IASC is restructured to form a new board: the IASB

advertisement

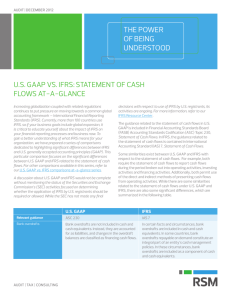

Jana Raedy University of North Carolina ► Initial 14 members are appointed to the IASB - 2000. ► The IASB begins promulgating standards as IFRS from IAS. The SIC becomes the IFRIC-2002. ► The European Union endorses IFRS for 2005 adoption - 2002. ► Norwalk Agreement is executed between the IASB and FASB -2002. ► SEC published a roadmap (Roadmap) for elimination of a US GAAP reconciliation for FPIs 2005. ► The FASB and IASB published a Memorandum of Understanding, to set forth priorities in their joint work program -2006. 1970s 1980s 1990s ► The IASC is formed – 1973. ► IASC Advisory Council formed to provide oversight of IASC 1994. ► Standards Interpretations Committee (SIC) is formed 1997. ► IASC is restructured to form a new board: the IASB – 1999. 2000s ► SEC eliminated the US GAAP reconciliation for FPIs - 2007. ► SEC (under Chairman Cox) published a proposed Roadmap for the mandatory adoption of IFRS in the US - 2008. ► FASB and IASB reaffirmed their commitment to the MOU -2009. ► SEC established a Work Plan for its 2011 IFRS adoption decision -2011. Courtesy of Ernst &Young Foundation IFRS required or permitted Local GAAP based on legacy IAS No action taken/date set for adoption In process of adopting or converting to IFRS Courtesy of Ernst &Young Foundation Currently FASB and IASB are working on many convergence projects that are to be completed in 2011. ◦ Consolidation, Fair value measurement, Financial instruments, Financial statement presentation (presentation of OCI), Leases, Revenue recognition SEC expected to come to some decision in 2011 ◦ Based upon recent statements – my guess is not until the latter part of the year SEC will allow a minimum of four years to adjust if it mandates the use of IFRS. This would mean the use of IFRS in 2015 at the earliest. ► ► ► ► Adoption: US would practice under IFRS as issued with no modifications. Convergence: US would practice under US GAAP with efforts to converge differences with IFRS standards over time. Endorsement: US would review each IFRS standard as issued and determines whether the standard should be endorsed for practice with or without modification. Condorsement (SEC currently discussing): ► US GAAP would continue to exist. ► The IASB and FASB would finish the major convergence projects in the MOU. ► The FASB would work on the following simultaneously: ► No new major projects but rather set priorities of converging US GAAP (remaining topics not on the current agenda) to IFRS. This would be to make sure that these existing IFRS standards are suitable for US capital markets. ► Consider new standards issued by the IASB for endorsement (but not required) or incorporation (required) into US GAAP. This would ideally be issuing the standards in the codification without modification. This would also assume the US involvement in IFRS standard setting. ► This approach would allow the US to maintain control of US standards. Big, big picture: ◦ Not very different. Principles are virtually identical. Conceptual Framework is one convergence project. Big picture, by topic (typical intermediate coverage): ◦ Some differences, but not insurmountable for the classroom. Detailed level (what might be encountered in practice): ◦ Lots of differences. YES! And we should be teaching it now. Foreign subs located in the US are on IFRS. US multinationals have foreign subs on IFRS. Foreign private issuers trading in the US are only required to file IFRS reports. Much more likely now that students will do global rotations Competitive advantage for students CPA Exam now covers IFRS (effective January 2011) Recruiting firms are interested in students having IFRS knowledge To assess current curriculum ◦ Some topics no longer that important (extraordinary items) ◦ Some are infrequent in practice (non-monetary exchanges of assets, involuntary conversion of assets, sum-of-the-years-digits depreciation) ◦ Some are industry specific (depletion) ◦ Some aren’t allowed under typical circumstances (revenue recognition - installment and cost recovery methods) ◦ Others need to be added (revenue recognition – multiple deliverable, tax provisions, revaluations) To build other skills our students need ◦ Judgment/Decision Making Skills US GAAP relies extensively on judgment - IFRS even more so ◦ Critical Thinking Skills ability to read and interpret authoritative accounting literature ability to think about business problems ability to understand the reasons behind standards Fully integrated or as a stand-alone course? Full integration Stand Alone US GAAP knowledge Don’t spend time relearning US GAAP Provides a good review of US GAAP (use preclass homework) Confusing? Requires students to sort out 2 sets of standards while they are still trying to learn Can get US GAAP under their belts before attempting a “2nd language”. Faculty involvement Involves more faculty Minimizes number of faculty involved LESS RULES! MORE emphasis on: ◦ Students don’t remember them anyway. ◦ We can’t even teach all of US GAAP rules now. ◦ Teaching students to find the authoritative literature and interpret the standards for themselves. If we do this, then we don’t need to teach then every little rule. ◦ Creating a classroom/curriculum that provides opportunities for students to enhance their critical thinking, decision-making and judgment skills. Research Cases Basis for Conclusions Debate Cases My suggestions: ◦ Intro to IFRS (similar to what I’ve provided today) ◦ Discussion of principles vs. rules ◦ Discussion of the need for judgment and critical thinking skills. Needed for US GAAP, even more so for IFRS ◦ Very basic coverage of differences between US GAAP and IFRS. For example: Inventory – LIFO not allowed under IFRS LTOA – can be revalued under IFRS Hybrid securities – bifurcated under IFRS Coming soon! ◦ Gordon, Raedy and Sannella, Intermediate Accounting Fully integrated textbook Focus on judgment and critical thinking skills without sacrificing necessary rules International Accounting Standards Board (IASB) http://www.iasb.org Securities and Exchange Commission (SEC) http://www.sec.gov/spotlight/ globalaccountingstandards.shtml Financial Accounting Standards Board (FASB) http://www.fasb.org/intl/ International Association of Accounting Education and Research (IAAER) http://www.iaaer.org American Institute of Certified Public Accountants (AICPA) http://www.ifrs.com/ American Accounting Association (AAA) – look to International Accounting Section http://aaahq.org Access to eIFRS part of Membership *Individual , Student or Institution Deloitte http://www.deloitte.com/view/en_US/us/Services/audit-enterprise-risk-services/FinancialAccounting-Reporting/IFRS/index.htm E&Y http://www.ey.com/US/en/About-us/Our-people/About-us-Our-people-Academic-ResourceCenter http://www.ey.com/US/en/Services/Assurance/Accounting-and-Financial-Reporting/USGAAP_vs_IFRS_the-basics-March-2010_US-GAAP-and-IFRS-convergence Grant Thornton http://www.grantthornton.com/portal/site/gtcom/menuitem.91c078ed5c0ef4ca80cd8710033841ca/ ?vgnextoid=bb444cfadd5d3110VgnVCM1000003a8314acRCRD KPMG http://www.kpmgifrsinstitute.com/ PwC http://www.pwc.com/Extweb/service.nsf/docid/8E714A79E0DD6C9980256BBC00382351 IASPlus Home Page - News about International Financial Reporting http://www.iasplus.com For access to these materials contact Catherine Banks ◦ Catherine.banks@ey.com What would you like to discuss? Thanks for your time!