program overview

advertisement

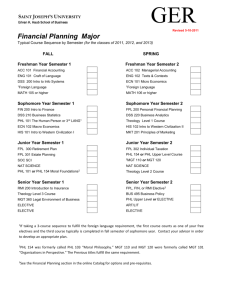

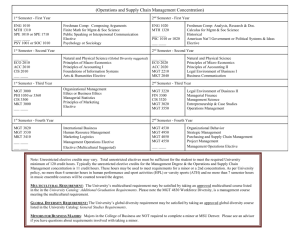

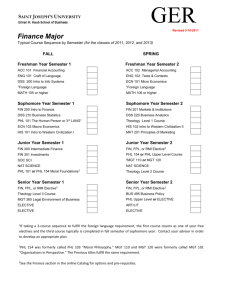

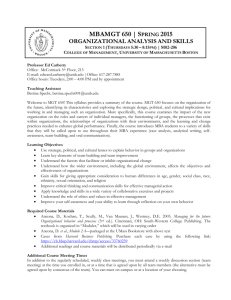

Master of Science in Financial Engineering PROGRAM OVERVIEW Session Outline Introduction (FE Faculty and Staff) What exactly is financial engineering? An Exercise in Expectations Program Structure Dual Degree Options Program Administration Registration Questions and Issues Bloomberg Q&A FE Faculty – Academic Directors Drucker School James Mills Mathematics Henry Schellhorn Financial Derivatives, Asset Management - Financial Mathematics, Operations Research – University of Oregon UCLA FE Faculty Other key core faculty from Drucker Murat Binay (Finance, Investments – University of Texas) Jay Prag (Finance, Fixed Income – Rochester University) Vijay Sathe (Strategy – Ohio State University) James Wallace (Financial Accounting, Financial Statement Analysis – University of Washington) Hideki Yamawaki (Strategy – Harvard University) Other faculty from the School Of Mathematical Sciences John Angus (Applied and Theoretical Probability – UC Riverside) Andrew Nguyen (UC Irvine) Allon Percus (Universite Paris-Sud) FE Staff Nola Wanta Assistant Director, MBA & FE Burkle 110 Virginia “Jeannie” Bullard Program Coordinator, MBA & FE Burkle 118 What Exactly is Financial Engineering? Financial engineering is the use of financial instruments, in particular derivative products, to restructure or rearrange cash flows to achieve particular financial goals, especially the management of financial risk. What Are Your Expectations? What are Our Expectations? Be Involved – take advantage of your faculty, staff and fellow students in both the FE program as well as the MBA program Be ethical – take seriously the philosophy and foundation of the Drucker School Commit yourself intellectually and emotionally to a rigorous and intense three semester program Comport yourselves at all times as professionals. Program Structure Required courses from Drucker Financial Accounting (MGT 326) Corporate Finance (MGT 335) Financial Derivatives (MGT339) Asset Management Practicum (MGT 402) Some elective courses from Drucker Strategy (MGT 340): fall Game Theory (MGT 383): spring Fixed Income (MGT 475): fall Real Options (MGT 476): fall Financial Strategy and Policy (MGT 373) Financial Statement Analysis: spring Introduction to Risk management (MGT 391): fall Program Structure Required courses from The School of Mathematical Sciences Probability (Math 251): fall Statistical Theory (Math 252) or Financial Time Series (Math 463): spring Stochastic Processes (Math 256): spring Mathematical Finance (Math 358): fall Recommended elective courses from the School of Mathematical Sciences Introduction to Scientific Computing (Math 364): fall Statistical Theory (Math 252) or Financial Time Series (Math 463): spring Numerical Methods for Finance (Math 361A) and Quantitative Risk Management (Math 458A): fall Simulation (Math 369): summer Programming in C++: summer Program Structure Other elective courses from the School of Mathematical Sciences Linear Statistical Models (Math 355): fall Numerical methods for PDEs (Math 362): fall Nonparametric and Computational Statistics (Math 352): spring Scientific Computing (Math 265): spring Advanced Numerical Analysis (Math 393): spring Partial Differential equations (Math 282): fall Courses in the Economics Department Econometrics II Econometrics III (but do not count towards Math degree) Course Sequence Fall – First Semester Probability (Math 251) Financial Accounting (MGT 326) Corporate Finance (MGT 335) Elective Spring – Second Semester Stochastic Processes (Math 256) Financial Derivatives (MGT 339) Statistics (Math 252) or Financial Time Series (Math 463) Elective Fall – Third Semester Mathematical Finance (Math 358) Asset Management Practicum (MGT 402) Elective Elective Dual Degree FE/MBA FE/MBA (80 units – if taken individually 108 units) Degrees FE/Math Dual Degree Math/MSFE Need 2 additional math courses 5 of the math courses must be level 300 or higher Need to have undergraduate degree in math or equivalent Important: must apply before completing 16 units of FE program MS degree in Math Need 4 additional math courses 5 of the math courses must be level 300 or higher Need to have undergraduate degree in math or equivalent Ph.D. in Financial Engineering We are not accepting applications this year Exchange Program University of Lausanne, Switzerland 2 students per academic year on the 3rd semester apply in March some financial aid University of Saint Gallen, Switzerland meant mostly for MBA Registration/Bloomberg/ Administration Administration – Policies & Procedures you need to know Registration: Questions and Issues Bloomberg Student Involvement (Clubs, Co-Curricular Activities, Internships) Q&A