Chapter 9 * Manufacturing Process

advertisement

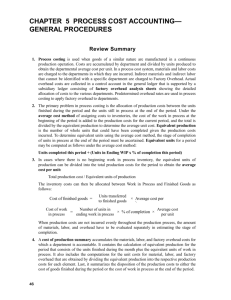

Chapter 9 – Manufacturing Process • • • • What are the Primary Activities in the Conversion Process? Schedule production Obtain raw materials (internal transfer) Use labor and manufacturing resources to convert raw materials int finished goods • Store finished goods until sold (internal transfer) S&A Exp Purchases Work In Process Raw Materials Direct Labor Applied Manufacturing Overhead Finished Goods Cost of Goods Sold Man Overhead Under / Overapplied Selling & Admin Costs Chapter 9 – Manufacturing Process • Which of the Conversion Process Activities are Accounting Events? • Obtain raw materials – Increase work-in-process inventory – Decrease direct materials inventory • Use labor and overhead – Increase work-in-process inventory • Store finished goods – Increase finished goods inventory – Decrease work-in-process inventory S&A Exp Purchases Work In Process Raw Materials Direct Labor Applied Manufacturing Overhead Finished Goods Cost of Goods Sold Man Overhead Under / Overapplied Selling & Admin Costs Chapter 9 – Manufacturing Process • What is the basic flow of information in the conversion process? • • • • • A customer places an order and production is scheduled. Direct materials are requisitioned and recorded. Labor is used and recorded A cost record is prepared and goods are manufactured. Goods are finished and recorded. S&A Exp Purchases Work In Process Raw Materials Direct Labor Applied Manufacturing Overhead Finished Goods Cost of Goods Sold Man Overhead Under / Overapplied Selling & Admin Costs Chapter 9 – Manufacturing Process • What is the purpose of the inventory accounts in a manufacturing company and what types of activities cause the accounts to increase and decrease? • Direct materials inventory—the cost of direct materials on hand; increases when direct materials are purchased; decreases when direct materials are issued into production Work-in-process inventory—the cost of products started, but not completed; increases when direct materials and direct labor are used in production and when manufacturing overhead is assigned to production; decreases when goods are finished and transferred out (cost of goods manufactured) Finished goods inventory—the cost of products finished, but not sold; increases when goods are finished and transferred in; decreases when goods are sold (cost of goods sold) • • S&A Exp Purchases Work In Process Raw Materials Direct Labor Applied Manufacturing Overhead Finished Goods Cost of Goods Sold Man Overhead Under / Overapplied Selling & Admin Costs Chapter 9 – Manufacturing Process • Definitions – Direct (Raw) Materials Cost • Physically traceable items / costs to the final product – Direct Labor Cost • Costs of employees who actually manufacture the product – Manufacturing Overhead Costs (Applied) • Represents indirect (materials and labor) manufacturing costs – Manufacturing Overhead Costs (Actual) • The real amount MOH costs us (prob not going to = applied amt) • Need to adjust in our COGS for accuracy – Selling & Administrative Costs • Represents other costs related to selling the item S&A Exp Purchases Work In Process Raw Materials Direct Labor Applied Manufacturing Overhead Finished Goods Cost of Goods Sold Man Overhead Under / Overapplied Selling & Admin Costs Chapter 9 – Manufacturing Process • Calculations Beginning + Purchases of R.M. = Cost of R.M. avail for use - R.M. Issued into production = Ending R.M. Inventory I’m headed to WIP!! Raw Mat Chapter 9 – Manufacturing Process I’m headed to Finished Goods!! • Calculations WIP + Direct Mat Issued +Direct Labor Used + Applied Manu O.H. = Cost of goods in Process -Cost of goods manufactured =Ending WIP Inventory Chapter 9 – Manufacturing Process • Calculations +Cost of Goods Manufactured =Cost of Goods Avail for Sale -Cost of Goods Sold (COGS) =Ending Fin Goods Inv I’m headed to COGS!! Finished Goods Chapter 9 – Manufacturing Process • Calculations Beginning COGS + Cost of Finished Goods Sold + / - Man OH Under / Over Applied =Total COGS For The Period COGS Begin Chapter 9 – Overhead Application • Overhead… Isn’t it a cost to the manufacturing (WIP)? – – – – Yes!!! So, how do we “get it into” WIP? Overhead occurs differently than DM and DL! DM / DL happen regularly… easy to match with WIP MOH happens sporadically • Tough to match directly (that’s why it’s “indirect”) to WIP • Must “Apply” it to WIP to match it up • How do we Apply it? – A “guess-timation” of the MOH costs – What if we “Apply it” wrong? (which we will, not going to be dead on!) – Have to adjust our COGS » Overapplied (too much) needs to decrease COGS » Underapplied (not enough) needs to increase COGS • So… what do we do??? – How do we Journalize it? Chapter 9 – Manufacturing Process • Definitions – Direct Materials Cost • Physically traceable items / costs to the final product – Direct Labor Cost • Costs of employees who actually manufacture the product – Manufacturing Overhead Costs • Represents indirect (materials and labor) manufacturing costs – Selling & Administrative Costs • Represents other costs related to selling the item