Profile and Performance of AFMIN Members

advertisement

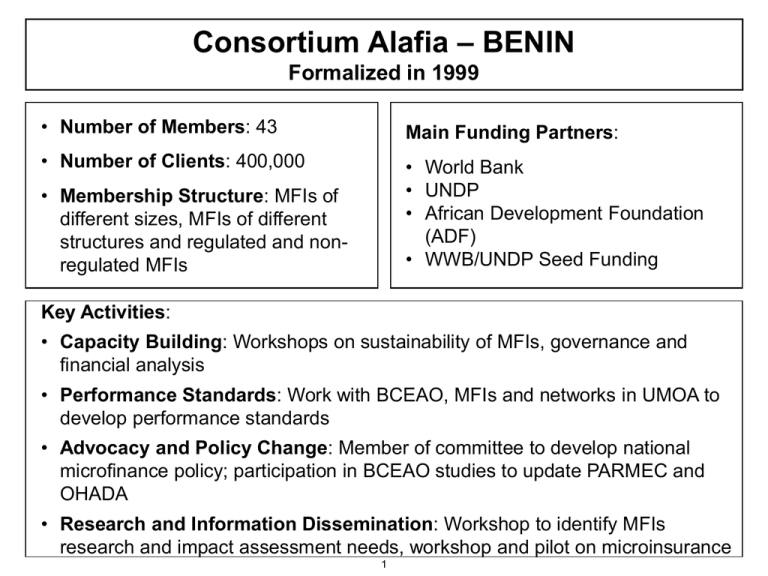

Consortium Alafia – BENIN Formalized in 1999 • Number of Members: 43 Main Funding Partners: • Number of Clients: 400,000 • World Bank • UNDP • African Development Foundation (ADF) • WWB/UNDP Seed Funding • Membership Structure: MFIs of different sizes, MFIs of different structures and regulated and nonregulated MFIs Key Activities: • Capacity Building: Workshops on sustainability of MFIs, governance and financial analysis • Performance Standards: Work with BCEAO, MFIs and networks in UMOA to develop performance standards • Advocacy and Policy Change: Member of committee to develop national microfinance policy; participation in BCEAO studies to update PARMEC and OHADA • Research and Information Dissemination: Workshop to identify MFIs research and impact assessment needs, workshop and pilot on microinsurance 1 AISFD – COTE D’IVOIRE Formalized in 1998 • Number of Members: 23 Main Funding Partners: • Number of Clients: 100,000 • BCEAO • WWB/UNDP Seed Funding • Membership Structure: Regulated MFIs of different sizes Key Activities: • Capacity Building: Started a training program for members • Performance Standards: Development of a framework for members to build shared performance standards • Advocacy and Policy Change: Engagement in national strategy to support microfinance in Côte d’Ivoire, participation in the Financial Sector Development Support Program (PADESI) • Research and Information Dissemination: Publication of an information bulletin that promotes microfinance in Côte d’Ivoire 2 AEMFI - ETHIOPIA Formalized in 1999 • Number of Members: 19 Main Funding Partners: • Number of Clients: 1.3 million • • • • • Membership Structure: MFIs of different sizes including the largest in Ethiopia and high performing MFIs Norwegian People’s Aid (NPA) IFAD Pact Ethiopia WWB/UNDP Seed Funding Key Activities: • Capacity Building: Elaboration and implementation of training for MFIs • Performance Standards: Established a performance monitoring unit; training on the use of MBB toolkit; agreement on core performance indicators • Advocacy and Policy Change: Assistance in building the capacity of the Supervision Department of the NBE with support of donors • Research and Information Dissemination: Publications in the Microfinance Development Review; Working papers and research results including a review of the performance of the microfinance industry in Ethiopia 3 GAMFINET – GAMBIA Formalized in 1999 • Number of Members: 16 • Number of Clients: 161,000 Main Funding Partners: • Membership Structure: Regulated and non regulated MFIs, high performing MFIs, international NGOs, government agencies and projects. • WWB/UNDP Seed Funding Key Activities: • Capacity Building: Organization of best practice workshops for members • Performance Standards: Consensus building on AFMIN performance indicators and training on their implementation • Advocacy and Policy Change: Engagement of policy makers in dialogue on microfinance policy issues • Research and Information Dissemination: Organization of local and regional exchange visits 4 GHAMFIN - GHANA Formalized in 1998 Main Funding Partners: • Number of Members: 80 • • • • • • • Number of Clients: 60,000 • Membership Structure: MFIs of different sizes and types, regulated and non regulated MFIs Government of Ghana World Bank USAID IFAD GTZ Care International Key Activities: • Capacity Building: Organization of training courses on governance and financial planning • Performance Standards: Development, with SEEP, of a national toolkit for the implementation of a performance benchmark for the local industry • Advocacy and Policy Change: Development of a national strategic microfinance framework document on behalf of the Ministry of Finance, currently awaiting cabinet and parliamentary approval to come into effect 5 REGUIPRAM – GUINEA Formalized in 1998 • Number of Members: 8 • Number of Clients: 100,000 Main Funding Partners: • Membership Structure: MFIs of different sizes, MFIs of different structures and regulated and nonregulated MFIs • WWB/UNDP Seed Funding Key Activities: • Capacity Building: Workshops on business planning, best practice for MFIs and the regulatory framework • Performance Standards: Workshops on performance indicators, adoption of performance standards by members • Advocacy and Policy Change: Drafting national strategy for microfinance, meetings with the Central Bank on the regulatory framework for microfinance • Research, and Information Dissemination: Inventory of MFIs and dissemination of best practice publications 6 APIM – MALI Formalized in 1999 • Number of Members: 28 Main Funding Partners: • Number of Clients: 500,000 • • • • • Membership Structure: MFIs of different structures, regulated MFIs and high performing MFIs USAID GTZ World Bank WWB/UNDP Seed Funding Key Activities: • Capacity Building: Hosting of a microfinance week; training in business planning for MFIs, internal controls and refinancing; and the homologation of 7 MFI modules with 22 trainers and APIM/MALI modules with 7 trainers; establishing credit reference bureaux • Advocacy and Policy Change: Participation in defining national strategy for microfinance; contribution to the poverty alleviation project; working with the Malian Bank of Solidarity • Research and Information Dissemination: Study on financial viability of MFIs in UEMOA, study on forms of collateral used by MFIs 7 AMFI - KENYA Formalized in 1999 • Number of Members: 15 • Number of Clients: 150,000 Main Funding Partners: • Membership Structure: MFIs of different sizes, including large MFI and MFIs of types • USAID Key Activities: • Capacity Building: Training of managers and credit officers, establishment of Credit Reference mechanisms for MFIs, launching of microfinance Skills Courses • Performance Standards: Training on performance standards for managers • Advocacy and Policy Change: Involvement in formulation and drafting of microfinance bill for Kenya; participation in the development of the poverty reduction strategy paper, a national initiative 8 ANIP-MF - NIGER Formalized in 2000 • Number of Members: 10 Main Funding Partners: • Number of Clients: n/a • PRAMEF • La Coopération Française • WWB/UNDP Seed Funding • Membership Structure: Regulated MFIs Key Activities: • Capacity Building: Training needs assessment, training of trainer with CAPAF • Advocacy and Policy Change: Participation in the action plan for the national microfinance strategy • Research and Information Dissemination: Inventory of MFIs and MFI clients 9 CDMR - NIGERIA Formalized in 1999 • Number of Members: 26 Main Funding Partners: • Number of Clients: 460,000 • Ford Foundation • USAID-MBP • Membership Structure: Large MFIs of different sizes Key Activities: • Capacity Building: Training on impact assessment; involvement in program appraisal strategies that target low-income individuals for poverty alleviation; development of participatory learning and action (PLA), participatory rural appraisal (PRA) training and strategic planning workshops • Advocacy and Policy Change: Lobbying of the government, both the CBN and the Ministry of Finance, for favorable policy for microfinance operations • Performance Standards: Workshops and publications on financial ratios; agreement on core performance indicators for the industry. 10 Micro Enterprise Alliance – SOUTH AFRICA Created in 1994, formalized in 2001 • Number of Members: 20 • Number of Clients: 610,000 Main Funding Partners: • Membership Structure: MFIs of different sizes and types, regulated MFIs, high performing MFIs, international NGOs and government agencies and projects • Ford Foundation • Hivos • SIDA Key Activities: • Capacity Building: Elaboration of diploma courses to be offered with the university of Pretoria. SAQA certified • Advocacy and Policy Change: Formation of a Government Liaison Committee to engage government agencies in the economics cluster; work with the government microfinance wholesaler on a national capacity building strategy • Research and Information Dissemination: Case studies on MFIs which closed 11 APIMFT - TOGO Formalized in 1998 • Number of Members: 19 Main Funding Partners: • Number of Clients: 200,000 • BCEAO • GTZ • WWB/UNDP Seed Funding • Membership Structure: MFIs of different sizes and types, regulated MFIs Key Activities: • Capacity Building: Training for trainers; Workshops on good governance, the development of financial reports and business plans, internal controls, the launch of financial products and financial ratio analysis • Performance Standards: Workshops on building standards in the field of microfinance • Advocacy and Policy Change: Active participation in the development of the national policy governing microfinance in Togo 12 AMFIU - UGANDA Formalized in 1999 • Number of Members: 78 Main Funding Partners: • Number of Clients: 260,000 • Hivos • The European Union • The Netherlands Development Organization (SNV) • Membership Structure: MFIs of different sizes and structures, regulated and non regulated MFI, international NGOs, government agencies, projects and donors Key Activities: • Capacity Building: Capacity needs assessment, organization of thematic debates and best practice workshops • Performance Standards: Elaboration of draft working document specifying selected indicators, their definition and reporting formats with inputs from members MFIs, donors, MFF and other stakeholders • Advocacy and Policy Change: Participation in the development of the Microfinance Bill in Uganda, organization of lobbying events around the MDI Bill 13