Chapter_11 - rpstudygroup.com

advertisement

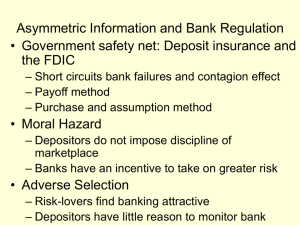

Economic Analysis of Banking Regulation Chapter 11 Stuff Review Sheet Test chapters: 6, 8, 9, 10, 11, 12 Wed, Ricketts 203, 7:00 No homework due Commercial Paper 7 ways banks are regulated FDIC Regulators restrict assets Minimum bank capital requirements Chartered and Auditied Disclosure Req’t Consumer Protection Restrictions on Competition 1) FDIC Regulation Bank panic ‘cycles’ every 20 years 1920’s: 600 insolvencies/year 1930-33: 2000 insolvencies/year 1934-81: 15 insolvencies/year FDIC closes insolvent banks (G-S, 1933) Payoff method Purchase and Assumption of bad debt method Used to be the most popular FDIC and Moral Hazard Depositors: no incentive to monitor bank mgmt. loan decisions Bankers: no worries about bad loan decisions causing savers to lose saving “Too big to fail” policy Taxpayers pay Glass-Steagall implications 2) Regulators Restrict Assets E.g. no common stock allowed Limits on risky loans 3) Minimum Bank Capital Req’t Traditional measure: Leverage Ratio Bank Capital/Assets (inverse of equity multiplier!!) Greater than 5%: well capitalized Less than 3%: Trouble! Basel Accord (1988) - International Hold 8% of ‘risk-adjusted’ assets Zero-weight: gov. securities 20% weight: claims on banks 50% weight: residential mortgages and municipal bonds 100% weight: loans to consumers and corporations Regulatory Arbitrage Fed in ‘96: 3 times max capital that could be lost in 10 days 4) Banks chartered, audited Criteria Mgmt. adequacy Likely earnings Adequacy of capital Effect on competition (pre-1980) Examination: Quarterly ‘call reports’ Annual Exams Assets Risky? Get rid of them! Worthless Loans? Write them down! Capital Inadequate? Figure out new strategy! CAMEL Rating Credit risk of bank assessed Enough collateral? Enough L-T relationships? Enough screening? Acronym Capital Adequacy Asset quality Management (oversight of board, internal policies) Earnings Liquidity Sensitivity IR rate assessed (Gap and Duration analysis) Stress testing, etc. 5) Disclosure Requirements Accounting standards Annual reports Risk level disclosure Disclose information about riskiest assets New Zealand: if full disclosure, then no examination necessary 6) Consumer Protection Truth in Lending Act (1969) Standardization and disclosure of lending terms Fair Credit Billing Act amendment (1974) Extends to credit cards Billing errors, mechanism for appeal Equal Equal Credit Opportunity Act (1976) Community Reinvestment Act (1977) Invest in neighborhood in which you accept deposits 7) Competition restriction Branching Banks can’t be in security industry Security, insurance can’t be in banking International Banking Regulation Similar to U.S. Country hopping, no overarching regulatory organization BCCI collapse (1991) 7th largets bank in world at peak Value of 20m, when audited in ‘91, only 10m! “Registered” in Luxembourg Laundering, bribery, arms trafficking, nuclear technologies, etc. Intentionally avoided detection: had its own shipping and trading company, intelligence agency, etc. Savings and Loan Crisis Largest banking crisis since the depression $500 billion dollar bailout over 40 years: still paying for it! Good example of: Deregulation vs. regulation Moral Hazard Bank management Early Causes Innovations in the ‘60s and 70’s, had to be riskier FSLIC: bank mgmt indifferent to taking risk Deregulation DIDMCA 1980 Garn- St. Germain Act 1982 Increased FSLIC insurance from 40K to 100K Can put 40% in commercial real estate loans 30% in consumer lending 10% in junk bonds or direct investments More early causes Recession of ‘80, ‘81 Brokered deposits Large denomination CD sold to brokerage Cut into smaller FSLIC covered deposits Remove incentive for large depositors to monitor lending practices of bankers (covered through innovation!) By 1982, 50% of S&L’s were insolvent!!! Resulting Problems Managers did not have experience with this expanded risk portfolio Regulators didn’t have the breadth, capacity, or experience to regulate Result Moral hazard by managers Conflict of interest by regulators Principal/Agent problem by politicians Asymmetric Information with public Regulatory Forbearance by FHLB, FSLIC Refrained from closing insolvent banks Irregular accounting allowed (goodwill) Why? Conflict of interest Not enough money to close (payoff/assumption) Don’t want to offend politicians Protect reputation FHLB established to encourage growth of S&L industry, not shut it down Zombie S&L’s: The Living Dead Bankrupt (negative bank capital) but still operating Had nothing to lose, moral hazard ‘Bad’ S&L’s gave high interest on deposits, taking business from ‘Good’ S&L’s Negative feedback loop ‘87 legislation Provided only $11 billion to back up losses, but… Directed FHLB to CONTINUE regulatory forbearance Politician Principal Agent Hide problems from taxpayers, hoping it will go away Career oriented Close relationships with industry insiders (conflict of interest) The Keating Five Charles Keating, owner of Lincoln S&L, insolvent Purchases 600M in junk bond to try to escape Big contributor to congressmen, tell regulators to leave him alone ‘89 collapse, $2.6 billion loss payed by taxpayers 3 senators not re-elected after reprimanded FIRREA (1989) - The Bailout Regulatory Structure Revised FSLIC and FHLB abolished Treasury Dept. takes over (Office of Thrift Supervision) Resolution Trust Corporation Seizes assets of 25% of S&L Sells $450B of assets of failed S&L Fed gov’t issues bonds for $150B deficit S&L regulations imposed again 70% must be housing, no junk bonds, leverage 8% Regulators have power to remove bank mgrs., impose penalties, issue cease and desist legal action FDICIA (1991) - Insurance No more brokered deposits Limited “to big to fail” policy Another money infusion from Treasury to cover S&L losses Corrective action provisions: FDIC MUST intervene early if a bank is getting into trouble Future proposed reforms Limit deposit insurance to 90% of deposits Outlaw regulatory forbearance Value bank capital at cost, not market (see today’s WSJ!) Consolidate regulatory agencies As of Dec. 2006, bank insurance fund and savings and loan insurance fund became deposit insurance fund World Banking Crises Scandinavia Russia Japan China East Asian ‘Tigers’ Latin America Argentina