The Art of Negotiations

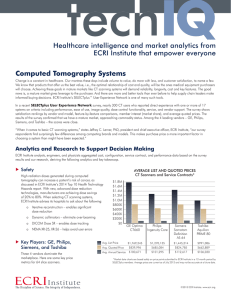

advertisement

The Art of Negotiating Jennifer Myers Vice President, Health Technology Services Tim Browne Director, Supply Chain Services SEPAC September 2012 Agenda ECRI Institute Overview Negotiating Vendor Objectives Provider Strategies and Tactics Unlocking the Handcuffs of Supply Chain Capital Perspective Medical/Surgical Supply and Implant Perspective Open Discussion ECRI Institute ECRI Institute is a nonprofit organization that has researched the best approaches to patient care over the past 44 years. We are used by thousands of hospitals, public and private payers, governments, and other constituencies. ECRI Institute is designated as an Evidence-based Practice Center (EPC) by AHRQ and as a Patient Safety Organization (PSO) by Department of Health and Human Services (DHHS). ECRI Institute ECRI Institute does not accept gifts, grants, or consulting contracts from the medical device or pharmaceutical industries, and accepts no advertising. Federal income tax returns for all employees are examined yearly to ensure there are no investments in these industries. Understanding The Vendor’s Objectives, Process and Strategies Vendor’s Objectives Get the highest price possible Sell my products/services Beat my competitor – move market share Close the deal quickly Vendor’s Sales Process Create value Identify opportunities Present their version of an ROI (fuzzy?) Present their version of the evidence (credible?) Identify decision makers Establish trust Seek and make a coach and a champion* Establish negotiation points Vendor’s Strategy Seek and Make a Champion - *Miller Heiman Approach Seek out the buying influencer’s roles Economic Technical User Coach Champion – the person that can pull the trigger and sign off Analyze the stakeholders Who is working against me? Who is on my team? Who is my “champion”? Who is my “coach”? They play to the coach and ultimately the champion The Coach leads them to the champion The Coach tells them who and what to avoid They “coach” the vendor on navigating the negotiation Vendor’s Strategy Confidentiality Agreements - tying your hands GPO Discounts – big brother is watching us Physician relationships – seeking and making the Miller Heiman “coach” and “champion”. Convincing arguments – “We are giving you the highest discount we’ve ever offered” Hidden costs – you may be getting the highest discount, but something else may be inflated (service, supplies, T&C, etc.) Compliance agreements or commitment agreements – locking you in “you committed to 80% compliance with GE and you’re only at 65%” Ties you to service, supplies, etc. ― Make sure that you negotiate service and supply costs up front at point of commitment contract agreement to avoid inflated costs and to drive utilization Vendor’s Strategy they use a team approach VP Sales Regional Sales Manager Regional Service Manager Sales Representative Service Engineer Provider’s Strategies and Effective Tactics Effective Tactics Use a team, they do Use your value analysis committee Have a strong value analysis process established Use value analysis teams to help navigate the decision and negotiation process Seek and present multiple good, solid and equivalent options Control the deadlines/timelines Design a custom strategy – every vendor is different, every sales rep is different, every technology introduces different issues, analyze what you are up against and custom design a negotiation strategy ― Build it into your value analysis process ― Effective Tactics Physician education on negotiations This is by far the most challenging issue related to contract negotiations how they can help, how they can interfere Develop an ongoing physician buy-in strategy It requires a top-down approach (C-Suite mandate) Show them the evidence: Use real examples of where they helped and where they may have interfered Supply chain education on negotiations Take the Miller Heiman (or similar) course, they do Learn and stay educated on what the vendors are using to train their sales teams Read the Harvard Business School publications on Negotiating Outcomes Effective Tactics Do not sign confidentiality agreements Huge impact on negotiations Educate your lawyers, your clinicians, even your C-Suite Once you sign, your hands are tied You cannot benchmark your pricing – you will never know if your price is good, bad or fair If you transmit the data to any 3rd party you are liable – even your GPO, your consultants, your staff The importance of benchmarking Allows you to continuously gauge your progress Allows you to see where you stand versus your peers, the national averages, etc. Allows you to negotiate better prices. Save $! Hospital’s Strategy Plan B, Plan C You need good alternatives to back you up ―If Plan A fails and no agreement is reached what is your Plan B, Plan C, etc.? ―As long as you have good alternatives in place, if Plan A does not work out you still have good, solid and equivalent options ―Never fall in love with Plan A until it’s a done deal Hospital’s Strategy Removing the emotion Don’t allow the end-users or clinicians to fall in love with one make/model They need to be happy with at least 3 different makes/models ―You need a good Plan B, Plan C, etc. ―Get them to provide their needs, not the solution (make/model) ―You need to find them 3 or 4 choices that they will be happy with ―Include them in the decision process, make them “love” all of the options Example: OR Integration Narrowing down to 3 excellent choices Unlocking The Handcuffs of Supply Chain Process, Relationships and Tools Devise a process for requesting capital items. Here are some suggested elements of a process: Requested ― items should be identified generically by their function not by manufacturer and model number A brief statement of need should accompany the request ― this equipment will be used to… A financial justification form should be filled out ― demand, need, expected revenues, etc. An output-driven Request For Proposal (RFP) should be prepared with consideration and definition given to: ―What performance specifications are required ―What performance specifications are “nice to have” ―A grading system for respondents Process, Relationships and Tools Exactly what kinds of relationships do you need to build, and with whom? You need to build collegiate, evidence-based relationships and you need to build them with the key leaders of your organization—both clinical and business leaders. It may be difficult at first, but you need to build relationships based on trust, and you do that by: ― (1) listening respectfully to others ― (2) gathering appropriate data and documentation ― (3) remaining engaged and non-adversarial ― (4) repeating steps 1-3 time after time after time until you have become accepted as a peer. This will be a difficult task to accomplish with some of your peers and easier with others. Process, Relationships and Tools In order to do the investigatory work necessary to complete the process work, you will need a specific set of tools: Patient Safety Resources Decision Support Resources Evidenced-Based Resources Value Analysis Resources Price Benchmarking Services Sales Training and Contract Negotiation Resources Through Process, Relationships and Tools Supply chain needs to: Devise a good process Build the right relationships Implement the best tools Effective Approaches for Medical/Surgical Supplies and Implants The Value of Benchmarking Your Data “Not having some kind of benchmark is equivalent to driving at night without headlights. You need to see where you are going.” ECRI Institute Member Approaching Benchmarks Price Benchmarks Utilize benchmarks that not only compare your pricing to other members of your GPO, but against all facilities types and GPOs within the US Benchmarks Typically do not Account for: Rebates GPO Affiliations Sole Source Contracts Bulk Buys Agreement Types Consumable agreement Disposable agreement Reagent agreement Cost per procedure Utilization Benchmarks Benchmark your utilization at the same time you benchmark your pricing to determine if there are opportunities to further reduce costs by modifying existing utilization practices. Check Your Benchmarks Regularly Price and Utilization are Moving Targets Modern Healthcare/ECRI Institute Price Index Ensure the Accuracy of Your Data You will have one opportunity to engage your peers You will lose future opportunities to engage your peers if you present inaccurate information Double check your data frequently! Once the Opportunities Have Been Identified Engage Your Team Administration, especially the CFO Clinicians and physicians Suppliers Continue the Engagement Additional opportunities will present themselves Team engagement when a contract is up is already way too late Strive for long term team engagement rather than episodic Once the Team is Engaged Some Tips to Keep Them Engaged Seek everyone’s views and it will earn you their respect and trust Remove barriers to change Set a pace that is appropriate for your culture Assure your partners that proposed changes will not affect quality, safety and service Provide your partners with cost, outcome and comparative data that support clinical changes Hold your partners accountable during the process Try not to force change as it will typically result in short term success If engagement proves to be difficult Consider utilizing an unbiased 3rd party to present the facts Savings and Utilization Opportunities by- Supplier Category Item Physician/Clinician Timing of Initiatives Evaluate the Optimal Time to Commence Initiative Are the contracts up for renewal? What is the fiscal year of the suppliers? Are there technologies on the verge of FDA approval that you would like covered under the contracts? Once everyone sees the common opportunity and is engaged in the process Construct a Plan Don’t get caught in the weeds Set a schedule Execute Contracting Options Sole Source Contracting Categories that do not Warrant Multiple Suppliers Low impact on patient outcome ― Combs, Bath Basins, Office and Industrial No trials required No physician preference Supplies Capitated versus Line Item Contracting Categories that Warrant Multiple Suppliers-Typically PPI Products Pros ― Allows hospitals to utilize multiple suppliers ― Level the playing field for prices of similar products Cons ― Lose the ability to benchmark ― Rapid introduction of new products, typically exceptions to the cap, could quickly diminish the percent of items covered under capitated agreement ― Difficult to manage from an MMIS and OR perspective Methodologies to Consider Value Based Purchasing The Patient Protection and Affordable Care Act (PPACA) ― Quality vs. Cost Value Analysis Primarily for introduction of new/replacement products Strategic Sourcing Finding the appropriate supplier to partner with Once the Initiative is Complete Celebrate your achievements together Supply Chain, Clinicians, Physicians Revenue Sharing Closely Monitor the Results Document your ROI Compare spend and utilization with historical data Develop scorecards Identify and replicate your success in future initiatives Profile categories on an on-going basis No category should be considered taboo or exempt from the process Leave no stone unturned THANK YOU