Rash-Away

advertisement

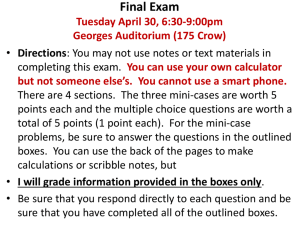

Final Exam Sample Problem Price, Promotion, and Demand Elasticity The group product manager for ointments at American Therapeutic Corporation was reviewing price and promotion alternatives for two products: Rash-Away and Red-Away. Both products were designed to reduce skin irritation, but Red-Away was primarily a cosmetic treatment whereas RashAway also included a compound that eliminated the rash. The price and promotion alternatives recommended for the two products by their respective brand managers included the possibility of using additional promotion or a price reduction to stimulate sales volume. A summary of the current price, cost, contribution margin (CM), ad spend, and volume for the two products follows: Unit price Variable costs CM Ad Spend Volume Rash-Away $2.00 $1.40 $0.60 $200,000 1,000,000 Red-Away $1.00 $0.25 $0.75 $150,000 1,500,000 Both brand managers included a recommendation to either invest an incremental $150,000 in advertising or reduce price by 10 percent. 1. What level of unit sales and dollar sales will be necessary to recoup the $150,000 incremental increase in advertising expenditures. FC/(P – VC/unit) FC/CM = Q required to break even (BEQ) = Q required to break even (BEQ) Incremental Q + Original Q $150,000 = 250,000 + 1,000,000 $0.60 Unit Sales BER = BEQ * P 1,250,000 × $2.00 Dollar Sales Rash-Away: 1,250,000 $2,500,000 Red-Away: 1,700,000 $1,700,000 $150,000 = 200,000 + 1,500,000 $0.75 1,700,000 × $1.00 2. What level of unit sales and dollar sales will be necessary to maintain the level of total contribution dollars if the price of each product is reduced by 10 percent? Current Contribution $s Rash-Away: $0.60 × 1,000,000 = $600,000 Red-Away: $0.75 × 1,500,000 = $1,125,000 Required Quantity at New Contribution Margin Rash-Away: Red-Away: Rash-Away: Red-Away: $600,000 $0.40 × Q = $0.65 × Q = $1,125,000 Unit Sales 1,500,000 1,730,769 $1.80 × 1,500,000 Dollar Sales 2,700,000 1,557,692 $0.90 × 1,730,769 3. For the two proposed changes, you estimate that demand elasticity with respect to advertising is .5 and that demand elasticity with respect to price is -2.0. What would total unit and dollar sales be for each option? E = %DQ / %DPromo E = .5 E = %DQ / %DPrice E = -2 .5 = %DQ / (150,000/200,000) -2.0 = %DQ / -.10 .75 × .5 = %DQ = .375 -.10 × -2.0 = %DQ = .20 DQ = .375 × 1,000,000 = 375,000 DQ = .20 × 1,000,000 = 200,000 Q = 1,000,000 + 375,000 Q = 1,000,000 + 200,000 -2.0 = %DQ / -.10 .5 = %DQ / (150,000/150,000) -.10 × -2.0 = %DQ 1 × .5 = %DQ DQ = .20 × 1,500,000 = 300,000 DQ = .5 × 1,500,000 = 750,000 Q = 1,500,000 + 300,000 Q = 1,500,000 + 750,000 $150,000 Increase in Ad Spend Unit Sales Dollar Sales Rash-Away: 1,375,000 $2,750,000 Red-Away: 2,250,000 $2,250,000 10% Price Reduction Unit Sales Dollar Sales Rash-Away: 1,200,000 × $1.80 $2,160,000 Red-Away: 1,800,000 × $.90 $1,620,000 What Do You Recommend? $150,000 Increase in Ad Spend Breakeven Unit Sales Dollar Sales Rash-Away: 1,250,000 $2,500,000 Red-Away: 1,700,000 $1,700,000 10% Price Reduction Breakeven Unit Sales Dollar Sales 1,500,000 Rash-Away: 2,700,000 1,730,769 Red-Away: 1,557,692 $150,000 Increase in Ad Spend Forecast Unit Sales Dollar Sales Rash-Away: 1,375,000 $2,750,000 Red-Away: 2,250,000 $2,250,000 10% Price Reduction Forecast Unit Sales Dollar Sales Rash-Away: 1,200,000 $2,160,000 Red-Away: 1,800,000 $1,620,000 $.75 × 550,000 = $412,500 1,800,000 × $.65 – 1,500,000 × $.75 = $45,000 Rash-Away: Yes to increased ad spend because forecasted sales are greater than breakeven; no to price reduction… Red-Away: Might depend on the objective, but increased ad spend appears to dominate – unit sales, dollar sales, and contribution. Channel Margin Arithmetic After spending $300,000 for research and development, chemists at Diversified Citrus Industries have developed a new breakfast drink, called Zap, which provides the consumer with twice the amount of vitamin C currently available in breakfast drinks using all natural ingredients. Zap will be packaged in an 8-ounce container and will be introduced to the breakfast drink market, which is estimated to be equivalent to 21 million 8-ounce servings nationally. A major concern is the lack of funds available for marketing so management has decided to use newspapers to promote Zap and distribute Zap in major metropolitan areas that account for 65 percent of U.S. breakfast drink volume. Newspaper advertising will carry a coupon for $0.20 off the price of the first can purchased. The retailer will receive the regular margin and be reimbursed for redeemed coupons by Diversified Citrus Industries. Past experience indicates that for every five cans sold during the introductory year, one coupon will be returned. The cost of the newspaper advertising campaign (excluding coupon returns) will be $250,000. Other fixed overhead costs are expected to be $90,000 per year. Management has decided that the suggested retail price to the consumer for the 8ounce can should be $0.50. The only unit variable costs for the product are $0.18 for materials and $0.06 for labor. Retailers demand a margin of 20 percent of the suggested retail price and distributors a margin of 10 percent of the retailers’ cost. Channel Margin Arithmetic 1. Wholesale Cost = Manufacturer Price = $.50 – 20% × $.50 – 10% × ($.50 – 20% × $.50) = $.50 – $.10 – 10% × ($.40) = $.36 2. Contribution per unit $.36 - $.18 - $.06 - $.20/5 = $.08 3. B/E Volume = $340,000/$.08 = 4,250,000 4. B/E Share = 4,250,000/13,650,000 = 31% Questions?