Islamic Export Refinance Scheme

Islamic Export Refinance Scheme

Structure of Presentation

Objectives of the scheme

SBP-IBI arrangement

Limit

Musharaka Pool

Profit & Loss Sharing

IBI - customer arrangement

Part I

Part II

Penalties

Objectives of the Scheme

To Provide Liquidity to Islamic Banks for export financing

To Promote Exports

To change Composition of Exports

SBP – IB/IBB Arrangment

Distinctive Features

Musharaka between SBP & Bank

Profit and Loss sharing of Musharaka Pool

Payment of Provisional Profit

Takaful Fund for SBP

Limits under IERS

Assigned Annually – Reviewed Quarterly

SBP’s internal Criteria

1.5 times equity for IBs

20% of EFS for IBBs

SBP’s considerations while assigning limits

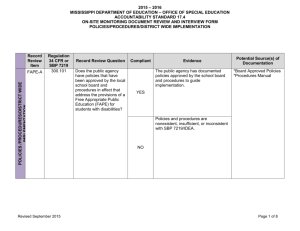

Musharaka between SBP & Bank

Minimum 10 blue chip companies

Blue Chip companies criteria

Credit Rating of B+ or higher or

Good Track record on the stock exchange (if listed) or

ROE of previous 3 years > EFS rates and

NO adverse CIB report

SBP contribution to Pool up to investment provided

Bank contribution equal to or more than SBP’s

Pool exposure to any one sector < 50%

Profit & Loss Sharing

Gross profit

Less provisions for year

Plus recoveries against earlier provisions

PLS as per weightages assigned

EFS rates used as benchmarks

What is Provisional Profit?

Takaful Reserve

Purpose

SBP’s share of losses shall first be met from the

Takaful fund.

How it is created

Differential amount of SBP’s share in Profits (Actual

Profit as per Audit less Provisional Payments)

Takaful Reserve is for SBP only – Not Banks

IB/IBB & Customer Arrangement

Similar to EFS

IERS is available as:

- Part-I (Transaction Based) DE/IDE both for preshipment

- Part-II (Limit based on previous Performance) DE only

IERS for Exporters

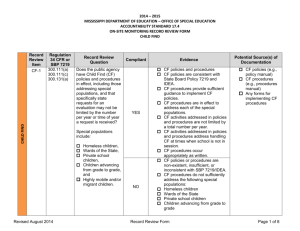

Part I Part II

Direct Exporters only

Tenor

Document for availing

Documents to submit

Substitution

Indirect Exporters as well as Direct Exporters

IDE-120 days;

DE-180 days

IDE: Form 4 ILC/SPO/

Financing Agreement

DE: Form 3/ FEO/ELC/

Financing Agreement

IDE: Invoice, Delivery challan /GNR)

Truck/Railway Receipt,

DE: Original Duplicate of

Form E, BL/AL, Invoice,

EPRC

Allowed

180 days

Limit assigned based on EE -1

Form 3

DP Note

EF-1

Not Required

Penalties / Fines

For defaults/ breaches in agreement fines are charged from the Exporter & banks

The Scheme is available on SBP website http://www.sbp.org.pk/incentives/ iers.htm