Slides

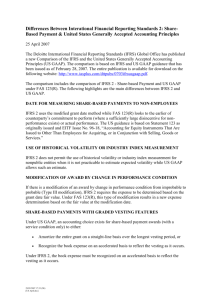

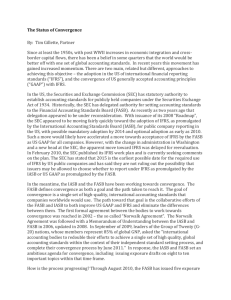

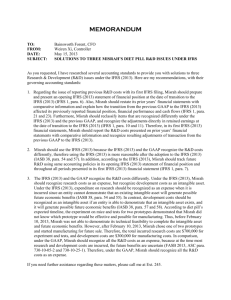

advertisement

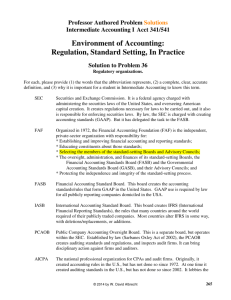

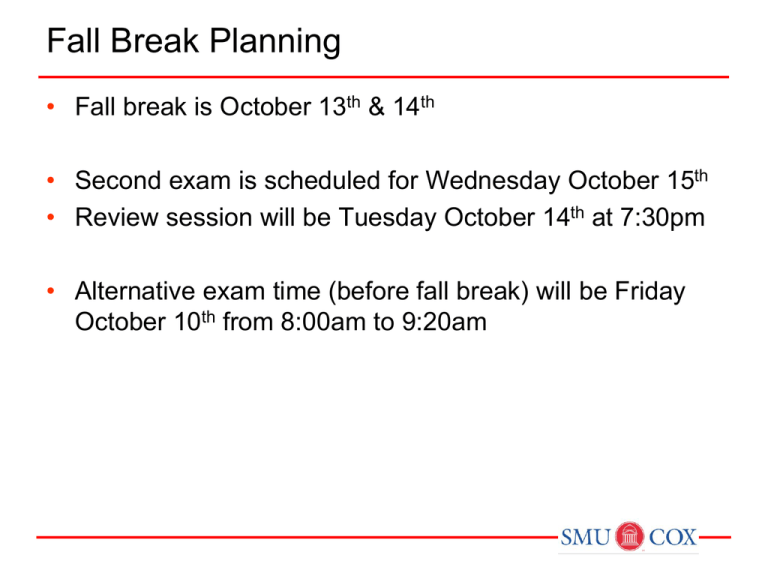

Fall Break Planning • Fall break is October 13th & 14th • Second exam is scheduled for Wednesday October 15th • Review session will be Tuesday October 14th at 7:30pm • Alternative exam time (before fall break) will be Friday October 10th from 8:00am to 9:20am CHAPTER 1 FINANCIAL ACCOUNTING AND ACCOUNTING STANDARDS Sommers – Intermediate I Generally Accepted Accounting Principles FASB Codification Goal in developing the Codification is to provide in one place all the authoritative literature related to a particular topic. Creates one level of GAAP, which is considered authoritative. All other accounting literature is considered non-authoritative. FASB has developed the Financial Accounting Standards Board Codification Research System (CRS). CRS is an online real-time database that provides easy access to the Codification. Generally Accepted Accounting Principles Illustration 1-5 FASB Codification Framework Issues in Financial Reporting GAAP in a Political Environment GAAP is as much a product of political action as they are of careful logic or empirical findings. Illustration 1-6 User Groups that Influence the Formulation of Accounting Standards Issues in Financial Reporting International Accounting Standards Two sets of standards accepted for international use: U.S. GAAP, issued by the FASB. International Financial Reporting Standards (IFRS), issued by the IASB. FASB and IASB recognize that global markets will best be served if only one set of GAAP is used. IFRS Insights – Relevant Facts – International standards are referred to as International Financial Reporting Standards (IFRS), developed by the International Accounting Standards Board (IASB). Recent events in the global capital markets have underscored the importance of financial disclosure and transparency not only in the United States but in markets around the world. – U.S standards, referred to as generally accepted accounting principles (GAAP), are developed by the Financial Accounting Standards Board (FASB). The fact that there are differences between what is in this textbook (which is based on U.S. standards) and IFRS should not be surprising because the FASB and IASB have responded to different user needs. In some countries, the primary users of financial statements are private investors; in others, the primary users are tax authorities or central government planners. It appears that the United States and the international standardsetting environment are primarily driven by meeting the needs of investors and creditors. IFRS Insights – Relevant Facts – The internal control standards applicable to SarbanesOxley (SOX) apply only to large public companies listed on U.S. exchanges. There is a continuing debate as to whether non-U.S. companies should have to comply with this extra layer of regulation. Debate about international companies (non-U.S.) adopting SOX-type standards centers on whether the benefits exceed the costs. The concern is that the higher costs of SOX compliance are making the U.S. securities markets less competitive. – The textbook mentions a number of ethics violations, such as WorldCom, AIG, and Lehman Brothers. These problems have also occurred internationally, for example, at Satyam Computer Services (India), Parmalat (Italy), and Royal Ahold (the Netherlands). IFRS Insights – Relevant Facts – IFRS tends to be simpler in its accounting and disclosure requirements; some people say more “principles-based.” GAAP is more detailed; some people say more “rulesbased.” This difference in approach has resulted in a debate about the merits of “principles-based” versus “rules-based” standards. – The SEC allows foreign companies that trade shares in U.S. markets to file their IFRS financial statements without reconciliation to GAAP. Idea of Convergence • Rules based accounting standards vs. objectives-oriented approach US GAAP → IFRS • Objectives oriented (principles-based) approach stresses professional judgment IFRS Insights ABOUT THE NUMBERS Illustration IFRS1-1 Global Companies Will US Move to IFRS? Accounting Today Article – “Accounting Convergence Unachievable” Discussion Question Q2-1 What is a conceptual framework? Why is a conceptual framework necessary in financial accounting? The Conceptual Framework The Conceptual Framework has been described as a constitution, a coherent system of interrelated objectives and fundamental that lead to consistent accounting standards. • Maintain consistency among standards. • Resolve new accounting problems. • Provide user benefits. Conceptual Framework Overview of the Conceptual Framework First Level = Basic Objectives Second Level = Qualitative Characteristics and Elements Third Level = Recognition, Measurement, and Disclosure Concepts. LO 2 Describe the FASB’s efforts to construct a conceptual framework. Conceptual Framework First Level: Basic Objectives Objective of general-purpose financial reporting is: To provide financial information about the reporting entity that is useful to present and potential equity investors, lenders, and other creditors in making decisions about providing resources to the entity. Second Level: Fundamental Concepts Qualitative Characteristics “The FASB identified the Qualitative Characteristics of accounting information that distinguish better (more useful) information from inferior (less useful) information for decision-making purposes.” Second Level: Qualitative Characteristics Illustration 2-2 Hierarchy of Accounting Qualities LO 4 Identify the qualitative characteristics of accounting information. Discussion Question Q2-3 What is mean by the term “qualitative characteristics of accounting information”? Second Level: Qualitative Characteristics Fundamental Quality—Relevance To be relevant, accounting information must be capable of making a difference in a decision. Discussion Question Q2-5 How is materiality (or immateriality) related to the proper presentation of financial statements? What factors and measures should be considered in assessing the materiality of a misstatement in the presentation of a financial statement? Second Level: Qualitative Characteristics Fundamental Quality—Faithful Representation Faithful representation means that the numbers and descriptions match what really existed or happened. Second Level: Qualitative Characteristics Enhancing Qualities Articles In Accounting, Truth Above All