Ricardo Rebeil Vice Presidient of Brokerage and Logistics Solutions

advertisement

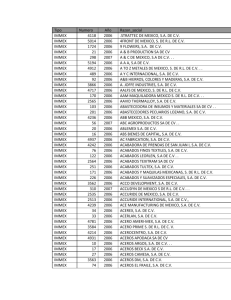

WMTA Monthly Meeting March 2011 IMMEX Program allows companies to temporary import goods to be used in an industrial process of elaboration, transformation or reparation of foreign goods which have been temporary imported for its further export. The main advantage of IMMEX is that IMMEX companies do not have to pay the General Import Duty, VAT and compensatory duties. The Ministry of Economics, along with the Ministry of Finance are responsible for authorizing IMMEX Programs in accordance to the IMMEX Decree, originally published in Mexico’s Official Gazette on November first, 2006. a) IMMEX Company Holding: When an IMMEX program integrates manufacturing activities of a Holding certified company that controls companies. b) Industrial IMMEX: The most common IMMEX, this program takes place when a company transforms, fabricates or repairs temporary imported goods for its further export. c) Lodging IMMEX: When one or more foreign companies provide technology and production supply, without operating directly (Albergue). d) Third Party IMMEX: When a certified company does not have facilities to operate a productive process and operates through third parties registered under its program (Terciarización). Article 3, Section III of the IMMEX Decree states that service IMMEX are the ones that provide services to exportation goods or that provide export services, only for the development of activities authorized by the Ministry of Economics. Service IMMEX Companies do not transform or manufacture goods, instead, they provide additional services to such goods in order for these to be exported as a final product under the IMMEX scheme. The importance of Service IMMEX relies on the specific role it plays in the Maquila industry. Although Service IMMEX do not transform or manufacture goods, they provide some specific services to the exportation goods that complement the exportation of a final product. With the implementation of Rule 4.3.25 of the General Foreign Trade Rules issued by the Ministry of Finance last December 24, 2010, Service IMMEX have become the only option to virtually transfer goods in the same condition as they where imported. In order for “regular” Industrial IMMEX to transfer goods in the same condition as they were imported, it is recommended for them companies to obtain their Service IMMEX authorization. Vendor 1 Vendor 2 Vendor 3 Sale Corp. Industrial IMMEX Service IMMEX Storage Industrial IMMEX The General Rules for Foreign Trade, issued by the Ministry of Economics, list the activities that shall be considered as a Service, which may be done by Service IMMEX Companies: 1. Supply, distribution or storage of goods (VMI). 2. classification, inspection or verification of goods. 3. procedures that don’t change the goods’ characteristics. 4. To put together kits with a promotional purpose 5. Repair of goods 6. Laundry 7. Embroidering and printing of clothes 8. Shielding, modifying or adapting vehicles Product design and engineer 9. Software design 10. Services regarding information technologies 11. Other Services. Last December 24, 2010, the Ministry of Economics issued a modification to the IMMEX Decree in which it clearly separates the industrial IMMEX procedure from Service IMMEX activities. The purpose of this modification is to eliminate taxation benefits to some Service IMMEX companies, such as call centers, storage and distribution centers and to some regular companies that used the Service IMMEX program in order to obtain taxation benefits. With these modifications, such benefits will only apply to regular Industrial IMMEX companies. Although the IMMEX Decree limited taxation benefits for Service IMMEX companies, some activities involving Service IMMEX companies are now considered as regular IMMEX activities for taxation purposes, such as: 1. The water dilution of goods; 2. Cleaning and washing of goods, including the removal of oxide, grease, paint or other coverings; 3. Applying lubricants, coverings, or protective paint to the goods 1. 2. 3. 4. 5. 6. Adjustment or cut of goods; Prepare the goods in doses Packing and repacking of goods; To submit the goods to quality controls Marking, stamping or classification Development of products and the improvement of such product’s quality Final Recommendations It is recommendable for regular IMMEX companies to apply for a Service IMMEX extension. It is strongly recommended to have a meeting with your Tax specialized lawyers in order to define the taxation implications of adding a Service IMMEX program. Please be sure to clearly identify if your processes are industrial or services, due to the regulations established on Article 303 of NAFTA. MS Identification Code According to Appendix 8 of Exhibit 22 of the General Trade Rules, Service IMMEX companies shall state in their pedimentos the identification Code MS, which is applicable to Service IMMEX. The lack in the declaration of the MS identification code may carry a fine of $993.00 pesos due to non exact data. MS Identification Code When an IMMEX Company has both, industrial and services authorizations, it could be possible that some goods arrive for an industrial process and other goods arrive for a service process. In this event, it is not necessary to declare the MS identification code. Customs authority validated the previous criteria by means of an official comunication dated April 2, 2007. • Ricardo Rebeil • Brokerage & Logistic Solutions, Inc. • rr@bls-usa.com • (619) 671-0276