Multinationals from former transition economies in the international

advertisement

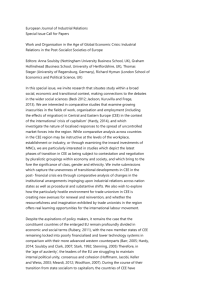

Multinationals from former transition economies in the international economy: a neglected research area Magdolna Sass Institute of Economics CERS of the Hungarian Academy of Sciences The Impact of Emerging Multinationals on Global Development Milan, 30-31 May, 2013 Outline Work-in-progress •Introduction/Background •Research question •Theoretical background/review of the literature on the topic •Method • Preliminary findings •Conclusion/future research Emerging multinationals from former transition economies • Country group: Visegrad +Slovenia • Quick growth since around 1997-2000 (depending on the country) • High concentration in terms of the number of investors (though SMEs as well, even born globals) • Large ones comparable in size to BRICs EMNEs • For example, the largest non-financial foreign investor company in Hungary, MOL (petrol and gas) would be the third largest locally controlled investor company on the basis of the size of foreign assets in Brazil, China, Mexico or Russia (Source: Emerging Market Global Players project coordinated by the Vale Columbia Center at Columbia University) Financials services: the Hungarian OTP Group is the only local/regional player in CEE region, with 100% of group assets in the region DATA AS OF 2008 UniCredit 53% Raiffeisen 2051% Erste 157% KBC 112% SocGen (5) 41% Total Assets(1) EUR bn Net Profit(2) EUR mn 121.6 2,577 85.4 79.3 (4) 1,078 Number of Branches Countries of presence(3) 4,005 19 3,231 1,569 2,099 71.6 309 1,940 65.9 1,201 5% 42.5 186 1,781 OTP n.s. 35.2 958 1,573 12 16 54 7 39 12 2,609 IntesaSP CEE, % share in Group Assets 20 16 11 9 6 7 100 ..% Contribution of CEE in Group Net Profit (After tax, after minority interests) Notes: (1) 100% of total assets, and profit after tax (before minority interests) for controlled companies (stake > 50%) and pro rata for non- controlled companies (stake < 50%). (2) After tax, before minority interest. (3) Including direct and indirect presence in the 25 CEE countries, excluding representative offices. (4) KBC Group recorded a loss in 2008. (5) SocGen including ProFin Bank in Ukraine. Source: UniCredit Group CEE Strategic Analysis 4 Research question • Are EMNEs from former transition economies (V4+Slovenia) different from developed country MNEs and other emerging MNEs in terms of the characteristics of their foreign expansion and their host/home impact? • What are the consequences for the macro level (and for economic policy)? • Descriptive Theoretical background/a short review of the literature on the topic • Dunning: OLI • Johansson and Vahlne: stages internationalisation – the importance of psychic distance • (empirical) literature on emerging multinationals (e.g. Aykut and Goldsten, 2006; Sauvant, 2009; Andreff, Balcet, 2011; Sosa Andrés et al., 2012), difference between developed country / „traditional” multinationals and EMNEs • Empirical literature on post-transition/CEE multinationals (scarce, more rcently Svetlicic (2004), Svetlicic and Jaklic (2006), Rugraff (2010), Radlo-Sass (2012), otherwise because of large country differences, concentrating on one country) Method • Detailed company case studies of the largest locally controlled investor firms in Hungary (later other countries) • semi-structured, questionnaire-based interviews with the leading managers, other sources of info: balance sheets, journal and newspaper articles + • Info gathered in the framework of the EMGP project (since 2009 three questionnaire surveys) • MOL (petrol and gas), OTP (financial services), Richter (pharmaceuticals), Videoton (electronics) and TriGránit (real estate development) • These five companies are estimated to account for at least half of the total stock of Hungarian OFDI • All locally controlled (indigenous) • Selected company characteristics analysed • (Macrodata - BOP: unreliable even what is available (geographical composition, sector) – V4: Radlo, Sass (2012), problems with company level data as well) Preliminary findings 1: why the relaive negligence? These EMNEs have regional (CEE-> Europe) than global significance (2011, only affiliates) Company No. Of foreign affiliates Geogr. Comp. Middle East and North Africa MOL Group 36 % 3 Gedeon Richter 34 % Videoton 2 OTP TriGránit Developed Asia-Pacific Eastern Europe and Central Asia Other Europe (WE+ CEE+ SEE) 3 94 13 81 % 50 50 9 % 22 78 (8) % 3 100 North America 3 Preliminary findings1 • The geographical outreach is much more regional than global (MOL: global: smaller resource seeking projects in Iran, Oman, Pakistan; limited presence in Italy, otherwise CEE/SEE, in some countries (Croatia, Slovakia) dominant; Richter’s expansion in Western Europe started only in 2010: acquisition of the German Grunenthal and Swiss PregLem) • Others: OTP: CEE/SEE, in some cases with significant market shares, TriGránit: similar; Videoton: efficiency-seeking (Bulgaria and Ukraine), minor • Overall: significant market shares only in CEE/SEE • Financial weakness due to the global crisis (home country) and political attention in host countries – Preliminary findings 2 • The notion of „virtual indirect” investor companies: majority foreign-owned but domestically controlled, common feature: relatively large companies privatised on the stock exchange, dispersed majority foreign ownership with no controlling owner (enhanced by special regulations in the case of MOL) • Tri-Gránit: another type of virtual indirect: majority owned by a foreign company (Cyprus), which is owned by a Hungarian private person • To circumvent the weakness of local financing/financial institutions, unavailability of local financing; method of privatisation, the important role of management – more similar to direct/indigenous • Results reinforced by the EMGP project (CEOs-board of directors, managerial board, language etc.) • No distinction in the literature (e.g. Altzinger et al., 2003, Rugraff, 2010) • Paradox of expanding abroad for escaping acquisition (defensive motive), but thus becoming an even more attractive acquisition target – ÖMV and Surgutneftegas versus MOL („bail-out”: state) • May be specific to Hungary/other NMS (? Poland?) and Argentina TechInt? Illustration: OTP ownership structure Ownership structure as at 31 March, 2013 Owners Domestic investors total: Government held owner Employees, senior officers OTP Bank Nyrt. Other domestic investors Domestic investors total: Foreign shareholders Foreign shareholders Other* Total * Non-identified shareholders Share in % of total equity (ownership share) 5.2% 1.7% 1.5% 22,1% 30.3% 66.6% 3.1% 100% Shareholders with over/around 5% stake as at 31 March, 2012 Name Megdet, Timur and Ruszlan Rahimkulov Hungarian Oil and Gas Company (MOL) Groupama Lazard Group Number of shares Ownership Voting rights 24,941,495 8.91% 9.04% 24,000,000 8.57% 8.70% 23,228,306 15,523,677 8.30% 5.54% 8.42% 5.63% Preliminary findings 3 OA •Dynamism of OA: „regional” (transition-specific, privatisation-related, management knowledge of adapting former SOE to the market; + based on established regional networks (SOEs)) knowledge ->entry mode M&A •gradually developing into a regional market economy-specific knowledge (illustration: OTP, Tri-Gránit) • further develops into a more „universal” OA: examples: MOL (in resourceseeking activities) and Richter Gedeon (2010) – European outreach •Exception: „almost local” player: Videoton: also specific knowledge (developing from a Hungarian into a regional EMS) Motivations of foreign expansion: •Videoton: connected to specific knowledge: the only efficiency-seeking, all others market-seeking (plus strategic asset: RG, resource: MOL) •Dynamim: knowledge-seeking motive: is present only in the case of Richter Gedeon in its more recent acquisitions in 2010 (especially in its Western European expansion: acquisition of the Swiss PregLem and German Grunenthal) •In the case of „virtual indirect” investor companies, a strategic asset seeking motive is also present •Push and pull factors Conclusion Work-in-progress • Different approach from the literature: detailed company case studies (scarce data, concentrated structure) Preliminary results: • Still more regional (CEE/SEE) significance, substantial market share only there <-> EMNEs • The notion of virtual indirect introduced – foreign majority ownership does not equal to foreign control, acts as direct; importance of management (defensive) – system-specific; four of the top 5 indigenous investors are virtual indirect • Generalisation not possible but development of OA of Hungarian MNEs points to an in-between position (from EMNE towards DMNE)