Guest Lecture - Doug Campbell

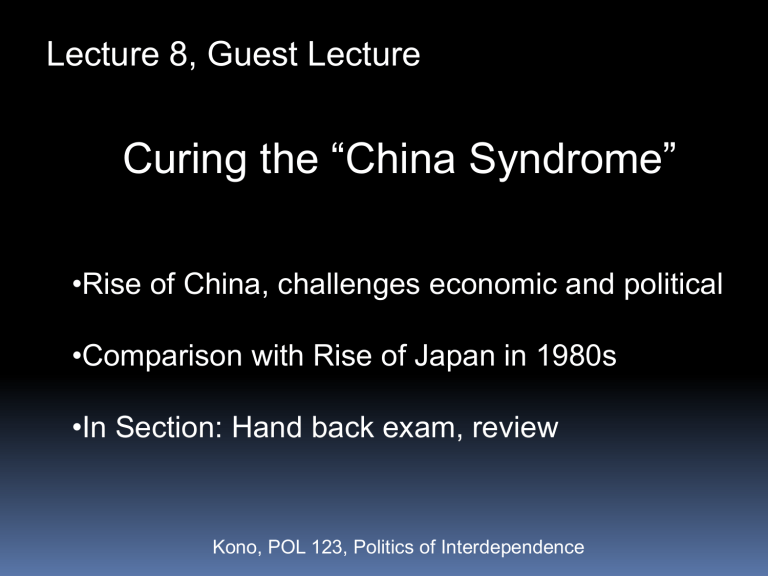

Lecture 8, Guest Lecture

Curing the “China Syndrome”

•Rise of China, challenges economic and political

•Comparison with Rise of Japan in 1980s

•In Section: Hand back exam, review

Kono, POL 123, Politics of Interdependence

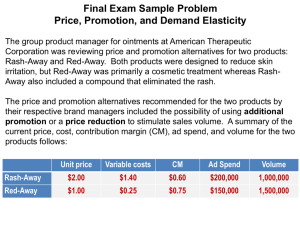

Rise of China, in Historical Perspective

US Bilateral Trade Shares

Somehow bigger political issue

Kind of a big deal

From Campbell, 2014

Impact of Rise of Japan on Public Conscious

•Even though Reagan Deficits led to a generally strong dollar in 1980s, Japan was made a scapegoat (Japan, to be fair, had been managing its currency in a “dirty float”, but more before 1980)

•Michael Crichton “Rising Sun” (1992) ; Vogel “Japan As Number One”

•Vincent Chinn – In early 1980s, beaten to death with a baseball bat by unemployed autoworkers in Detroit, who said “it’s because of you little motherf*$!#rs that we’re out of work”. They thought he was Japanese, but served no jail time.

•2000s very different (thankfully much less zenophobia/racism)

“Bretton Woods II”

•Developing Countries Manage their Exchange Rate (like Bretton Woods) using 1) Capital Controls (remember the Trilemma) and

2) by Accumulating Dollar Reserves to plug leaks

•Nominally Free Trade (low tariffs), but undervalued currency (equivalent to import tariff and export subsidy)

•In the 2000s, these flows became large for the first time

Measures of “the” Real Exchange Rate

China devalued its currency in 1980s; US manufacturing wages 80X

Chinese wages in early 90s; also, no labor unions in China

US vs. China Trade Balance

Manufacturing Production

Implications for Defense?

The “China

Syndrome”

Not Just China (Dollar strong in early 2000s)

• More Open Manufacturing Sectors vs. Less Open Sectors when Dollar

Appreciated Generally (WARULC = Weighted-Average Relative Unit Labor

Costs)

From Campbell 2014; Note: This Research design is called a

“difference-in-difference”.

Economic Geography of Manufacturing

•Autor, Dorn, Hanson (2013) find local communities which compete with

China suffered increased unemployment and a fall in wages

Political Impact?

•Unclear – Seemingly modest political pressure on either the Bush or Obama administrations. Congress has also not been that protectionist. Why?

•Surprising given salience of trade issues in 1980s “the

Japan Problem”?

+ Many large American firms have benefitted enormously from outsourcing to China – low outsourcing costs lead to higher profits for firms like

Apple. Losses likely concentrated on workers.

+ Many economists, including those who served in both

Bush and Obama administration, are reflexive “freetraders”, genuinely believe China’s Currency manipulation is a gift to the US (China sends US valuable goods in return for slips of paper – how could it make US worse off?).

•Thing to note here is that in US, imports grew much faster than exports in the naughties; MNC exports were still growing, Foreign sales of US-based

MNCs even grew faster…

Problems with Economists’ Views

1. given the capital controls, not clear that

Bretton Woods II is a “free-trade” regime at all…

2. Argument that China’s policy doesn’t matter breaks down if there is QWERTY style hysteresis (=history matters), learning-by-doing, network externalities, agglomeration economies…

3 . Or, trading-partner capital controls also harmful at the “ zero lower bound ”, when monetary authorities don’t have use of normal tools of demand management (see Rodrik p. 62).

Lessons from History: The 1980s

• More Open Manufacturing Sectors vs. Less Open Sectors when Dollar

Appreciated (WARULC = Weighted-Average Relative Unit Labor Costs)

From Campbell 2014

Trade has winners and losers; Local Labor Market Effects of RER Movements: Gary, Indiana

Trade has winners and losers; Local Labor Market Effects of RER Movements: Gary, Indiana

Local Labor Market Effects of RER

Movements: Jackson 5 Theater

Political Impact of the Dollar’s 1980s Rise

•In 1980, under pressure from US Treasury, Japan

(mostly) liberalized its capital markets

•In 1984, under more pressure from White House and

Treasury (who are under pressure from automakers),

Japan undergoes additional capital market liberalization measures

•In 1985, under pressure from White House, Japan (and

Germany) agree to intervene in Currency Markets to

Strengthen Dollar and reduce its surpluses (Plaza

Accord)

•Soon after, the dollar fell, and the “Japan Problem” was over

Why Such Different Results in the 1980s and 2000s?

The end of the “Japan Problem”

Cure for the “China Syndrome”?

•Difficult to file WTO case against China for currency manipulation (how to prove legally?

Measures in previous slide suggest Renmenbi undervalued by 20-60% in 2011.)

•Also difficult to negotiate with China directly (little bargaining power; no US military bases in China)

•Indirect Method: create higher inflation in US, devaluing China’s reserve holdings (US inflation has been at historic lows the past four years)

•Problem: Is there the political will to do anything?

Bibliography

•Autor, David H., David Dorn, and Gordon H. Hanson. 2013. "The China

Syndrome: Local Labor Market Effects of Import Competition in the United

States." American Economic Review , 103(6): 2121-68.

•Campbell, Douglas L. 2014. “Relative Prices, Hysteresis, and the Decline of

American Manufacturing”. UC Davis Working Paper.

•-- 2013. “Through the Looking Glass: A WARPed View of Real Exchange

Rate History”. UC Davis Working Paper.

•Dooley, Michael P., David Folkerts ‐ Landau, and Peter Garber. "The revived bretton woods system." International Journal of Finance & Economics 9.4

(2004): 307-313.

•Frankel, Jeffrey A. "And now won/dollar negotiations? Lessons from the yen/dollar agreement of 1984." Department of Economics, UCB (1990).

•Krugman, Paul R. 1986. "Is the Japan problem over?." NBER Working paper.

•-IS-Lmentary , America’s Chinese Disease , Doctrine of Immaculate Transfer

Section: Exams

Mean: 34.6, or 82.4%

Range: 20.33-44

Std. Dev.: 5

20 25 30 scores

35 40 45

Recent Findings on Currency Unions and Trade

•(Klein and Shambaugh, 2003), Exchange Rate Volatility only very weakly Correlated with reduced trade; indirect pegs not correlated with more trade

•Interwar Gold Standard not correlated with increased trade flows

•Formation of Euro not associated with significantly higher trade

•Campbell, 2013; over period 1947-1997, Currency Unions not actually associated with higher trade flows -- previous estimates disregarded war, communist takeovers, ethnic cleansing episodes, and wars for independence, and didn’t control for dynamics

Potential Explanation: Changing money from one currency to another is not actually a large trade cost. (Credit/ATM cards slide the same way.)

+Theoretical Impact of Exchange Rate volatility on trade actually ambiguous.

Hint: Since I’ll be grading the final, you might not want to write that exchange rate volatility reduces trade flows, or that the gold standard was a solution to the problem of international trade costs.

![Midterm1: StudyGuide[Schaeffer]](http://s3.studylib.net/store/data/007091072_1-c0613f2c3bd55f3b4ea56190b4a7d5fa-300x300.png)