China*s *Onward Journey* FDI - East Asian Economic and Business

advertisement

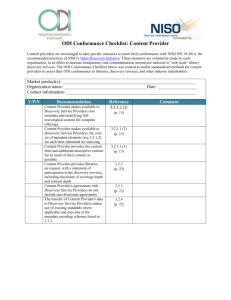

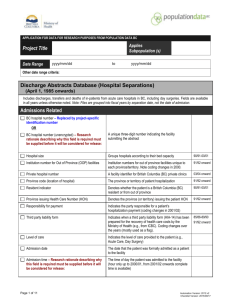

What is wrong with contemporary business history narratives explaining Chinese ODI? Lessons from China’s ‘Onward Journey’ FDI 1 Background, literature review: • Growing interest in Chinese ODI (because of growing volumes, high profile cases) in number of academic disciplines: – Case study work – Econometric studies, some surveys as well • International business (IB) work finds that ‘strategicasset-seeking’ is important • Appealing, because it means we need new theories, so this is the dominant narrative today 2 But a problem with contemporary business history narratives: • Don’t incorporate ‘onward journey’ ODI • Most successful privately owned companies looking to invest overseas use an offshore holding company (BVI, Cayman Islands, Hong Kong) • So excluded from econometric studies • Case studies often focus on SOEs (or ignore implications of holding company structures) 3 Research Questions: • R1: Is ‘onward journey’ ODI from private Chinese businesses significant, in terms of volume? • R2: If so, what motivates it (market seeking, efficiency seeking etc.)? Destinations/size? • R3: Does ‘strategic asset seeking’ explanation apply to these privately controlled Chinese TNCs? 4 Method • Construct a sample of 150 publicly listed but privately controlled Chinese firms • 85 from HK stock exchange, 65 from US exchanges (NASDAQ, NYSE) • Using most recent annual reports, establish they are privately owned (weed out H shares etc.) • Then establish which ones have overseas subsidiaries (noninvestment holding), use notes to consolidated financial statements 5 6 7 Results (R1) • A surprise – 32 of 85 from HK have ‘onward journeyed’ – 25 of 65 in US sample • Size: significant investments, totalling $500 million in 10 largest investments alone (R1) • Sample include some well known companies (Li Ning, Shenzhou Int., Nine Dragons Paper, Texhong Textiles, Mindray Medical Int., Wuxi Pharmatech) 8 Results (R2) • Market seeking very important, prior trade links, establish subsidiary for after sales service etc. – e.g. Kingdom Group in Italy, linen; Shenzhou Int. in Cambodia $30 m., counter trade restrictive measures; ND in Viet Nam); Mindray Medical International ($210 million takeover of Datascope) • Efficiency seeking also important – Texhong Textile in Viet Nam (some of the largest manufacturing investments); Shenzhou (Cambodia); Nine Dragons 9 Results (R2) • Unexpected result: TNC global production networks, facilitating internationalisation • BYD Electronics (India/Hungary with Nokia); Minth Group (auto parts, Nissan, Fiat etc.); Wuxi Pharmatech (biotech) 10 Results (R3) • Only limited evidence of strategic-assetseeking • Possibly Mindray and Wuxi Pharmatech • Most look to R&D at home 11 Discussion/Conclusions • Private sector ‘onward journey’ ODI totally missed to date • Market seeking/efficiency seeking are important in these financially constrained firms • So do we really need new theories about ‘strategic asset seeking’? • Business history currently being written, but isn’t it missing these important companies? 12 Policy • Don’t discourage offshore holding companies? • Useful for raising capital, helping Chinese companies expand overseas? 13