Value Based Management

advertisement

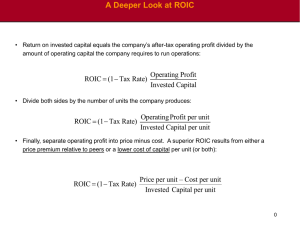

Value Systems, Value Chains and Value-Based Management The Essence of Organizational Performance Is the Creation of Value Copyright © 2008 by Robert B. Carton The Value System The Value System Each Box represents a transaction between entities. Supplier Value Chains Firm Value Chain Channel Value Chains Buyer Value Chains • Value chains differ among firms in an industry reflecting their histories, strategies, and success at implementation. • Competitive advantage derives from creating more value for the next position in the value chain then competitors. • Competitive scope, the industry segments it serves, differs between firms. • Firms may exploit the benefits of broader scope internally or they may form coalitions with other firms to do so. Copyright © 2008 by Robert B. Carton Value Chain The The Value Chain Firm Infrastructure Human Resource Management Technology Development Inbound Logistics Operations Margin Procurement Outbound Marketing Logistics & Sales Service Primary Activities Comparing firm’s value chain to competitors identifies competitive advantages where the firm’s activities are technologically or strategically distinct. Copyright © 2008 by Robert B. Carton Value Chain Analysis Value Chain Analysis Divide the company’s operations into specific activities or processes Identify discrete activities within each process Are these strengths or weaknesses for your firm? How do these activities integrate with each other? Attach costs to each activity Disaggregate costs of each activity to find opportunity Identify activities that create value for customers Focus analysis on these activities Importance of activities varies by industry Copyright © 2008 by Robert B. Carton Value-based Management VBM is the process of maximizing the value of a company on a continuing basis. It is an integrative process designed to improve strategic and operational decision making by focusing on key drivers of corporate value. • Value drivers are unique to each organization based upon their competitive advantages and industry structure. Copyright © 2008 by Robert B. Carton Value Is Contextual Value may be tangible or intangible, operational or financial Public companies focus on return to shareholders Private companies may define value creation in may other ways • Lifestyle • Combined returns to owners including family Not-for-profit companies • Progress towards social ends • Development of a cure Our focus will be financial Copyright © 2008 by Robert B. Carton Value Drivers Are Not All Financial A value driver is any variable that affect the value of the organization. Non-financial objectives may be used to inspire and guide behavior of employees, many of whom will not care about financial value creation. Customer satisfaction Product innovation Employee satisfaction Non-financial objectives still ultimately translate into financial performance. Copyright © 2008 by Robert B. Carton Organizational Key Value Drivers Organizations cannot act directly on value. They act on things that influence value. It is through these drivers of value that senior management learns to understand the rest of the organization and establishes strategy. Those value drivers that have the greatest impact should be the focus of management. Value drivers must be developed down to the level of detail that aligns the value driver with decision variables under the control of line management. Key value drivers are not static so they must be reviewed periodically. Copyright © 2008 by Robert B. Carton Company Valuation Is Based Upon Discounted Cash Flows Value is created only when companies invest capital at returns in excess of their cost of capital Entails managing the balance sheet as well as the income statement Must balance short and long term perspectives ROIC and growth are the fundamental drivers of a company’s value A company must do one or more to increase value Increase ROIC on existing capital Increase ROIC on newly invested capital Increase growth rate (so long as ROIC exceeds WACC) Reduce weighted average cost of capital (WACC) Copyright © 2008 by Robert B. Carton Value Driver Identification Opportunity Costs Your Money Market Value of Investment + Financial Capital Return on Investment + Other Peoples’ Money + ÷ Retained Earnings Cash Flow Paid Out Return to Owners Profits + Creation of New Opportunities Increase In Market Value + Remaining Value of Exiting Opportunities Copyright © 2008 by Robert B. Carton Profit Value Drivers Quantity New Customers Price Revenues Quantity Existing Customers Price Profits Purchased Inputs Cost of Goods Sold Labor Costs Administration Overhead Sales and Marketing Research and Development Copyright © 2008 by Robert B. Carton VBM and Organizational Change VBM and four key aspects of organizational change. Helps define the specific financial performance objectives that a company should adopt. Helps decide between alternative strategies and resource allocations. Requires clear performance targets and follow-up measurement. Provides focus on what is important – key value drivers. VBM is a marriage between a value creation mindset and the management processes and systems necessary to translate that mindset into action. Copyright © 2008 by Robert B. Carton VBM Management Processes Strategy development and alternatives evaluation Achieve competitive advantage that translates into value creation Target setting Based upon key value drivers Action plans Performance measurement Copyright © 2008 by Robert B. Carton