General Cable Corporation

advertisement

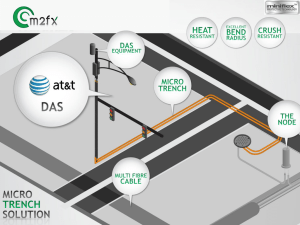

November 9, 2010 Kyle Pellum Jack Hainline Dan Glotzbach Seung Jae Oh Outline Position History Company Overview Industry Analysis SWOT Competitors DCF Recommendation Position History 4/12/2010 – Bought 200 shares at 30.01 Current Stock Price (as of Nov. 8, 2010): $31.14 Unrealized Gain (as of Nov. 8, 2010): $226 Company History Incorporated in New Jersey in 1927 Headquartered in Highland Heights, Kentucky 11,000 employees on six continents Worldwide leader in developing, designing, manufacturing, marketing, distributing and installing copper, aluminum and fiber optic wire and cable products Raw materials account for 75% of conversion costs Began public trading on the NYSE on May 16,1997 Have grown largely through acquisitions that have assisted in entry into new markets around the world General Cable 2009 Annual Report (Page 2) Sources of Revenue Profitability of General Cable relies heavily on world demand for energy Growth in wire and cable industry lags behind growth in the economy General Cable has focused on benefitting from increased emphasis on renewable energy (wind turbines) Demand for electrical utility cables have declined in the U.S. for the past two years General Cable 2009 Annual Report (Page 12) Percentage of Revenue by Country 21% 11% 52% 10% 10% General Cable 2009 Annual Report (Page 21) Percentage of Revenue by Product Family General Cable 2009 Annual Report (Page 22) Acquisitions (BICC) June 1999 Significantly increased General Cable’s market share and reduced reliance on relatively undifferentiated products such as building wire General Cable 2000 Annual Report (Page 3) Acquisitions Norddeutsche Seekabelwerke GmbH (NSW) 2007 $28 million Based in Nordenham, Germany Serves the global submarine power cable and submarine fiber optic communication system markets Baltic Sea wind turbines Phelps Dodge International Corporation (PDIC) 2007 PDIC was a global company and the acquisition more than doubled General Cable’s presence in the Middle East General Cable 2007 Annual Report (Page 6) Acquisitions Phoenix Power Cables acquired January 2010 Acquired 90% stake in South Africa company (GCPSA) Based in Durban, South Africa is now named General Cable Phoenix South Africa Investments in mining and infrastructure are expected to result in increased demand in electrical power cable General Cable 2010 1st Quarter 8-K (Page 7) Acquisitions BICC Egypt acquired September 2010 for $21.7 M Headquartered in Cairo, Egypt Manufactures wires and cable for the transmission and distribution of energy Pakistan Cables Limited acquired October 2010 Headquartered in Karachi, Pakistan Manufactures and sells copper rod wires and offers general wiring cable as well as low-voltage and medium voltage cables General Cable 2010 3rd Quarter 8-K (Page 6) Recent Financial Results Third quarter earnings of $0.54 analyst estimates by $0.04 Demand in ROW was better than expected particularly in Brazil where ongoing investment in infrastructure boosted sales Demand for electric utility products in the U.S. were better than expected due to the release of a number of projects for the transmission grid and wind farms Volume in Europe was better than expected due to a stabilizing Spain, increased demand for medium-voltage submarine products in Germany, and high-voltage products in Spain General Cable Homepage > Investors > News Releases http://investor.generalcable.com/phoenix.zhtml?c=81254&p=irol-newsArticle&ID=1491422&highlight= Industry Analysis Competitive, mature and cost driven industry Little product differentiation among industry participants from a manufacturing or technology standpoint Increasing demand for submarine cable Underwater oil drilling platforms require integrated cable Offshore wind farms Demand for telecommunication remains low A few companies hold a large portion of market share and significant growth through acquisitions Price of raw materials have been volatile and they account for large portion of manufacturing cost Cost to enter industry is high SWOT-Strength Market Leadership Geographic Diversity Product Diversity Successful expansion into emerging market through acquisitions SWOT-Weakness Production of fiber optic cables Heavily depends on one supplier Cyclical demand SWOT-Opportunity Increasing demand of renewable energy Increasing demand in emerging market Increasing demand for fiber optic products SWOT-Threat Highly competitive market Foreign country risk Volatility in the price of raw materials Interruptions of supplies from key suppliers Technological shift from copper to fiber optic communication products Competitors Belden CDT Inc. (NYSE: BDC) Designs, manufactures, and markets cable, connectivity, and networking products in various markets. Their cables products include copper and fiber optic cables. Belden primarily operates in the United States, Canada, Europe, Latin America, Africa, the Asia Pacific and the Middle East. Competitors CommScope Inc (NYSE: CTV) Provides infrastructure solutions for communication networks worldwide. The company operates in four segment: Antenna, Cable and Cabinet group (ACCG), Enterprise, Broadband and Wireless Network Solutions (WNS) The ACCG segment includes product offerings of primarily passive transmission devices for the wireless infrastructure market. The Enterprise segment provides structured cabling systems for business enterprise applications and connectivity solutions for wired and wireless networks. The Broadband segment consists of coaxial cable, fiber optic cable, and conduit for cable television system operators. The WNS segment include base station subsystems and core network products, such as power amplifiers, filters, location-based systems, network optimization systems, and products and solutions that extend and enhance the coverage of wireless networks, such as RF repeaters and distributed antenna systems. Competitors Nexans SA (Paris Stock Exchange) Manufactures and sells cables and cabling systems for the energy and telecom infrastructure, industry, building, and local area network markets. The company also engages in the cable recycle business. Nexans has operations in Europe, the Middle East, Russia, Africa, North America, South America, and the Asia-Pacific Competitors Draka Holding N.V. Engages in the development, production, and sale of cable and cable systems worldwide. The company operates in three groups: Energy and Infrastructure, Industry and Specialty, and Communications. The Energy and Infrastructure group offers low-voltage and instrumentation cables. It offers cables for construction, industrial, and infrastructure markets in Europe and the Asia-Pacific areas. The Industry and Specialty group engages in the specialty cable operations. It offers automotive cables, and cables for wind turbines, aviation, defense, and offshore oil and gas industries in North America and the Far East. The Communications group offers optical fiber cable products. It also offers cable solutions for telecommunications, data communications, and broadband access networks markets. The company’s products are also used in aircraft, trains and cars, ships, offshore rigs, and homes and offices for various applications. Competitor’s Performance Company Comp Set Company Name LTM Gross Margin % LTM EBITDA LTM EBIT LTM Net LTM Total Margin % Income Revenues, 1 Margin % Yr Growth % Margin % CommScope, Inc. (NYSE:CTV) Belden, Inc. (NYSE:BDC) Draka Holding NV (ENXTAM:DRA K) Nexans SA (ENXTPA:NEX) 29.7 15.6 9.5 3.5 (0.3) 33.1 14.5 11.0 4.4 12.5 8.9 5.9 3.0 (1.0) (9.1) 13.4 8.5 6.0 0.9 (4.7) General Cable Corp. (NYSE:BGC) 13.4 8.4 6.3 2.1 1.9 Financial data provided by Multiple Analysis Company Name TEV/Total TEV/EBITDA TEV/EBIT P/Diluted EPS P/TangBV Revenues LTM - Latest LTM - Latest Before Extra LTM - Latest LTM - Latest LTM - Latest CommScope, Inc. (NYSE:CTV) Belden, Inc. (NYSE:BDC) Draka Holding NV (ENXTAM:DRAK) 1.20x 7.38x 11.84x 29.79x 107.23x 1.03x 6.96x 9.10x 19.48x 9.69x 0.52x 8.25x 15.36x NM 1.59x Nexans SA (ENXTPA:NEX) 0.32x 3.72x 5.28x 30.86x 1.05x General Cable Corp. (NYSE:BGC) 0.51x 6.05x 8.02x 17.36x 1.49x Stock Performance Discount Rate WACC (ROE) Cost of Equity (ROE) Cost of Debt Weighted Average Cost of Capital (ROE) WACC (ROE) ROE (2001-2004) 31.70% 20.79% ROE (2004-2007) 94% 7.13% ROE (2007-2010) 3.17% 14.26% ROE (average) 20.79% CAPM Discount Rate (Goal-Post Theory) Cost of Equity Cost of Debt Weighted Average Cost of Capital 17.63% 7.13% 12.39% Market Return 9% Risk-Free Rate 3% Market Premium 6% Beta Average 1.91 Cost of Equity (CAPM) 14.48% Growth Rate Assumption Growth Rate Assumptions 2006 2007 2008 2009 2010E 2011E 2012E 2013E 2014E North America 8.99% -2.90% -31.86% 22.64% 10.0% 13.0% -15.0% 11.0% Europe and North Africa 34.07% 12.15% -28.16% -9.89% -5.0% 3.0% -10.0% 6.0% 170.13% 334.96% -28.70% 17.97% 30.0% 30.0% 14.0% 44.0% 25.91% 9.62% 12.2% 17.0% -1.6% 26.2% ROW Growth Rate 35.01% -29.62% DCF Valuation 2010 2011 2012 2013 2014 Net Income $ 107.83 $ 128.44 $ 160.69 $ 133.59 $ 209.29 + Depreciation & Amortization $ 113.77 $ 131.14 $ 152.50 $ 174.21 $ 196.37 +Interest Expense $ (69.81) $ (83.71) $ (100.39) $ (104.19) $ (108.13) - Changes in NWC $ 192.88 $ (312.92) $ 107.90 $ 225.67 $ (212.14) - CapEx $ (125.74) $ (128.25) $ (130.82) $ (133.44) $ (136.11) FCF $ (166.82) $ 360.54 $ (25.92) $ (155.49) $ 373.57 $ 2,418.50 Terminal Value FCF $ (166.82) $ 360.54 $ (25.92) $ (155.49) $ 2,792.07 DCF $ (162.02) $ 311.58 $ (19.93) $ (106.39) $ 2,363.39 Growth Rate Terminal Value $ 2,418.50 4% 5 Year Discount Rate 12.39% Terminal Discount Rate 13.00% DCF Valuation Total PV of FCF $ 2,386.62 Less: Debt $ 1,000.70 Equity Value $ 1,385.92 # of Shares (in millions) 52.11 Intrinsic Value $ 26.60 +10% $ 29.26 -10% $ 23.94 Sensitivity Analysis Discount Rate $ Growth Rate 26.60 10% 11% 12% 13% 14% 15% 16% 2.50% $ 37.12 $ 31.30 $ 26.71 $ 23.00 $ 19.93 $ 17.35 $ 15.15 3.00% $ 39.69 $ 33.17 $ 28.10 $ 24.05 $ 20.73 $ 17.97 $ 15.63 3.50% $ 42.69 $ 35.32 $ 29.69 $ 25.24 $ 21.64 $ 18.67 $ 16.17 4.00% $ 46.24 $ 37.82 $ 31.51 $ 26.60 $ 22.67 $ 19.45 $ 16.77 4.50% $ 50.48 $ 40.74 $ 33.60 $ 28.14 $ 23.83 $ 20.34 $ 17.46 5.00% $ 55.62 $ 44.19 $ 36.03 $ 29.91 $ 25.15 $ 21.34 $ 18.23 5.50% $ 61.95 $ 48.31 $ 38.87 $ 31.95 $ 26.66 $ 22.48 $ 19.09 Recommendation DCF Value= $26.60 +/- 10%: $23.94 - $29.26 Share Price as of 11/8/10: $31.14 HOLD 200 Shares Sell 2 January 2011 Call Options Strike: $33 Limit Order: $1.00 Recommendation Rates of Return from option scenarios Option is exercised 33-30 = 3 , (3+1)/30 = 13.33% Option is never exercised. Able to sell options 3 times a year. 1 * 3 = 3, 3/30 = 10% Based on our estimations selling the options will either give us 13.33% for one time or allow us to get a steady cash stream of 10% per year.