Jim Reilly and Ravi Subbaraya - Florida Government Finance

advertisement

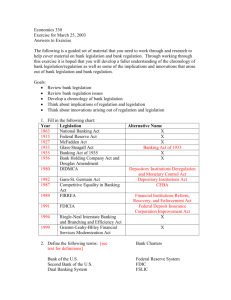

Dodd-Frank Wall Street Reform and Consumer Protection Act Overview Florida Government Finance Officers Association – 2012 Annual Conference Presented by: James Reilly Director Dodd-Frank Act Implementation Ravi Subbaraya Head, Business Banking Products Financial Crisis Accommodative monetary policy Transfer of assets from banks’ balance sheet to global markets Excess leverage at financial firms, primarily investment banks Unrealistic consumer expectations Lowered underwriting standards A confluence of events contributed to the financial crisis Creation of complex, opaque financial assets Failure of rating agencies to adequately assess the inherent risk of these assets Failure of regulators to identify and correct emerging weaknesses Fair value accounting 2 Financial Industry Change Then… The Banking Act of 1933 • Created the FDIC • Glass-Steagall Act separated commercial/investment banking • FOMC elevated independent monetary policy Legislative response to the Great Depression brought a decade of broad structural change to the U.S. financial industry: Securities Act of 1933 Securities Exchange Act of 1934 Trust Indenture Act of 1939 Investor Advisors Act of 1940 Investment Company Act of 1940 3 And Now… Dodd-Frank Overview In contrast to previous legislation, the Dodd-Frank Act was largely a partisan bill that was debated for less than a year in Congress. The Act, together with the rigorous capital and liquidity standards proposed by Basel III, will create a significant challenge in the coming months and years. Over 240 rulemakings and 96 agency studies are necessary to fully implement the legislation. While most of this regulatory action has started less than 30 percent of the rules have been finalized to date. Complexity of implementation is significant; it will be costly and time consuming. 4 Key Themes of the Act Theme Description Consumer and Investor Protection Bureau of Consumer Protection Preemption Interchange Fees SEC Investor Protection authority Mortgage Reform / Increased Disclosures Durbin Amendment Market Stability, Enhanced Prudential Standards and Systemic Risk Enhanced prudential standards Prudential Regulation and Supervision Restrictions on Bank Activity Transparency and Disclosure • • • • Capital, leverage, liquidity, credit concentration limits Living Wills Stress Testing Early Remediation Financial Stability Oversight Council Office of Financial Research Collins Amendment “Basel III” Regulatory Restructuring • • • • • Enhanced FDIC supervision Enhanced rules on acquisitions Enhanced Fed role OTS Eliminated CFTC / SEC oversight of derivatives Volcker Rule • • Proprietary Trading Hedge Funds/Private Equity Funds Swap Push-out OTC Derivatives • • • Clearing/Exchange Trading Position Reporting SEC/CFTC Oversight 5 Regulatory Environment Has Also Changed In the U.S. there exists a regime of functional regulation whereby specific entities are regulated according to the activities in which they are principally engaged (e.g., commercial/retail lending, investment banking, insurance). Accordingly, there are multiple regulators that supervise the various activities of banks and their holding companies, sometimes at cross purposes and with somewhat conflicting concerns • Federal Reserve • Office of the Comptroller of the Currency • Federal Deposit Insurance Corporation • Commodity Futures Trading Commission • Securities and Exchange Commission • National Credit Union Administration • Consumer Financial Protection Bureau • State Banking/Insurance/Securities Authorities • State Attorneys General • SROs 6 Regulatory Environment Has Also Changed Through statutes and implementing regulations very specific policies exist regarding capital, leverage, liquidity, executive compensation, safety and soundness, financial reporting, credit, commercial and retail lending and affiliate transactions, among others. Mandates are enforced through general and targeted examinations which are ongoing throughout the year. In large financial institutions a sizeable number of examiners are in residence and engage in continuous discussions with management. The DFA will expand the scope and tenor of the supervisory process through extensive data collection and peer group analysis. “Macroprudential” regulation, systemic risk and TBTF will become key themes going forward. 7 Caught in the Web Who can do what to whom Financial Agencies: Old Lines of Reporting: New Old with new powers Affected parties CFTC Office of the Comptroller of the Currency Has authority to examine State Regulatory Authorities and AG’s FSOC OFAC / FinCEN SEC Can request information FEDERAL RESERVE FDIC OFR CFPB FINRA Investment Advisory Derivatives Source: JPMorgan Chase Consumer Lending Commercial Lending Brokerdealer Retail Banking Alternative investments Investment Banking Payment and Clearing Systems 8 Key Takeaways The Dodd-Frank Act (“DFA”) is over 2300 pages long and requires over 240 rulemakings and close to an additional 100 studies and reports for full implementation. The DFA creates new offices and agencies (e.g., the Consumer Financial Protection Bureau, the Financial Stability Oversight Council) that have a broad scope and mandate. Loss of pre-emption of federal consumer financial laws will require compliance by banks with national charters with the laws of each state in which they do business. This will become an ongoing compliance burden . Volcker Rule, as currently proposed, has a broad extraterritorial impact and many unintended consequences. The Durbin Amendment (debit card swipe fees) resulted in a very meaningful transfer of revenues from banks to retailers with no discernable benefit for consumers. Enhanced Prudential Standards (capital, leverage, liquidity, stress tests and resolution planning) will be difficult to implement an will require ongoing reporting and updating. Agencies have admitted they will not meet statutory deadlines in many areas. This will add to implementation risk. 9 Business Impacts and Implications Implementation of DFA = Significant investment in resources to understand and implement new rules = Higher Cost Creation of new offices and agencies (e.g., the CFPB) = New regulators, Stricter do’s and don’ts = redesign disclosures, enhanced reporting Durbin (and prior to that Reg. E)= Lost fee revenue = end of free checking FDIC Assessment Based Change = based on assets not deposits = adjusts of bank quality FDIC Protection on Non Interest Bearing = Collateral Costs Reg. Q = Beginning of the End of Non Interest Bearing Checking = lower interest income Loss of pre-emption: Product & pricing vary by state = collateral, training, compliance becomes state specific = higher costs e.g., Gift Cards Results Higher banking costs for Consumers and Businesses Higher costs for Banks Redirected investments Fewer Banks Enhanced Prudential Standards (capital, leverage, liquidity) = Rethink asset mix Delays in implementation = Uncertainty and change = moving targets 10