Handout

advertisement

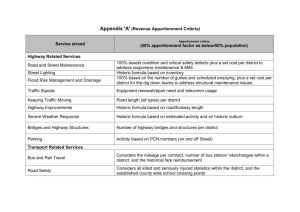

Apportionment Apportionment • Apportionment is a ratio or formula intended to represent the level of business the company is conducting within a state. 3-factor formula • Evenly weighted property, payroll, sales • States trending away from evenly weighted 3-factor formula • Double-weighted sales • Single sales factor Property • Averages values are used • Most states use original cost, some states use NBV (NJ) • Rented property is valued at eight times the net annual rate Payroll • Compensation is defined as wages, salaries, commissions and any other form of remunerations paid directly to employees for personal services • Generally should tie to your IRS Form 940 • Some states do not include officer’s compensation in payroll factor • Payments made to independent contractors are generally excluded Sales of TPP • Sales of Tangible Personal Property (“TPP”) are generally in state if: • It is delivered or shipped to a purchaser within the state, regardless of the f.o.b. point or other conditions of the sale. Sales of Services • Cost of Performance • Market based sourcing Cost of Performance • Gross receipts from services are attributed to a state if the activity is performed wholly within the state. • If the activity is both within and without a state, it is included in the receipts factor of the state where the greater proportion of the income-producing activity is performed, measured by costs of performance. Analyzing Cost of Performance • Taxpayer determines what activity produced the income • Cost of performance analysis conducted • • Determine the costs associated with the activity Determine the states in which those costs were incurred • Cost of performance rule is all-or-nothing approach • Entire sales are attributed to the single state in which the greater proportion of the costs of performance is incurred Income-producing activity (MTC) • Term applies to each separate item of income, examples include: • The rendering of personal services by employees or the use of tangible or intangible property by the taxpayer in performing a service • The sale, rental, leasing, licensing, or other use of real property • The rental, leasing, licensing, or other use of tangible personal property • The sale, licensing, or other use of intangible personal property Cost of Performance (MTC) • Direct cost that is incurred for a specific purpose and is traceable to that purpose • Example: The direct costs associated with a service contract for maintaining business equipment would include both the cost of repair parts and the compensation costs of the service technicians. • Indirect costs (including G&A) are not included in cost of performance analysis Market-based sourcing • Receipts from services attributed to a state based on where service recipient is located • GA, IL, IA, ME, MD, MI, MN, UT, WI • CA in 2013 • Can create double taxation if you are doing services in a COP state but have customers receiving the benefit in marketbased sourcing states • MTC currently uses COP, but has proposed an amendment to use market-based sourcing Sourcing of Intangibles • States vary widely on sourcing of intangibles • Always check state rules here Special industries • States may have specific apportionment formulas for the following: • • • • • • • • • • • Airlines Railroads Trucking companies Financial institutions Television and radio broadcasters Publishers Telecommunication service companies Mutual funds Pipeline companies Ship transportation companies Professional sports franchises Steps to completing apportionment • Sum apportionment totals • Tie out apportionment to the workpapers • Gross receipts and property should tie to the trial balance • Payroll should tie to 940s (check against TB for large deviation) • Compare to PY apportionment • Look for new states that have factors present – consider whether to file there • Look for states where factors may have swung largely Steps to completing apportionment (cont.) • Input apportionment into ProFx • If you have a state where there is everywhere sales, property or payroll, but that respective state does not have any of these factors, input a zero for that state in the Allocation and Apportionment worksheet. • Verify that everywhere columns per ProFx tie to apportionment workpapers Inputting apportionment in ProFx Steps to completing apportionment (cont.) • Things to watch out for • Market-based sourcing versus COP sourcing states • Most states are COP, but if you have a market-based sourcing state, you will have to input that numerator separately • Everywhere sales may differ by state • Sub-part F and Section 78 Gross Up Changing everywhere totals Common State worksheet, A&A – Total everywhere overrides Changing everywhere totals Common State worksheet, A&A – Total everywhere overrides