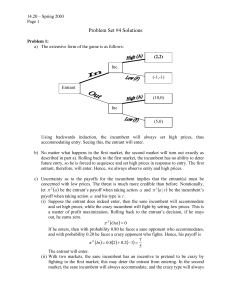

Numerical Example:

•Let P=100-Q, and let c

1

=c

2

=0.

•Hence D(p

1

)-k

2

=100- p

1

-k

2

•Hence to find

A

, maximize p

1

(100-p

1

-k

2

)

•FOC imply that p

1

=(100- k

2

)/2.

•Hence

A

= (100- k

2

) 2 /4.

•

D

= p

2

D(p

2

)= p

2

(100- p

2

).

•

A

=

D implies that (100- k

2

) 2 /4= p

2

(100- p

2

).

5

•Solving yields p

2

={ 100-[(200- k

2

)k

2

] .5

} /2.

•Clearly, there is an inverse relationship between p

2 entrant.

and k

2 for the

•As increases, profits increase, but must fall to insure that the constraint (

A

=

D

) holds. Otherwise the incumbent will deter entry.

•In the first stage, entrant maximizes

E

=p

2 k

2

, where p

2

[(200- k

2

)k

2

] .5

} /2. This needs to be solved numerically.

={ 100-

6

7

Finally we need to check that p

2

<p

1

. Otherwise, the entrant will not make any sales.

•p

2

={ 100-[(200- k

2

)k

2

] .5

} /2 < p

1

=(100- k

2

)/2 implies

[(200- k

2

)k

2

] .5 > k

2

, which implies

[(200- k

2

)k

2

] > k

2

2 , which implies

200k

2

> 2k

2

2 , which implies

100 > k

2

.

•This is true because demand function is P=100-Q.