Crash & Depression

The

Great Crash and

The

Great Depression

(Chapter 25 is a must Read!!!)

•

In 1929, Yale University economist Irving

Fisher:

“The nation is marching along a permanently high plateau of prosperity.”

5 days later the bottom fell out of the market.

It ushered in the Great depression and the worst economic downturn in American History.

Optimism and Prosperity

•

1928—there was great optimism and confidence in the economy—the Boom was on!!

• No reason to believe that America’s time had not finally arrived—we were the top of the heap.

• Hoover stated: “We in America today are nearer to the final triumph over poverty than ever before in the history of any land. The

Poor house is vanishing from among us.”

Optimism and Prosperity

• Everyone believed him;

• The NYT “It has been 12 months of unprecedented advance, of wonderful prosperity … [we’re in the money] …”

•

John Jacob Raskob, CEO of GM and DNC chairman published an

Op-ed piece

• “Everybody ought to be rich.”

Optimism and Prosperity

• Raskob went so far as to publish an article in the

Ladies Home Journal

•

Every American could be rich within a few years if they only invested $15 per week in

Common Stocks.

• He failed to realize that most Americans only made between $17 and $22 per week.

(the lucky ones).

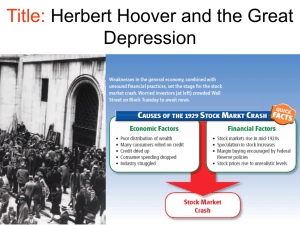

Bull Market

• 1) Rising Stock

Dividends;

•

2) Increase in Personal

Savings;

•

3) Easy Money Policy;

•

4) Over invested and over production; for futures production;

•

5) Lack of Stock market regulation;

•

6) Psychology of

Consumption

The Crash

• Many economists looked to the market as an economic health indicator;

• Sept. 1929 Market prices fluctuated;

• Stock prices and market valuation was disproportionately out of line with true liquid value;

•

GDP and GNP was falling even though stock prices were steadily rising.

• October 24, 1929 is referred to as “Black

Thursday” Panic ensued as people watched stocks fall drastically—began dumping adding to the panic;

•

JP Morgan and others bought up worthless stock to ease the panic; Friday 25 th Morgan maintained a stable market; however, no one came out and reassured the people—so on

Monday 28 th John “Q” Public again began a selling frenzy;

•

Tuesday Oct 29, 1929, it crashed down around everyone, “Black Tuesday.”

•

Many used the market as a health indicator of the economy, many viewed everything as lost and prices continued to fall;

• November 13 th 1929, the market had lost $30 billion dollars;

• Still some optimism persisted: JD Rockefeller,

• “Depressions have come and gone—prosperity will return

…”

•

Music summed up the mood of the times:

• 1930: “Happy Days Are

Here Again.”

• 1931: “I’ve Got Five

Dollars.”

• 1932: “Brother, Can

You Spare A Dime.”

• GDP dropped from $90 billion to $40 Billion.

The Depression

• President Hoover chose to call this economic downturn a Depression;

•

He did this because in

American History downturns as bad as this was usually referred to as a “Panic” such as the

“Panic of 1837, 73 and

93”

•

Wanted to avoid a panic.

•

Unfortunately the economic issues exacerbated some already perplexing social issues:

•

Unemployment and Poverty

•

Family disintegration

•

Soaring High School drop out rate (4million)

•

Homelessness

•

Organized protests

• “Hoovervilles” dotted the landscape

•

Farmers physically fought foreclosures

•

The Bonus Expeditionary Force (WWI

Veterans)

•

(They were protesting Unpaid Pensions)

Images of Depression

• Bread and Soup Lines;

•

Hoboes Hopping

Freight Trains;

•

College Grads as Gas

Station Attendants;

•

Increased rates of suicide[14 to17 per

100,000]; Mental Illness on the increase;

• Businessmen selling pencils or apples;

• “Okies” [dustbowl ]

•

These stereotypes fit only a small percentage of the people; long-term unemployment and everyday dismal economics and hopes was more troubling.

•

Two basic economic facts soured the lives of everyday Americans (it was a global depression after all): 1) Unemployment

2) Inability to sell goods and services

• In

FDRs inaugural address, he stated:

• “Let’s be frank. You and I know that immediate relief of the unemployed is the immediate need of the hour.”

•

Getting people back to work was tantamount to any other government initiative.

•

To buy and sell, one needed a consumer base and without a job, there was no consumer base .

Dust Bowl and “Okies”

• Great Depression hit farmers the hardest, at least in the midwest and South;

• Low crop prices wiped out profits;

• A great drought created a

‘Dustbowl’ due to over farming; grazing, and drought

•

But many farmers stayed put, because at least they could eat

•

1/3 of Americans fell below the poverty line;

•

Some industries made a profit—for instance the automobile and cigarettes, and the movies;

•

It was called Escapism—at least one could go for a drive, have a smoke or go to the Movies to forget for a little while.

• Humorist Will Rogers stated, “We’re the first nation in the history of the world to go to the poorhouse in an automobile.”

Franklin Delano Roosevelt

•

FDR promised a New Deal; also promised Relief,

Recovery, and Reform—

•

The election of 1932: Hoover stated, “this … is a contest between … two philosophies of government.”

• We have also been taught that FDR swooped in to save

America!!

What Did FDR Stand For?

•

Strong stand on public power;

•

A reduction of federal expenses;

•

A balanced budget.

• Defined himself:

• Democrat with a capital “D”

• Christian with capital “C”

•

Wilsonian internationally

•

Gentleman

•

FDR needed to be liked; he was charming and manipulative; he also was very charismatic, dynamic and used modern mediums to get his message to the people;

• Accepted his own limitations and surrounded himself with “The Brain Trust.” Very forward thinking in terms of gender—Frances Perkins was first female cabinet member—very evasive, however, when confronted with Race;

•

Very pragmatic, not idealist or an intellectual—very political savvy—seemed to know what would work and what wouldn’t work with the people … good pulse of the popular will and expectations.

•

Day after inauguration, rather than nationalize the banks as many liberals wanted, he enforced a “Bank

Holiday.”

•

Inspectors would determine the legitimacy of solvency—those found lacking would not reopen.

• Only a very few were actually inspected, many others were closed—however, it gave the public confidence that FDR was looking out for their best interest –they trusted him immediately! People began placing their money in banks again.

First 100 Days

•

Convened Congress in special session; launched the New Deal; The President was now the legislative leader not congress.

•

Mostly what he did was set up new governmental agencies and oversight boards—

The government would oversee Relief,

Recovery and Reform.

•

Any ailing business conformed or they received no stimulus money or government bailouts.

“Alphabet Soup”

• Agriculture Adjustment Act (AAA)—designed to stabilize prices and limit overproduction; first time farmers were ever paid not to plant crops. U.S.

Supreme Court eventually ruled this act unconstitutional by an invasion of private property rights;

•

Civilian Conservation Corps (CCC)—a public works project, under the control of the Army; designed to promote environmental conservation and get the young off the street corners and into the world (trees, lakes, dams, bridges, cleared beaches and camp grounds—fed the workers and paid them a stipend)

• Tennessee Valley Authority (TVA)—the most ambitious and controversial; built dams and power plants along the Tennessee River; brought electricity to millions of people and provided jobs, however, it destroyed communities, farms, and small towns all along the route.

• National Industrial Recovery Act (NIRA);

(established the National Recovery Administration) designed to stimulate production and competition—it eliminated anti-trust legislation, but also collective bargaining—regulate output, prices, and trade—very controversial because it restricted free trade--

NIRA

•

Whether radical or conservative—NIRA failed for three reasons:

•

1) assumed businesses would police themselves; most of the codes and regulations were drawn up by big business—so small business suffered;

•

2) did not respect collective bargaining;

•

3) tried to stabilize prices by reducing production.

• FDR tried to be an “Honest Broker.” One who could negotiate among all competing interests;

•

The Executive would take the lead in coercing business and community to follow his lead;

• 2 Inherent flaws with “Honest Brokerism:”

•

1) Presidents lose influence the longer they are in office;

•

2) Strong political interest and lobbying groups can influence even a strong executive.

•

The New Deal can roughly be divided into two periods:

•

1) The First New Deal (1933-1935)—mostly characterized by Relief of immediate problems such as unemployment;

•

2) The Second New Deal (1935-1937)— characterized by Reform—fundamental reform of society—not just economic issues.

•

Did it fail or succeed?

• America blamed the 3 “Bs”

• Bankers

• Brokers

• Businessmen

Blame

•

Other indicators that should have been picked up on— artificial money and abnormally low interest rates and easy money—the

Florida land boom/Bust—no one seemed to believe it could get real bad.

How Did This Happen?

• We have been taught that “wild cat speculation,” “unregulated big business,”

“capitalist greed,” and that “Hoover was inept and did nothing to spark a stimulus,” and that

FDR “provided hope and recovery,” But that in reality, it was WWII that finally pulled

America from the deep economic doldrums of depression.

• “Historians are not economists and Economists are not historians”

(Murphy, R., 2009)

. There must be a better explanation.

• Regardless of one’s economic theory, the

Milton Friedman Chicago School of

Economics—low interest rates and cut taxes and capitalist oriented or Paul Krugman and his School of Keynesian (liberal deficit spending) Economics; both are Nobel

Laureates.

•

Both were wrong when it came to interpreting the Great Crash of 1929 … at least according to Strickland a simple Math and History teacher …

•

Milton Friedman, rather than blaming Hoover and capitalism as did Paul Krugman, suggests that it was the fault of the federal reserve by letting the supply of money collapse. Simply, inept and incompetent bureaucrats caused the depression—which is why

Bernanke, a Friedman disciple, made sure there was plenty of money in the federal reserve by printing much and reducing interest rates to zero.

•

• business cycles are determined primarily by money supply and interest rates rather than government fiscal policy.

• Several Economic Historians point to the following:

•

1) Unequal distribution of wealth—1% of the population at the top; this suggests that the very wealthy must invest and continue luxury spending; when the market crashed both investment and spending came to an abrupt halt

• 2) Unequal distribution of corporate power: huge corporation had consumed most middle and small businesses—the largest corporations controlled over

50% of the nations wealth—so the few that went under seriously hurt the GDP and GNP

•

3) Banking Structures—no federal restrictions or uniformed guidelines in spending, investing and borrowing—no insurance for depositors;

•

4) Foreign Debt—U.S. a creditor nation. The US insisted on repayment in Gold Bullion. This means debtor nations had no money to repay their debts— the tariff was very protectionist (Smoot-Hawley) so there were no foreign goods coming into the US and the US had no outlet for its over produced goods

•

5) Poor Economic intelligence—believed in a selfregulating economy; Hoover remained on the Gold-

Standard; demanded a balance budget etc …

Who was to Blame, Truly?

• Let’s look at this purely from an historical point of view (no axe to grind).

•

Hoover did nothing! (really)—he actually spent exorbitant sums on public works. He was in fact excoriated by FDR when on the campaign trail—accused of spending too much, when what was needed was a contraction and balanced budget.

•

When in fact bigger government by Hoover aided the crash—FDR made it worse!

•

It has been argued that the cause of the Depression was due to Hoover’s heartless budget cuts and trying to balance the budget during such an economic downturn.

• The reality was Hoover increased massively government spending creating a deficit of $2.6 billion because of a public spending plan of $4.6 billion trying to bolster the economy.

• In today’s terms, that would be akin to Bush running a $3.3 trillion deficit compared to his actual $162 billion deficit—so Hoover was the model Keynesian

Economist.

•

It is true he tried to trim it some and reduce some of the deficit, but this was after he saw that these policies were not working very well— essentially Keynes’ model failed miserably—by the time Hoover abandoned this policy, unemployment was at 20%.

•

But Krugman as Hoover and Roosevelt missed the obvious explanation that the unprecedented federal interventions to fight the depression were the actual cause of the unprecedented depression and ensured its severity and longevity.

•

There was precedent; end of WWI America faced a huge depression. Rather than increase government spending or forcing wage and price controls, Pres. Wilson slashed the budget by

$12 billion.

•

Moreover, as receipts continued to fall, Wilson slashed spending further by 34% during a deepening depression (Keynes’ nightmare) unemployment peaked at 11.7% in 1921. The depression was over by 1922-23 and unemployment was at 2.4%.

•

Paul Krugman gives the impression that

Hoover’s heartless budget cuts created the depression—

• Funny he doesn’t mention that Hoover also raised taxes. 45% of deficit decrease was due to budget cuts, the remaining 55% was due to an increase in taxes.

•

Unemployment jumped to 8.9% in 1930—if the stimulus by Hoover isn’t passed then it will get worse (heard that before), well unemployment again jumped 16% in 1931

(stimulus did not work); in fact unemployment jumped to 23% in 1932, and FDRs immediate spending spree to create stimulus forced unemployment to 25%.

•

Between 1929 and 1934 production continued to freefall on annual of 27%, by 1933 unemployment broke 28%. Joblessness, massive reduction in GDP also accompanied massive Bank failures—depositors by 1933 lost

$1.3 billion. The craziness was that while much of the population hovered on the brink of starvation, massive quantities of food and livestock were deliberately destroyed to fatten profits.

• FDRs initial influx of alphabet projects created a small up tick and did give many people confidence.

As with any stimulus there is a small gain, but the artificiality of it always fails to achieve what it promises. It was the same with the New Deal.

Unemployment did fall and some people went back to work and the GNP seemed to be on the rise. People felt good again. But make-work projects are temporary and soon the economy receded and again unemployment shot up. By 1935 it seemed things were getting better—unemployment still at 10%, but by

1938 unemployment shot back up to above 19%. Just before the WWII crisis unemployment broke 20%.

•

The Keynesians and the Friedmanites both argue that without implementing their policies such as deficit spending and slashed reserve rates to increase the money supply the depression could have been worse; really. Why then has there been such panics and depressions before but they recovered in 2 to 5 years without all this governmental interference? Moreover the 1930s lasted many more years and with much more intensity.

Conclusion

•

In fact it was only when the government and the Federal Reserve rolled up their sleeve and really went to work to fight the downturn that things really got very worse. The government caused the depression, the New Deal prolonged the misery, and WWII hurt the private sector and individual entrepreneurship and the overall health of the economy that would not heal until the private sector boom of the 1950s.