Click To This Presentation

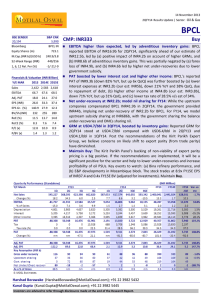

advertisement

P RIVATE E QUITY: I NTRODUCTION A Private Equity Fund invest in the securities of the unlisted companies. Type of Private Equity Funds Growth Funds are funds whereby money is collected from investors and invested into securities of unlisted companies having significant growth potential by way of debt or equity investments. Real Estate Funds are funds whereby money is collected from investors and is then invested into securities of unlisted companies involved in the Real Estate business by way of debt or equity investments. PIRAMAL | INDIAREIT PRESENTS REAL ESTATE PRIVATE EQUITY DOMESTIC FUND SCHEME V KEY DEFINITONS Sponsor Sponsor in the case of INDIAREIT is PIRAMAL GROUP. Warehousing Benefits Warehousing means that in case there is a deal and there is not enough money in the fund for its execution then the sponsor provides temporary capital for the execution of the deal. Vintage Year The year of inception of the fund. Exits Term Sheeted Exists whose terms are negotiated and are at or near completion. Ticket Size Minimum Ticket Size is Rs 25 Lakhs which is to be paid over a period of 2 + ( Extension of 1 Year) from interim close. The money to be paid upfront is 10% of the total investment amount. Fund Duration The duration of the fund is 6 + (2 extension of 1 year) from Interim Close. This is a close ended fund with a tenure of 6 to 8 years. Hurdle Rate 12% p.a. This implies that the fund will have a profit sharing with the investor only above 12% in the specified ratio. STRONG SPONSOR – PIRAMAL GROUP UNPARALLELED ALIGNMENT The sponsor has a commitment of 7.5% to the fund, as against market norm of 2-3% and is treated in equality with other investors. SUPERIOR DEAL SOURCING ABILITY Strong brand, governance and pool of capital with ability to close quickly, facilitating proprietary ‘off market’ deal flow and first point of call’ from preferred partners (developers). Willingness of the sponsor to warehouse deals in advance of fund raising, providing WAREHOUSING BENEFITS • Access to distress deals with short funding timelines, and • Deployment immediately on drawdown; accrual of IRRs from Day 0 Unique ability to close large ticket transactions through significant ‘coinvestment’ capital, providing COINVESTMENTS •Access to a wider deal universe • Preferred deal terms due to limited competition WHY INDIAREIT? – PIONEERS IN REAL ESTATE INVESTING CONSISTENT MARKET LEADING STRATEGY VALIDATED TRACK RECORD • Successfully provided growth capital to mid-sized local developers, for residential projects in tier 1 cities, since inception. • Amongst first and few funds to complete full cycle of raising, deployment, effecting exits and distributions. • Manage/advise 4,229 Cr; Already returned INR 838 Cr from own funds and INR 152 Cr from managed accounts. PERPETUAL SOURCE OF CAPITAL • Consistent ability to raise funds across market cycles. • Deployment of INR 400-700 Crores annually. ABILITY TO CAPITALIZE ON AN UNPRECENDENTEND MARKET • Liquidity pressure for developers. • Limitations in sources of funding • Opportunity to structure transactions with equity-like returns and debt-like risk HIGHLY EXPERIENCED MANAGEMENT TEAM DEEP BENCH STRENGTH Talented and empowered professionals STABLE AND GROWING TEAM 120+ years of cumulative real estate experience MULTI-CITY PRESENCE 23 professionals in four offices DIVERSE SKILLS Strong investment and asset management capabilities HIGHLY EXPERIENCED MANAGEMENT TEAM T RACK R ECORD OF PREVIOUS PRODUCTS CONSTANT ABILITY TO FUND RAISE, DEPLOY AND EXIT THROUGH DIFFERENT MARKET CYCLES W HY R EAL E STATE IN THE C URRENT E NVIRONMENT ? CURRENT MARKET ENVIRONMENT PRESENTS HUGE OPPORTUNITY FOR STRUCTURED INVESTMENTS LIQUIDITY PRESSURE FOR DEVELOPERS • Slow sales velocity and hence limited internal accruals • Costs of construction increasing faster than general inflation LIMITATIONS IN SOURCES OF FUNDING • Banks / Capital Markets reducing exposure to this sector • No acquisition funding from banks. • NBFC terms inflexible. EXCEPTIONAL OPPORTUNITY TO STUCTURE FAVORABLE TRANSACTIONS • Developers willing to offer higher pricing in return for flexible capital • Deals offering substantial security, downside protection and opportunity for upside. • Developers also benefit from better realizations rather than having to sell their stock for cheap W HY D OMESTIC F UND S CHEME V: FOCUS ON TIER 1 CITIES • Mumbai, Bangalore, Pune, Chennai, NCR; more resilient markets with sustained demand and easier exits MID SIZED RESIDENTIAL DEVELOPMENTS • Appropriately sized land parcels ensuring investments fructify during fund life END USER AFFORDABILITY • Consistency and regularity of end product sales W HY D OMESTIC F UND S CHEME V: EXECUTION ALIGNMENT OF PARTNER INTEREST ACTIVE MONITORING OF PROJECTS • ‘Skin in the game’; Experienced partners with demonstrated execution capabilities. • Local team presence; Regular and rigorous reporting mechanisms W HY D OMESTIC F UND S CHEME V : DOWNSIDE PROTECTION NON SPECULATIVE UNDERWRITING • No title or aggregation risk; ‘last mile’ funding RELEVANT ADDITIONAL CONTROL MECHANISMS IN PLACE TO FACILITATE EXIT • Escrow mechanism; appropriate project rights and representation. KEY FUND TERMS Thank You 2 ND M OTILAL O SWAL S ECURITIES LTD. F LOOR , PALM C OURT C OMPLEX , N EW L INK R OAD, M ALAD (W EST ), M UMBAI 400 064 Motilal Oswal Securities Ltd. (MOSL) Member of NSE, BSE and MCX-SX Reg. Office: Palm Spring Centre, 2nd Floor, Palm Court Complex, New Link Road, Malad (West), Mumbai 400 064. Tel: 022 3080 1000. Registration Nos.: NSE (Cash) : INB231041238 ; NSE (F&O) : INF231041238 ; NSE (CD) INE231041238 , BSE (Cash) : INB011041257 ; BSE(F&O) : INF011041257 ; MCX-SX (Cash) INB261041231;MCX-SX (F&O) INF261041231; MCX-SX (CD) INE261041231 ;CDSL : IN-DP-CDSL-09-99 ; NSDL : IN-DP-NSDL-152-2000 ; AMFI :ARN 17397 #PMS : INP000000670; #PMS & Mutual funds are offered through Motilal Oswal Asset Management Company (MOAMC) which is group company of MOSL. PMS Regn No. INP000004409 is offered through Motilal Oswal Wealth Management Pvt. Ltd (MOWMPL) which is group company of MOSL #Motilal Oswal Commodities Broker Pvt Ltd (MOCBPL) member of MCX, NCDEX and NSEL. MCX Member ID 29500, NCDEX – NCDEX-CO-04-00114, NCDEX Spot Exchange Limited 10014 & National Spot Exchange Ltd (NSEL): 13730. FMC Unique membership code: MCX: MCX/TCM/CORP/0725, NCDEX: NCDEX/TCM/CORP/0033. Commodity Services are offered through MOCBPL which is a group company of MOSL. Motilal Oswal Securities Ltd is a Distributor of Mutual Fund, IPOs and Insurance Product. *Investment in securities is subject to market risk.