The Challenges of CDD in Africa – Mr Mu`Azu U

advertisement

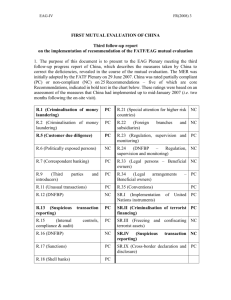

THE CHALLENGES OF CUSTOMER DUE DILIGENCE IN AFRICA Mu’Azu Umaru Director, Research and Planning GIABA Secretariat, Dakar, Senegal PRESENTED TO AT the AFREXIMBANK ANNUAL CUSTOMER DUE DILIGENECE & CORPORATE GOVERNANCE FORUM Dakar, Senegal, 28-29 OCTOBER 2014 CUSTOMER DUE DILLIGENCE 08/04/2015 INTRODUCTION • Broadly, approaches to maintaining effective anti-money laundering/combating the financing of terrorism (AML/CFT) regime is two-fold: – Preventive approach – Detection/enforcement approach • The preventive approach is designed to deter or prevent the criminals from perpetrating the crime of money laundering and the whole range of predicate offences INTRODUCTION cont’d • Initiatives pursuant to the realisation of the preventive approach include Customer Identification or Customer Due Diligence (CDD) • CDD - International requirement – Financial Action Task Force • FATF 40 Recommendations (formerly 40+9) • CDD – R10 with impact on several Recommendations, including Recs 1, 11, 12, 13, 14,16, 20 etc – Basel Committee • Customer due diligence for banks • Considers KYC for client on-boarding etc WHAT CDD ENTAILS 08/04/2015 Nigerian Financial Intelligence Unit (NFIU) IMPERATIVES OF EFFECTIVE CDD • Proper and effective CDD, amongst other things, helps to: – Prevent the mis-use of financial institutions as well as reduce the incidences of fraud and other financial crimes • Limit criminals from having access to the financial system – Maintain the integrity, reputation, soundness and stability of local and global financial system – Promote good business, governance, and risk management – Minimizes regulatory sanctions & adverse consequences of such sanctions on financial institutions – Generally, enhance implementation of robust AML/CFT programme by financial institutions CENTRALITY OF CDD IN AML/CFT REGIME ML/TF RISK ASSESSMENT (R1) ML/TF INVESTIGATION (R30) CONFISCATION OF PROCEEDS OF CRIME (R3) STR/CTR REPORTING (R20) CDD ROBUST AML/CFT REGIME RECORDS KEEPING (R11) FIU ANALYSIS (R29) AML/CFT INSPECTION (R26,28) IMPLEMENTATION OF CDD MEASURES • The implementation of CDD measures presents unique challenges, especially in developing countries, and Africa in particular. – African nations are low capacity countries with largely weak and underdeveloped formal banking/financial system CUSTOMER DUE DILIGENCE (R5): GLOBAL PERFORMANCE OF COUNTRIES (MER) FSRB MUTUAL EVALUATION RATING FOR R5 (FATF 40+9 RECs) C LC PC NC NA 0 0 5 10 0 MENAFATF 0 0 6 9 0 GIABA 0 0 2 14 0 CFATF 0 0 16 13 0 MONEYVAL 0 7 17 6 0 APG 0 3 18 19 0 GAFISUD 0 0 8 2 0 EAG 0 0 7 2 0 10 79 75 ESAAMLG CUSTOMER DUE DILIGENCE (R5): PERFORMANCE OF AFRICAN COUNTRIES (FATF 40+9 RECs) 16 14 12 10 ESAAMLG 8 MENAFATF GIABA 6 4 2 0 C LC PC NC NA GAPS RESULTING TO THESE POOR PERFORMANCES Legal gaps: • No express provision in law requiring CDD when – Carrying out occasional transactions above a designated threshold – Carrying out occasional transactions that are wire transfers in the circumstances covered by SR VII – There suspicion of ML and TF – The FIs have doubts about the veracity of or adequacy of previously obtained customer identification data • No express provision in the law requiring reporting entities to verify the identity of persons purporting to act on behalf of a customer where the customer is a legal person or legal arrangement GAPS ……. Cont’d • No clear obligation to identify and take reasonable measures to verify beneficial owner for all customers (including determining whether the customer is acting on his/her own behalf, understanding the ownership/control structure of the legal entity, and determine the natural persons who exercise ultimate control over the entity Regulatory gaps • Weak AML/CFT regulatory/supervisory regime – Weak oversight of reporting entities – Poor application of administrative sanctions • Inadequate capacity GAPS ……. Cont’d • Implementation/Operational gaps – Reporting entities – Balancing profit with CDD/other regulatory requirements • Profitability Vs cost of undertaking CDD and complying with other AML/CFT requirements • De-risking – some financial institutions are now terminating or restricting business relationships with clients to avoid rather than manage risk in line with RBA owing to issues relating to profitability, regulatory requirements, reputational risks etc – Limited implementation of CDD requirements by FIs and non application by other reporting/accountable entities – No rules concerning CDD measures for existing customers – CDD documentation exemption for customers conducting oneoff transactions – Use of threshold - for instances, specified forms of identification are required can lead to inadequate documentation being taken in circumstances where threshold is not met. – Weak human capacity INFRSTARUCTURE/WAY FORWARD • Review legal and regulatory framework, especially in view of changes in the FATF standards • Develop robust national database on identification system – Reliable national databases, reliable crime reports, credit references, and other sources of information which could facilitate customer identification, proper risk assessment etc • Use of alternative means for identification/ verification of customers: – – – – Traditional chiefs/rulers Religious leaders Voter’s registration cards Biometric identification system, which will help to reduce the need for an identifiable physical address etc • Nigeria – recent introduction of the biometric identification system for bank customers INFRSTARUCTURE…. Cont’d • Improve human capacity – to improve AML/CFT awareness and assess the degree of risks associated with their customers • Well funded and independent compliance function • Introduction of low-risk banking and financial products and services that require minimal identification • Application of risk based approach in the implementation of CDD – Simplified & Enhanced CDD measures • Establishment of centralized CDD repository • Automate -Deployment of an effective AML solution software that will enhance CDD efficiency • Capture and store relevant documentation- Reviews and document management • Perform continuous risk assessment CONCLUSION • The risks of financial systems being misused for ML/TF purposes is real • In spite of the challenges associated with the implementation of CDD measures, stakeholders in the continent, including regulatory authorities and financial institutions must take appropriate and practical steps to implement requisite AML/CFT measures, especially CDD to prevent the misuse of their businesses, promote financial system stability and a secure world. Thank you for your attention GAIBA Secretariat Dakar, Senegal Tel: +221338591818 Email: secretariat@giaba.org Website: www.giaba.org