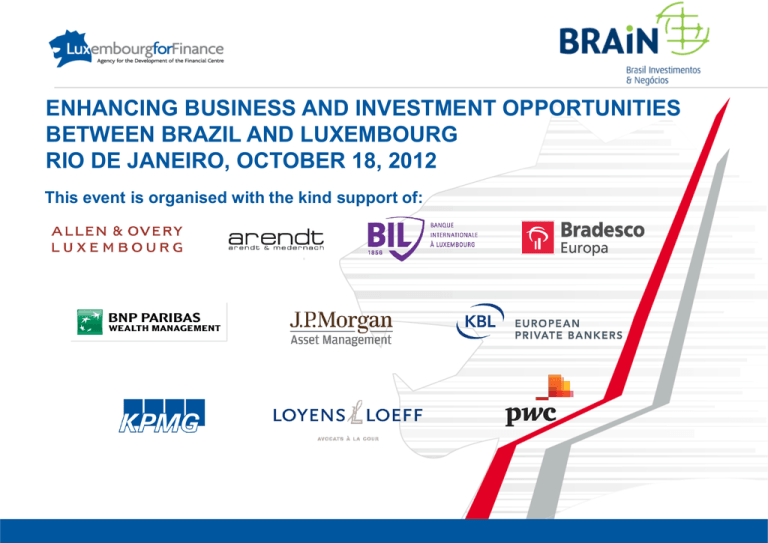

Diapositive 1 - Luxembourg For Finance

advertisement

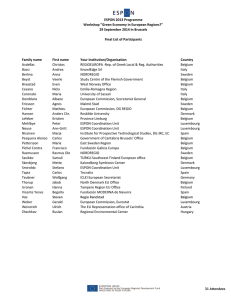

ENHANCING BUSINESS AND INVESTMENT OPPORTUNITIES BETWEEN BRAZIL AND LUXEMBOURG RIO DE JANEIRO, OCTOBER 18, 2012 This event is organised with the kind support of: WELCOME ADDRESS Paulo Oliveira CEO, BRAIN LUXEMBOURG: IDEAL PARTNER TO EXPAND THE INTERNATIONAL BUSINESS OF BRAZILIAN COMPANIES Carlo Thelen Member of the Managing Board, Luxembourg Chamber of Commerce LUXEMBOURG, A GLOBAL HUB FOR FINANCIAL SERVICES Fernand Grulms CEO, Luxembourg for Finance LUXEMBOURG, INTERNATIONAL SERVICE PROVIDER FOR BRAZILIAN ENTREPRENEURS Introduction: Carlo Thill, Vice Chairman, The Luxembourg Bankers‘ Asssociation Moderator: Franciso da Cunha, Director, Deloitte Tax & Consulting Experts: José Da Silva, Head of Latin American Markets, BGL BNP Paribas Guilherme Bezerril, Head of Latin American, SGG Jean-Philippe Leroy Managing Director, Bradesco Europa SA Testimonial: Carlo Panunzi, Vice Chairman of the Board of ArcelorMittal Brasil Luxembourg, international service provider for Brazilian entrepreneurs SETTING UP A LUXEMBOURG HEADQUARTER – IT WORKS! • Jean-Philippe Leroy, Managing Director, Bradesco Europa SA • Jose Da Silva, Head of Latin American Markets, BGL BNP Paribas • Guilherme Bezerril, Head of Latin America, SGG • Carlo Panunzi, Vice Chairman of the Board of ArcelorMittal Brasil 7 40% of European economic added value is situated whithin a 500 km radius. (70% whithin 700km) Frankfurt 30 mins Amsterdam 350 km London 45 mins Berlin 1,5h Brussels 200 km Vienna 1h Paris 2h Prague 1,5h Zurich 1h Milano 1,5h Lisbon 2h Madrid 2h 8 WHY BRAZIL IS GOOD FOR LUXEMBOURG Growth fundamentals Brazilian economy Internationalisation ambitions of Brazilian entrepreneurs Luxembourg exports to Brazil A priority for Luxembourg Source of inspiration and strength Investments in servicing capacity of Luxembourg Private Banks to Brazilian entrepreneurs Intercultural fit! - Multicultural and multilingual services 9 WHY LUXEMBOURG IS GOOD FOR BRAZIL Ideal hub and gateway for investing in and via Europe Growing number of multinationals with European HQs in Luxembourg Strong ties with Brazil 2nd FDI partner Safe place for investors Stock Exchange specialized in international bond listings International financial centre specialized in cross-border activities EU market = 500 M consumers Intellectual Property friendly Intercultural fit! - Multicultural and multilingual services 10 WHY LUXEMBOURG IS GOOD FOR BRAZIL Specialized in serving the most sophisticated clients … WEALTH BANDS IN 7% TERMS OF ASSETS Growing importance of Latin American Investments in Luxembourg … PB LUXEMBOURG GROWTH MARKETS 8% 41% 9% 5% 100,000 - 250,000 € 250,000 - 500,000 € 5% 23% Eastern Europe (non-EU) 17% 500,001 - 1,000,000 € Asia & Asia-Pacific 1,000,001 - 5,000,000 € 14% 5,000,001 - 10,000,000 € 10,000,001 - 20,000,000 € 19% 8% > 20,000,000 € Latin America Middle East 36% Africa United States of America 8% 11 BUSINESS SERVICE PLATFORM 12 Wealth SERVICE OFFERING TO ENTREPRENEURS AND THEIR FAMILIES Management Client sophistication Wealth Management Investment Investment Services Services Family office Family office Succession planning Succession planning Wealth&&corporate corporatestructuring structuring Wealth Property&&Real RealEstate Estate Property Tax / retirement Tax / retirement Estate Planning Estate Planning Art&&collectibles collectibles Art Philanthropy Philanthropy PrivateEquity Equity Private Microfinance/ SRIs / SRIs/ Islamic / IslamicFinance Finance Microfinance Wealth Management Cashmanagement management Cash TradeFinance Finance Trade Corporate/ Investment / InvestmentBanking Banking Corporate Direct Direct Advisory Advisory Tax Tax / retirement / retirement Advisory Advisory mgt mgt Market Market research research Brokerage Brokerage Pension Pension products products Investment Services Discretionary Discretionary mgt mgt Insurance Insurance solutions solutions Investment Investment funds funds Wealth Wealth Structuring Structuring Structured Structured products products SOPARFI SICAR SIF Daily Daily Banking Banking Services Services Property Property and and personal personal credits credits Deposit Deposit and and saving saving accounts Dailyaccounts Credit Credit Cards Cards Services Banking Daily Daily banking banking offering offering Complexity of solutions 13 High quality health care system and solutions Safest capital in the world International schools Language & mindset – truly cosmopolitan Outstanding quality of life 14 CONCLUSION 15 LUXEMBOURG, AN INTERNATIONAL REGULATED FUND CENTER: AN OVERVIEW OF UCITS AND OTHER VEHICLES Moderator: Marc Saluzzi, Chairman, Assoication of the Luxembourg Fund Industry (ALFI) Experts: Georges Bock, Managing Partner, KPMG Luxembourg Rafik Fischer, General Manager- Head of Global Investor Services, KBL European Private Bankers Marc Feider, Partner, Allen & Overy Luxembourg Edouardo Penido, Chairman, IIFA Distribution impact FUNDS PRODUCT/REGIME OVERVIEW UCITS • Transferable securities only • Public distribution – EU Passport • High level regulation SIF (Specialized Investment Funds) • All asset classes • Qualifying investors only • Lower level of regulation • Diversification requirement AIFMD UCI Part II • All asset classes • Public distribution – no EU passport • Medium level regulation SICAR • Risk capital only • Qualifying investors only • Lower level of regulation Flexibility 17 LUXEMBOURG FUNDS: THE VEHICLE OF CHOICE FOR CROSS-BORDER DISTRIBUTION Luxembourg market share of foreign cross-border funds registered for sale Sweden, 71% France, 70% Germany, 67% Switzerland, 70% South Korea, 100% Japan, 61% Bahrain, 76% Peru, 64% Taiwan, 75% Hong Kong, 73% Singapore, 71% Chile, 73% Luxembourg UCITS distribution market Source: Global Fund Distribution analysis December 31, 2011. 18 CROSS-BORDER FUNDS: AN EU SUCCESS STORY Number of cross-border funds and registrations Source: Global Fund Distribution analysis December 31, 2011 19 A FULL FLEDGED MARKET INFRASTRUCTURE… PSF 324 Stock exchange Distributors 6.398 listed funds 66 Custodians 1. Private Banks 2. Life Insurance 3. Platforms 3 864 funds €2,300bn 13,000 jobs 344 Management Companies 144 Fund Administrators (including 3rd party ManCo) Auditors/ lawyers Regulator CSSF … to support your international ambitions 20 THANK YOU! WWW.LUXEMBOURGFORFINANCE.LU 21