Review for Test

advertisement

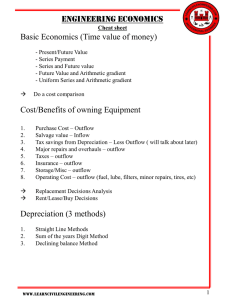

Chapter 10 Review REVIEW QUESTION 1 • Which of the depreciation methods writes off more depreciation near the start of an asset’s than in later years? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 1 • Which of the depreciation methods writes off more depreciation near the start of an asset’s than in later years? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 2 • Which of the depreciation methods allocates an equal amount of depreciation to each year? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 2 • Which of the depreciation methods allocates an equal amount of depreciation to each year? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 3 • Which of the depreciation methods does NOT use a residual method in the first year? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 3 • Which of the depreciation methods does NOT use a residual method in the first year? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 4 • Which of the accounting methods is used to compute amortization? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 4 • Which of the accounting methods is used to compute amortization? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 5 • Which of the accounting methods is used to compute depletion? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 5 • Which of the accounting methods is used to compute depletion? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 5 • Which of the depreciation methods allocates a fixed dollar amount per unit of output by an asset? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 5 • Which of the depreciation methods allocates a fixed dollar amount per unit of output by an asset? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 6 • Which of the depreciation methods is used MOST by companies for their financial statements? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 6 • Which of the depreciation methods is used MOST by companies for their financial statements? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 7 • Which of the depreciation methods is calculated by multiplying the asset’s decreasing book value by a percent that is two times the straight-line rate? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 7 • Which of the depreciation methods is calculated by multiplying the asset’s decreasing book value by a percent that is two times the straight-line rate? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 8 • Which of the depreciation methods is preferable for tax purposes? – Units of Production – Declining balance – Straight line – All of the above REVIEW QUESTION 8 • Which of the depreciation methods is preferable for tax purposes? – Units of Production – Declining balance – Straight line – All of the above True or False • The cost of fencing around a building is included in the cost of the building True or False • The cost of fencing around a building is included in the cost of the building True or False • The cost of land includes the cost of removing unwanted buildings True or False • The cost of land includes the cost of removing unwanted buildings True or False • Treating a capital expenditure as an expense causes an understatement of net income True or False • Treating a capital expenditure as an expense causes an understatement of net income True or False • Estimated residual value is the expected cash value of an asset at the end of its useful life True or False • Estimated residual value is the expected cash value of an asset at the end of its useful life True or False • A loss on the sale of a plant asset is recorded when the sales price exceeds the book value True or False • A loss on the sale of a plant asset is recorded when the sales price exceeds the book value True or False • Tangible assets are assets with no physical form that have value because of the special rights they carry True or False • Tangible assets are assets with no physical form that have value because of the special rights they carry True or False • Depletion expense is the portion of a natural resource’s cost used up in a particular period True or False • Depletion expense is the portion of a natural resource’s cost used up in a particular period True or False • A patent is an exclusive right to reproduce and sell a book, musical composition, film, other work of art, or computer program, and must be amortized over the useful life of the patent. True or False • A patent is an exclusive right to reproduce and sell a book, musical composition, film, other work of art, or computer program, and must be amortized over the useful life of the patent. True or False • If assets are junked before being fully depreciated, there is a loss equal to the book value of the assets. True or False • If assets are junked before being fully depreciated, there is a loss equal to the book value of the assets. True or False • You capitalize all costs that provide future benefit True or False • You capitalize all costs that provide future benefit Other terms to look over • • • • • • • • Plant assets Residual value Amortization Depletion Tangible vs. intangible assets Land vs. land improvements Ordinary vs. extra ordinary repairs Copyright, brand names, licenses, patents