File

advertisement

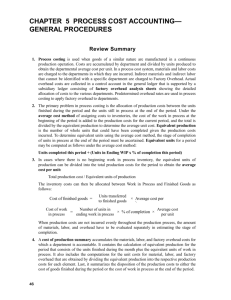

CHAPTER NO.03 FINANCIAL STATEMENTS Kardan Institute of Higher Education 1 Financial Statements Financial statements are those statements which are prepared to know the financial position and performance of an entity. These are the major financial statements: – Balance Sheet – Income Statement 2 What is a Balance Sheet It is a statement which is prepared to know the financial position of an organization at a specific date. In other words it gives information about assets, liabilities and capital of an entity at a specific date 3 Major Balance Sheet Items Assets Current assets: – Cash & securities – Receivables – Inventories Fixed assets: – Tangible assets – Intangible assets Liabilities and Equity Current liabilities: – Payables – Short-term debt Long-term liabilities Shareholders' equity 4 Balance Sheet as on ______ Assets: – Current Assets: – Non-Current Assets: – Total Assets: $7,681.00 $3,790.00 $11,471.00 Liabilities: – Current Liabilities: – LT Debt & Other LT Liab.: – Equity: – Total Liab. and Equity: $5,192.00 $971.00 $5,308.00 $11,471.00 5 What is income statement It is a statement which is prepared to know about the financial performance of a an entity for a specific period. It is prepared to compare revenues against expenses to know the profitability of an organization. 6 Major Income Statement Items Sales Sales returns Cost of goods sold Operating expenses: – Selling and distribution expenses – Administration expenses Interest expenses Taxation 7 XYZ COMPZNY Income Statement For the year ended Dec 31,2010 Sales Costs of Goods Sold Gross Profit Selling & Distribution expenses Administrative expenses Profit from Operations Interest Profit before tax Income Taxes Net Income $25,265.00 -$19,891.00 $5,374.00 ($1,761.00) (1,613.00) $2,360.00 ($100.00) $2,260.00 ($785.00) $1,575.00 8 Inventories for a Manufacturing Concern A manufacturing business has three distinct inventory accounts: 1. Raw Material Inventory: This inventory account (sometimes called Materials and supplies or stores) reflects the cost of raw materials and factory supplies that will be consumed in the manufacturing process. 2. Kardan Institute of Higher Education Work in Process Inventory: This account reflects the cost of raw materials, direct labor, and factory overhead on goods on which manufacturing has begun but has not been completed at the end of the specific period 3. Finish Goods Inventory: The Finished Goods Inventory account reflects the cost for goods that have been completed and are ready for sale 9 Cost of Goods Sold Merchandiser Manufacturer Beginning merchandise inventory Beginning finished goods inventory Plus purchases Plus cost of goods manufactured Merchandise available for sale Finished goods available for sale Less ending merchandise inventory Less ending finished goods inventory Kardan Institute of Higher Education Cost of good sold Cost of good sold 10 XYZ COMPANY COST OF GOODS SOLD STATEMENT FOR THE YEAR ENDED DECEMBER, 2012 $ Direct Materials used: Beginning Raw Materials Purchases Purchases Returns Freight in Cost of Materials Available for Use Ending Raw Materials Direct Materials used Direct Labour Cost Factory overhed Total Factory Cost Add: Beginning Work in Process Total Work Put in to Process Less: Ending Work in Process Cost of Goods Manufactured Add: Beginning Finished Goods Cost of goods available for Sale Less: Ending Finished Goods Cost of Goods Sold 10,000 200,000 (3,000) 4,000 211,000 (12,000) 410,000 250,000 150,000 810,000 25,000 835,000 (28,000) 863,000 26,000 889,000 (34,000) 855,000 11 XYZ COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31,2010 $ SALES 200,000 LESS: SALES RETURNS (5,000) NET SALES 195000 COST OF GOODS SOLD (100,000) GROSS PROFIT 95,000 LESS: OPERATING EXPENSES: SELLING EXPENSES (25,000) ADMIN EXPENSES (45000) NET INCOME 25,000 12 Exercises 01 The following data is taken from the books of Toyota Manufacturing for the year ended Dec 31, 2005 Purchase of raw materials Direct Labor cost Factory Overhead Raw Materials Work in process Finished goods Required : Total Manufacturing cost Cost of goods manufactured Cost of goods sold $50,000 20,000 10,000 Inventories opening 10,000 15000 5000 closing 20,000 10,000 3000 Exercises 02 The following data is taken from the books of Habib Gulzar beverages limited for the year ended Dec 31, 2010 Purchase of Raw Materials Direct Labor Cost Factory overhead Cost $50,000 40,000 30,000 Raw Materials Work in process Finished goods Required : Total Manufacturing cost Cost of goods Manufactured Cost of goods sold statement Inventories Opening 10,000 20,000 30,000 Ending 15000 10,000 20,000 Exercises 03 The following data relates to the Moon Manufacturing for the year ended Dec 31, 2009 Raw Materials Work in process Finished goods Inventories January 1 40,000 30,000 30,000 December 31 20,000 15000 10,000 Purchase of Raw Materials Direct Labor cost Factory overhead $ 60,000 50,000 30,000 Sales for the year Sales return and allowance Marketing expenses Administrative expenses Income tax expense Required: Cost of goods sold statement Income statement 300,000 20,000 10,000 15000 5000 Exercises 04 The December 31, 19B trial balance of the Balkwell Company showed: Sales ……………………………… $ 9,000,500 Sales return and allowances …….. $ 25,200 Purchases (net) …………….. 2,400,000 Transportation in …………………….. 32,000 Direct Labor ……………………. 3,204,000 Factory overhead ……………………. 1,885,600 Sales Salaries …………………. 2,00,000 Advertising expense ……………….. 1,55,000 Delivery expenses ……………………. 65,000 Inventories December 31, 19B December 31, 19A Finished goods $467,400 $ 620,000 Work in process 136,800 129,800 Materials 196,000 176,000 Required: Total Manufacturing cost Cost of goods manufactured Cost of goods sold Income statment Exercises 05 Cost of goods sold statement, income statement The accounting department of the Ruthven Company provided the following data for May ; Sales $72,000; marketing expenses 5 %, administrative expenses 1 %, other expenses 5 % of all sales ; purchases $ 36,000; factory overhead 2/3 of direct labor; direct labor $ 15,000. Beginning inventories: Finished goods ………………………………………………… $ 7,000 Work in process …………………………………………. 8,000 Materials …………………………………………………….. 8,000 Ending inventories: Finished goods …………………………………………… Work in process …………………………………………. Materials…………………………………………………….. Required: Cost of goods sold statement Income statement $ 10,200 15,000 8,500