PRICING STRATIGIES

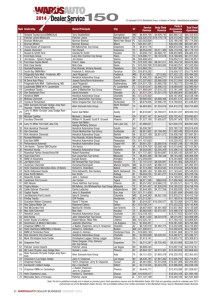

advertisement

PRICING STRATEGIES OF THE AUTOMOBILE INDUSTRY PRESENTED TO AEM 4160 EMILY KOWALCHIK, SOFIA STEINBERGER, KAREN THIARA, ALEX WOLOSHIN, HENRI WUILLOUD Why Research The US Automobile Industry? Cars are used everyday, but they are a major purchase for the average consumer. Because of the size of the investment and the plethora of choices available, it is important for consumers to consider the different factors that go into the price of a vehicle. It is interesting to see the effect a brand’s image has on a consumer’s willingness to pay and the price of a vehicle. Industry Structure Manufacturing Process Distribution and Sales Channels Manufacturing process is labor and capital intensive Channels: private v. independent US industry is heavily regulated Sales of cars Manufacturing Emissions Fuel economy standards Safety Herfindahl-Hirschman Index Hyundai-Kia 8.7% Honda 9.2% Volkswagen 3.7% Nissan 9.3% Chrysler 11.5% Mazda 2.4% Subaru 2.3% Toyota 14.1% BMW 2.2% MercedesBenz 1.9% Ford 15.5% HHI 1158 General Motors 17.5% Competitive Landscape Market concentration is medium Competition is medium and increasing Barriers to entry are high and steady Globalization high and increasing Company/Brand Differentiation Aside from price, companies differentiate their brands by: Engine Level of luxury Design Status Independent company attributes US Auto Industry- By the Numbers Total US Car Sales 2010: 11.5 Million Total US Car Sales 2011: 12.72 million leading to total dealership revenue of 609 billion. US AUTO SALES HAVE BEEN STEADILY INCREASING SINCE THE END OF THE RECESSION 18 Total US Car sales 2012: 14.5 million cars 13 percent growth from 2011 Projected US Car Sales 2013: Projected to be 15.5 million Would return US car sales to pre-recession levels CAR SALES (IN MILLIONS) 16 14 12 10 8 6 4 2 0 2010 2011 2012 2013 (Projected) SOURCE:WSJ Top Selling Automakers in United States TOP 5 AUTOMAKERS IN US BY MARKET SHARE THE TOP 5 AUTOMAKERS IN US COMPRISE 68% OF THE MARKET Top 5 GM 18% Other 32% 32% Ford 16% Honda 9% Toyota 14% GM Ford Other Chrysler Chrysler 11% Toyota Honda 68% Other General Motors Largest automaker by vehicle sales in the US Sales: 2.6 Million cars Revenue: $152.3 Billion (Global) Extensive brand portfolio in US that includes: Buick Cadillac Chevrolet GMC One year stock price increase of 4.8% CHEVROLET WAS RESPONSIBLE FOR NEARLY 3/4 OF GM’S SALES IN 2012 Buick Cadillac 16% Chevrolet 7% 6% 71% GMC Ford Second Largest automaker in US Sales: 2.3 Million cars Revenue: $134.3 Billion (Global) US Brands: Ford Lincoln FORD WAS RESPONSIBLE FOR OVER 95% OF COMPANY SALES IN 2012 Ford Lincoln 4% One year stock price increase of 8.5% 96% Toyota Company Numbers Sales: 2.1 Million cars Revenue: $225.85 Billion (Global) US Brands Toyota Lexus Scion TOYOTA WAS RESPONSIBLE FOR OVER 3/4 OF THE COMPANY'S SALES Toyota Lexus Scion 3% 12% One year stock price increase of 29.24% 85% Chrysler Company Numbers Sales: 1.7 million cars Revenue: $65.78 Billion (Global) DODGE WAS RESPONSIBLE FOR 1/3 OF CHRYSLER'S SALES IN 2012 Chrysler US Brands: Chrysler Dodge Jeep Ram Privately held corporation 19% 29% Dodge Jeep Ram 19% 33% Honda Company Numbers Sales: 1.42 million cars Revenue: $47.32 Billion (2011) HONDA ACCOUNTS FOR NEARLY 90% OF THE COMPANY'S SALES Honda Acura 11% US Brands Honda Acura One year stock price increase of 2.82% 89% Pricing Strategies Industry Wide Agreements Manufacturer/Brand Level: Specials Manufacturer Level: Premium Pricing Brand Level: Bundling of Add-Ons Dealership Level: Competition Pricing Used Car Pricing Industry-Wide Norm: Types of Agreements Second Degree Price Discrimination – Versioning There are different versions of agreements. Consumers can choose between buying or leasing a car. Buying a car is the more expensive option. Leasing a car involves lower monthly payments. Key Constraint: The cheaper option cannot be so attractive that consumers with a higher WTP choose it. Those who can afford to buy a car will benefit when purchasing the car because they will build equity. Manufacturer/Brand Level: Specials Third Degree Price Discrimination – Prices/terms vary for different consumer segments. Sometimes manufacturers offer specials to certain consumer segments. Example: Special financing option for students or recent graduates (GM, BMW). Students/recent graduates have a higher elasticity of demand, which means they should be offered a more attractive financing plan if you want to make a sale. Does making it easier for lower-income people to purchase a car hurt the brand image? Premium Pricing Raw Data Analysis Collected MSRP car prices by hand for Honda, Ford, Toyota, and Chevrolet Compared a premium brand model and a base brand model for each manufacturer Used a similar sedan model for all eight car models as a control base Honda Civic and Acura ILX Ford Taurus and Lincoln MKS Toyota Avalon and Lexus ES350 Chevrolet Impala and Cadillac XTS Calculated the percent markup in order to equalize the price levels and get a more clear picture of the premium pricing trends Premium Pricing Results An Automaker's Premium Brand Has a Higher Price than its Base Brand 50000 45000 MSRP CAR PRCE ($) 40000 35000 30000 25000 20000 15000 10000 5000 0 Honda Civic and Acura ILX Ford Taurus and Lincoln MKS Toyota Avalon and Lexus ES350 BRAND AND MODEL OF CAR Base Brand Premium Brand Chevrolet Impala and Cadillac XTS Premium Pricing Results Premium Markup Comparisons (%) 70 65 61 BASE TO PREMIUM MARKUP (%) 60 50 42 40 30 20 17 10 0 Honda Civic and Acura ILX Ford Taurus and Lincoln MKS Toyota Avalon and Chevrolet Impala and Lexus ES350 Cadillac XTS BRAND AND MODEL OF CAR Survey Results PEOPLE'S ASSUMPTION OF BIGGEST PRICE DIFFERENCE (%) Chevrolet and Cadillac Have the Largest Difference in Perceived Brand Image 40 37 35 30 26 25 20 21 16 15 10 5 0 Honda Civic and Acura ILX Ford Taurus and Lincoln MKS Toyota Avalon and Lexus ES350 BRAND AND MODEL OF CAR Chevrolet Impala and Cadillac XTS Premium Markup Comparisons (%) 70 65 PEOPLE'S ASSUMPTION OF BIGGEST PRICE DIFFERENCE (%) BASE TO PREMIUM MARKUP (%) 61 60 50 42 40 30 20 Chevrolet and Cadillac Have the Largest Difference in Perceived Brand Image 17 10 0 Honda Civic and Ford Taurus and Toyota Avalon Acura ILX Lincoln MKS and Lexus ES350 BRAND AND MODEL OF CAR Chevrolet Impala and Cadillac XTS 40 37 35 30 26 25 20 21 16 15 10 5 0 Honda Civic and Acura ILX Ford Taurus and Lincoln MKS Toyota Avalon and Lexus ES350 BRAND AND MODEL OF CAR Chevrolet Impala and Cadillac XTS Bundling Automakers offer several versions of the same car Raw Data Analysis Collected MSRP for all different versions of the Ford Taurus, Honda Civic, Toyota Avalon, Acura ILX, and Lincoln MKS Compared bundled prices to menu prices Many options can be purchased separately from the bundle Premium brands always have Better Sound System Better interior materials (leather…) Better safety features (fog lights, back camera…) Cool specs (heated front seats and moon roof) Bundling Add-On Examples Bundling Price Variance Among Companies CAR MODEL PRICE DIFFERENCE BETWEEN 1ST AND 2ND OPTION PRICE DIFFERENCE BETWEEN 2ND AND 3RD OPTION Ford Taurus $2200 $4200 Toyota Avalon $2205 $2305 Honda Civic $2650 $1450 Acura ILX $3310 $2200 Lincoln MKS $2800 $4600 Is Bundling Worth It? ADDITION LX ($18,165) EX ($20,815) 16-inch Alloy Wheels Option for $1634 Standard 5-Speed Automatic Transmission Option for $1800 Standard Moonroof, auto climate control, Better Audio System Not available individually Standard Value of additions: $1634 + 1800 + extra…= 3434 + extra 3434 > difference between the two models ($2650) Bundling Implications Price of bundles are more elastic Second Degree Price Discrimination is very important Bundles are worth it Competition Pricing Among Dealerships Maguire has a monopoly in Ithaca No competition Other cities have dealerships clustered together Lots of competition Dealership Advertising IF AN AUTOMAKER ADVERTISES HEAVILY IN A GEOGRAPHIC AREA THE COMPETITOR WILL ADVERTISE AN EQUIVALENT AMOUNT 16,000,000 14,000,000 12,000,000 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 ATLANTA LOS ANGELES Audi BMW Dealership Advertising These are ads from two dealerships (Toyota and Honda) that are both located on Van Nuys Blvd. in Los Angeles, CA. The most important factor in pricing a used car is its depreciation in value. Depreciation is a bad thing for new car buyers and a good thing for used car buyers. Depreciation Example: Let’s say you are purchasing a brand new Nissan 370z. (Assuming 15,000 miles per year.) Source: Edmunds.com - Infographic: How Fast Does My New Car Lose Value? Depreciation Driving off of the dealership’s lot causes an average 11% decrease in value. On average, a car will depreciate 15-25% each year for the first five years. The car will be worth 37% of its original value after those five years. Certified Pre-Owned Pricing Disparities Across Geographic Locations By looking at different pricing criteria in the certified pre-owned market it is possible to see the differences in prices in different regions. Criteria Used: Four Models: BMW 328i, Scion tC, Ford Fusion, Honda Accord Four Regions: Los Angeles, CA; Manhattan, NY; Ithaca, NY; Tallahassee, FL Model years: 2010, 2011, 2012 Honda Accord Certified Pre-Owned Pricing Certified Pre-Owned Honda Accord Prices $30,000.00 $25,000.00 $20,000.00 $15,000.00 $10,000.00 $5,000.00 $0.00 2012 2011 Ithaca, NY (+150 Miles) Los Angeles, CA (+30 Miles) Manhattan, NY (+30 Miles) Tallahassee, FL (+150 Miles) 2010 *Besides a small difference in price level, the Ford Fusion had a very similar chart. BMW 328i Certified Pre-Owned Pricing Certified Pre-Owned BMW 328i Prices $45,000.00 $40,000.00 $35,000.00 $30,000.00 $25,000.00 $20,000.00 $15,000.00 $10,000.00 $5,000.00 $0.00 2012 2011 Ithaca, NY (+150 Miles) Los Angeles, CA (+30 Miles) Manhattan, NY (+30 Miles) Tallahassee, FL (+150 Miles) 2010 Scion tC Certified Pre-Owned Pricing Certified Pre-Owned Scion tC Prices $25,000.00 $20,000.00 $15,000.00 $10,000.00 $5,000.00 $0.00 2012 2011 Ithaca, NY (+150 Miles) Los Angeles, CA (+30 Miles) Manhattan, NY (+30 Miles) Tallahassee, FL (N/A) 2010 Results and Other Observations On average there is a slight increase in the price of certified pre-owned vehicles near large metro areas. The small difference in price could be for several reasons. For example, some vehicles we looked at may have more features than others. Larger cities had more luxury cars available (CPOs). Lemons Problem Prevalent in the used car industry since the birth of the automobile In order to solve the problem automakers offer certified pre-owned vehicles Gives customer confidence in the vehicle they are purchasing Automaker goes through a rigorous certification process to ensure the quality of the vehicle Buyers pay a higher price for this luxury • Luxury Vehicles: $2,100 to $3,400 more than a typical used car • Non-Luxury Vehicles: $300 to $1,750 more than a typical used car Recommendations for Consumers Be informed! Increase your bargaining power by showing that you know exactly what your choices are and what you should be willing to pay for them. Are the bundles worth it? Are there any deals at the local dealerships? Recommendations for Manufacturers Get consumers when they are young and build their brand loyalty. Differentiate yourself as much as possible. Know what the perceived differences between your brands are and adjust your mark-ups accordingly. Recommendations for Dealerships Be aware of competition. Know the level of concentration in your geographic. Cater to your local market. For example, offer a zero down-payment option if you are located in a low-income area. Become a household name in the area.