HRinSlowingEconomy

advertisement

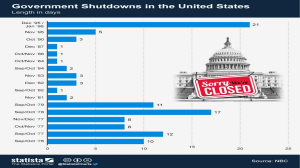

Human Resources in a Slowing Economy: Smart Alternatives to Layoffs Valerie J. Menager, Esq. Carr, McClellan, Ingersoll, Thompson & Horn, a Professional Law Corporation Following presentation is for general information purposes only, and is not to be relied upon for any specific case. HR Tools to Control Labor Costs • • • • Temporary Shutdowns Reducing Salary & Hours Reducing Benefits Temporary Leaves/ Outsourcing of Employees • Plan Ahead for Reduction in Force Events • Your ideas Advantages of Alternatives to RIF • Avoid severance pay • Minimize exposure from lawsuits from terminated employees • Minimize increases in your unemployment insurance rate • Reduce increase in disability leaves and workers compensation claims • Keep your Company agile to respond to increase demands • Control eventual recruitment and training costs • Improve Employee morale! Temporary Shutdowns Important planning considerations: Who will be impacted? Dual analysis: exempt or non-exempt? Are you going to require the use of vacation pay during the temporary shutdown? Temporary shutdowns in excess of 2 weeks may be considered terminations! Who will be Impacted? • Will the shutdown be Company-wide or will certain job functions not be eligible to be included in the shutdown? • Are there certain job functions where you’ll need only a skeleton staff? • Analyze these decisions like you would a RIF selection process to avoid the statistical appearance of illegal discrimination. Exempt vs. Non-Exempt • Partial week shutdowns are OK for employees classified as non-exempt but not for exempt employees • Make sure that shut-downs for exempt employees are for an entire “work week” • The definition of your company’s work week is very important Can Vacation Use Be Mandated during a Temporary Shutdown? • Vacation can not be forfeited under California law • DLSE requires 90 day notice of mandated change in vacation usage • Now is the time to incorporate into your vacation policy that the Company reserves the right to cash out accrued vacation time. Reducing Pay & Reducing Work Hours • Important considerations: – Who? – How much? – Do not simultaneously reduce pay and hours for exempt employees – Minimum wage requirements – Minimum hour requirements for benefits – At will employees, employment contracts, collective bargaining agreements Reducing Pay • Only reduce pay & hours prospectively, never retrospectively • Never reduce the salary of a non-exempt below the minimum wage under local, state or federal law • In California, never reduce the salary of an exempt employee below a weekly rate of twice the minimum wage • Reducing employees wages more than 50% can trigger Cal-WARN or WARN for employers of more than 75 employees Reducing Hours • Reducing work hours can impact eligibility for benefits: health care insurance, 401(k), stock option plans, etc. • Always review the minimum hour requirements for benefits to determine whether employees will lose benefits or have a qualifying event under COBRA, Cal-COBRA Reducing Pay & Hours for NonExempt Employees • Review non-exempt pay policies to determine how a reduction in hours impacts show-up premiums, split shift premiums and use of vacation/pto for partial days off • Non-exempt employees who have their wages and hours reduced by 10% or more may be eligible for partial supplemental pay through EDD Work Sharing program • Reducing pay is a good step if a RIF is inevitable because it will have the impact of reducing the pay out of accrued vacation at termination Exempt Employees • Exempt employees can have their salaries reduced, but if you simultaneously reduce their work hours you will be treating them like they are non-exempt employees entitling them to overtime premiums • Keep exempt employees’ scheduled work hours the same when reducing their salary Temporary Leave of Absence/Charitable Outsourcing • Paid leave of absence at a percentage of usual salary to retain uniquely talented workforce • Some companies are lending their employees to non-profits making a cost saving measure appear to be a benefit to some employees! Reducing Benefits • Review your handbook and benefit plans to make sure that they provide for employer discretion in modifying, reducing or discontinuing benefits • Always change benefits prospectively and give advance notice of intended changes • Changes to vacation policies requires 90 day notice Temporary Leave of Absence Important Considerations: -Impact on benefits: stock option (ISO v. NSO) vesting? COBRA or Cal-COBRA may be triggered? vacation payout may be triggered? Promises, Promises • Be careful about promises to employees about pay after salary reduction or personal leave ends • Claims for earned wages • Possible tax implications for deferred compensation Advance Planning for RIF is Crucial! • Always plan workforce needs at least 1 quarter in advance • WARN and Cal-WARN 60 day notice requirements • Public companies may be required to file notice with SEC due to RIF being a material event • Failure to pay all accrued wages will result in fines • Severance pay program may be subject to ERISA • Running out of revenues to pay earned wages, payroll taxes and benefit contribution and administration can lead to personal liability for officers, directors and investors. • Sufficient time to have proposed lay off reviewed for appearance of statistical discrimination Q&A • Questions on presentations • Your ideas on cost savings are welcome!