How Banks and Thrifts Create Money

How Banks and Thrifts Create Money

• Most transactions are “created” as a result of loans from banks or thrifts.

• Chapter demonstrates the moneycreating abilities of a single bank or thrift and then looks at the system as a whole.

How Banks and Thrifts Create Money

This chapter the term “bank” is used generically and applies to all depository institutions.

Balance Sheet

• A Balance sheets summarize the financial position of the bank at a certain time.

• The value of assets must equal the value of claims

• Claims on a balance sheet are divided into two groups:

– The bank owners’ claim is called net worth

– Non-owners’ claims are called liabilities

– Equation: Assets=Liabilities + Net Worth

Fractional Reserve System

• Type of system the U.S. has in which only a fraction of the total money supply is held in reserve as currency.

Goldsmiths

• In the 16 th century goldsmiths had safes for gold and precious metals, where they kept for consumers and merchants

• Receipts for these deposits were issued.

• Receipts were used as money in place of gold for convenience.

• Goldsmiths realized they could “loan” gold by issuing receipts to borrowers

Goldsmiths

• The loans began “fractional reserve banking,” because the actual gold in the vaults became only a fraction of the receipts held by borrowers and owners of gold.

Significance of fractional reserve banking:

• Banks can create money by lending more than the original reserves on hand

• Lending policies must be prudent to prevent bank “panics” or “runs” by depositors worried about their funds

• Federal Deposit Insurance Corporation

(FDIC) was created to prevent panics

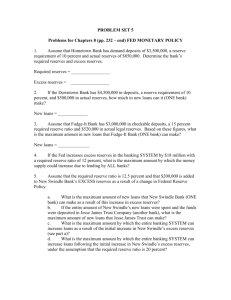

Money Creation by a Single Bank in

Banking System

• Bank is formed (example - with $250,000 worth of owners’ capital stock)

• Bank obtains property and equipment with some of the capital funds

• Bank begins operations by accepting deposits

• Banks keep reserve deposits in its district Federal

Reserve Bank

• Ex. pg. 254

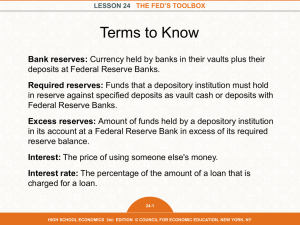

Required Reserves

Required reserves are an amount of funds equal to a specified percentage of the bank’s own deposit liabilities.

• Banks keep a significant portion of their own reserves in their vaults

Reserve Ratio

• The “specified percentage” of checkable-deposit liabilities that a commercial bank must keep as reserves.

• The Fed has the authority to establish and vary the reserve ration within limits legislated by Congress

(between 8% and 14%)

• First 6 million of checkable deposits held by bank exempt from reserve requirements

Reserves

• Three percent reserve required on checkable deposits between $6 million and $42.1million

• No reserves are required against noncheckable non-personal (business) savings CDs. (up to 9% can be required)

Control:

• Required reserves do not exist to protect against

“runs” because banks must keep their required reserves.

• Required reserves exists to give the Federal Reserve control over the amount of lending or deposits that banks can create

• Required reserves help the Fed control credit and money creation.

• Banks cannot loan beyond their fraction required reserves.

Asset and Liability

• Reserves are an asset to banks

• Reserves are a Liability to the Fed

Profits, Liquidity, and the Federal Funds

Market

• Profits: Banks are in business to make a profit

• They earn profits primarily from interest on loans and securities they hold

• Liquidity: Banks must seek safety by having liquidity to meet cash needs of depositors and meet check-clearing transactions

Profits, Liquidity, and the Federal Funds

Market

• Federal funds rate: Banks can borrow from one another to meet cash needs in the federal funds market, where banks borrow from each other’s available reserves on overnight basis

• The interest rate paid is called the

Federal Funds Rate

Need for Monetary Control

• During prosperity, banks will lend as much as possible and reserve requirements provide a limit to the expansion of loans

• During recession, banks may cut lending, which can worsen recession.

• Profit-seeking bankers will be motivated to expand or contract loans that could worsen the business cycle.

• The Fed uses monetary policy to counteract such results in order to prevent worsening recessions or inflation. (Cpt. 15)